- Most Ethereum stablecoin transactions nonetheless come from people, however companies now account for almost all of complete worth moved on-chain.

- Enterprise-to-business and person-to-business funds are rising quickly, with transaction sizes growing as establishments transfer bigger sums.

- The development suggests Ethereum is maturing right into a core settlement layer for real-world funds, not simply crypto hypothesis.

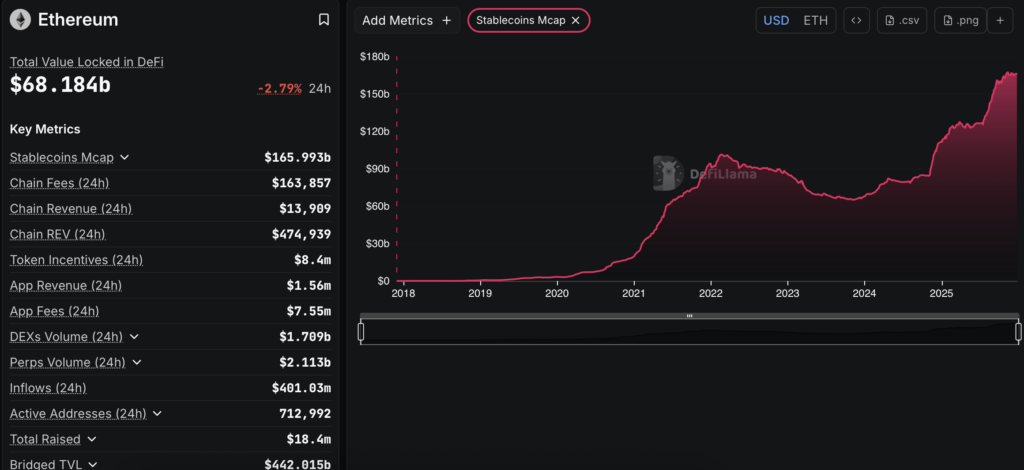

Ethereum’s stablecoin exercise is quietly shifting gears, and the numbers inform an fascinating story. New knowledge exhibits that whereas people nonetheless make up most transactions by depend, companies and retailers are actually transferring the vast majority of worth on-chain. In follow, meaning Ethereum is beginning to look much less like a peer-to-peer switch community and extra like a behind-the-scenes settlement layer for actual funds.

Most stablecoin transfers nonetheless occur between folks, a minimum of on the floor. However once you zoom in on the place the cash really goes, it’s business-linked wallets doing the heavy lifting. That’s a refined change, however an necessary one, particularly for anybody watching Ethereum’s long-term position past buying and selling and hypothesis.

Establishments Transfer The Cash, Customers Drive The Exercise

The shift was outlined in a latest Artemis analysis report that analyzed stablecoin transactions on Ethereum from August 2024 to August 2025. Since Ethereum hosts near half of the worldwide stablecoin provide, the dataset affords a fairly strong snapshot of what’s occurring on-chain. Artemis separated wallets into private and enterprise classes to see who was actually utilizing stablecoins, and the way.

What stood out was the imbalance. Individual-to-person transfers made up about 67% of all transactions, but accounted for simply 24% of the whole greenback worth. Enterprise-related funds, however, had been fewer in quantity however dominated quantity. In brief, people ship typically, companies ship large.

That development picked up tempo over the previous yr. Enterprise-to-business stablecoin quantity jumped 156%, and the common transaction measurement climbed by roughly 45%. That means corporations aren’t essentially making extra funds, they’re simply transferring a lot bigger sums. As James, Head of Ecosystem on the Ethereum Basis, put it on-line, establishments aren’t growing frequency, they’re growing measurement.

Much more placing was the expansion in person-to-business funds. That class noticed a 167% improve in quantity, hinting that customers are more and more paying retailers immediately with stablecoins. It’s a small sign, however one which factors towards on a regular basis utilization beginning to creep in.

What This Shift Says About Ethereum’s Route

All of that is occurring whereas ETH itself trades just under the $3,000 mark. The token slipped about 2.5% prior to now 24 hours, is barely up on the week, and nonetheless sits nicely beneath its August peak close to $5,000. Value motion, for now, feels hesitant.

However analysts argue that stablecoin utilization could find yourself mattering greater than short-term worth strikes. If Ethereum continues to anchor actual cost flows, that utility might change into one in all its strongest long-term demand drivers, even throughout quiet market phases.

Artemis’ broader Stablecoin Wrapped 2025 report provides extra context. USDT has added extra provide this yr than the subsequent 5 issuers mixed, and on-chain business-to-business funds are actually working at an annual tempo near $77 billion. That sort of scale suggests corporations are more and more snug utilizing blockchain rails for precise settlement, not simply experiments.

There are nonetheless caveats. Round 84% of stablecoin quantity flows by the highest 1,000 wallets, which raises truthful questions on focus and decentralization. Massive gamers nonetheless management many of the visitors, whilst adoption widens.

Nonetheless, taken collectively, the info factors to a maturing stablecoin economic system on Ethereum. The community is slowly evolving from a spot the place people ship small quantities to at least one one other, into monetary infrastructure that companies depend on. If that development holds, Ethereum’s future could also be formed much less by hype cycles and extra by its position because the plumbing for a digital, on-chain economic system that truly will get used.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.