- Grayscale believes real-world asset tokenization continues to be early and will develop as much as 1,000x over the following a number of years.

- Chainlink is considered as essential infrastructure, enabling information, compliance, and connectivity between blockchains and conventional finance.

- Regardless of current market pullbacks, Grayscale sees continued institutional demand, regulatory readability, and long-term accumulation alternatives.

Grayscale believes the real-world asset tokenization story continues to be in its early innings, and Chainlink may find yourself taking part in a a lot greater position than many anticipate. Talking on the Pondering Crypto podcast, Grayscale Head of Analysis Zach Pandl stated solely a tiny slice of worldwide belongings has moved on-chain to this point. That, in his view, leaves large room for progress over the following 5 to 10 years as conventional finance slowly shifts towards blockchain infrastructure.

Pandl framed the present part as foundational reasonably than explosive. Adoption is occurring, simply quietly. As banks, funds, and establishments search for higher settlement methods and programmable finance, the rails are already being laid.

Why Chainlink Sits on the Heart of This Shift

Grayscale lately transformed its current Chainlink funding product right into a spot ETF, a transfer Pandl described as a method to give buyers cleaner publicity to considered one of crypto’s most necessary infrastructure layers. Chainlink, he defined, isn’t a wager on a single blockchain or narrative.

As an alternative, it capabilities as connective tissue.

Chainlink gives trusted information feeds, compliance tooling, and cross-system integrations that enable tokenized belongings, stablecoins, and DeFi protocols to work reliably. With out that layer, large-scale tokenization struggles to operate. In Pandl’s phrases, Chainlink is much less about hypothesis and extra about the place finance itself is heading.

ETFs Are Increasing Past Bitcoin and Ethereum

Pandl additionally pointed to Grayscale’s broader ETF push, which now contains belongings like XRP, Solana, Dogecoin, and Chainlink. Regulatory readability, particularly following the lengthy highway to Bitcoin and Ethereum ETF approvals, has accelerated how shortly new merchandise are coming to market.

Every asset fills a distinct position. XRP started as a payments-focused community and is now branching into wider use instances. Solana continues to attract exercise due to velocity and low charges. Dogecoin, whereas unconventional, displays how investor curiosity has diversified.

Grayscale has additionally explored privacy-focused belongings like Zcash. Pandl pressured that if blockchains are anticipated to help actual monetary methods, privateness can’t be non-obligatory. Establishments merely received’t function on rails the place balances, payrolls, and transactions are absolutely uncovered.

Latest Market Pullbacks Don’t Sign a Cycle Prime

Addressing current value weak spot, Pandl pushed again in opposition to fears of a looming multi-year downturn. Bitcoin’s roughly 30% pullback from current highs might really feel uncomfortable, however he described it as pretty regular inside robust bull markets.

Traditionally, Bitcoin typically sees a number of corrections of 10% to 30% even throughout wholesome cycles. From Grayscale’s perspective, there’s no clear proof that the market is rolling over structurally. As an alternative, the correction appears to be like extra like digestion than collapse.

Two forces, Pandl stated, proceed to help the area: demand for different shops of worth as debt and inflation dangers rise, and simpler institutional entry as laws change into clearer.

Tokenized Property Might Develop 1,000x From Right here

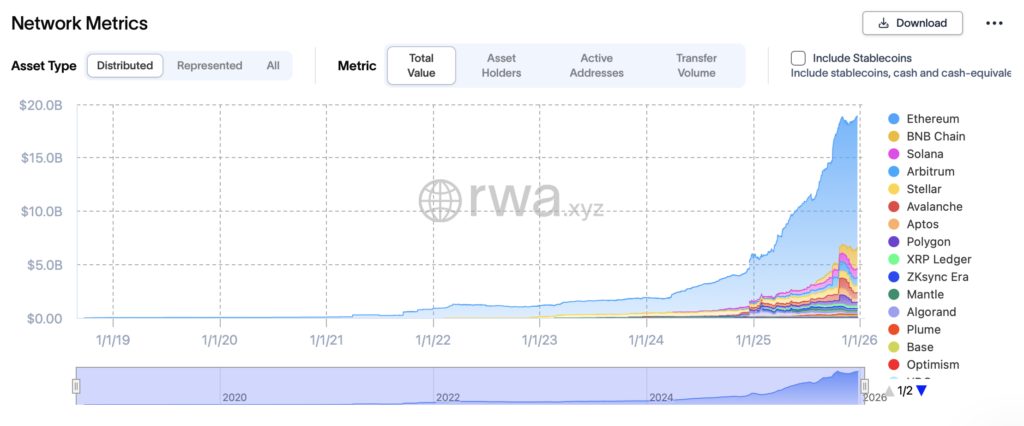

One of the vital placing factors from Pandl’s feedback was scale. At present, tokenized real-world belongings whole roughly $30–35 billion. That sounds giant till it’s in comparison with international fairness and bond markets value round $300 trillion.

In that context, tokenization barely registers.

Pandl believes tokenized belongings may broaden by as a lot as 1,000 instances over the following 5 years as conventional devices transfer on-chain. Advantages embrace quicker settlement, 24/7 markets, and fully new providers like on-chain collateral and lending. Platforms like Ethereum might host these belongings, however infrastructure suppliers comparable to Chainlink are what make the system operate.

Volatility Stays, however the Lengthy-Time period Case Holds

Crypto’s correlation with equities has elevated over time, Pandl acknowledged, nevertheless it nonetheless behaves extra like a commodity than a inventory index. Digital belongings typically transfer with equities, typically not. That unpredictability is a part of what makes them helpful diversifiers.

Volatility hasn’t disappeared, and it seemingly received’t anytime quickly. Nonetheless, Pandl recommended that for buyers aligned with the long-term imaginative and prescient, decrease costs are usually not essentially a menace. They are often an entry level.

From Grayscale’s standpoint, innovation continues, establishments are steadily arriving, and regulatory readability within the U.S. is bettering. The trail is probably not clean, however the path feels more and more outlined.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.