A brand new evaluation is reigniting one in every of crypto’s most crucial debates: whether or not buyers ought to maintain or promote tokens after receiving an airdrop.

Information shared by a dealer reveals that the majority airdropped tokens lose vital worth after launch, elevating questions on whether or not promoting is the extra rational technique.

Sponsored

Most Crypto Tokens Underperform After Launch, Evaluation Finds

In a latest X (previously Twitter) submit, cryptocurrency dealer Didi tracked private airdrop receipts from the final yr. The information revealed that just about all tokens suffered vital losses after their launch. For instance, M3M3 dropped 99.64%, Elixir fell 99.50%, and USUAL declined 97.67%.

Main initiatives misplaced vital worth as nicely. Magic Eden declined 96.6%, Jupiter fell 75.9% from its TGE value, and Monad dropped 39.13% since its debut. The one token above its preliminary value was Avantis, with a 30.4% achieve.

“Out of the 30 airdrops I’ve acquired since December 2024, just one is buying and selling barely above its TGE value at present. But promoting an airdrop at launch someway makes you a ‘traitor.’ Let’s be trustworthy concerning the recreation we’re taking part in. We’re all right here to earn a living. Anybody telling you in any other case is mendacity to themselves,” the submit learn.

The analyst added that historic knowledge reveals holding altcoins long run is a low-probability technique, with the probability of losses far outweighing the possibilities of sustained good points.

“Perceive the atmosphere you’re working in and prioritize capital preservation above the whole lot else. Income are solely actual as soon as they’re realized,” Didi stated.

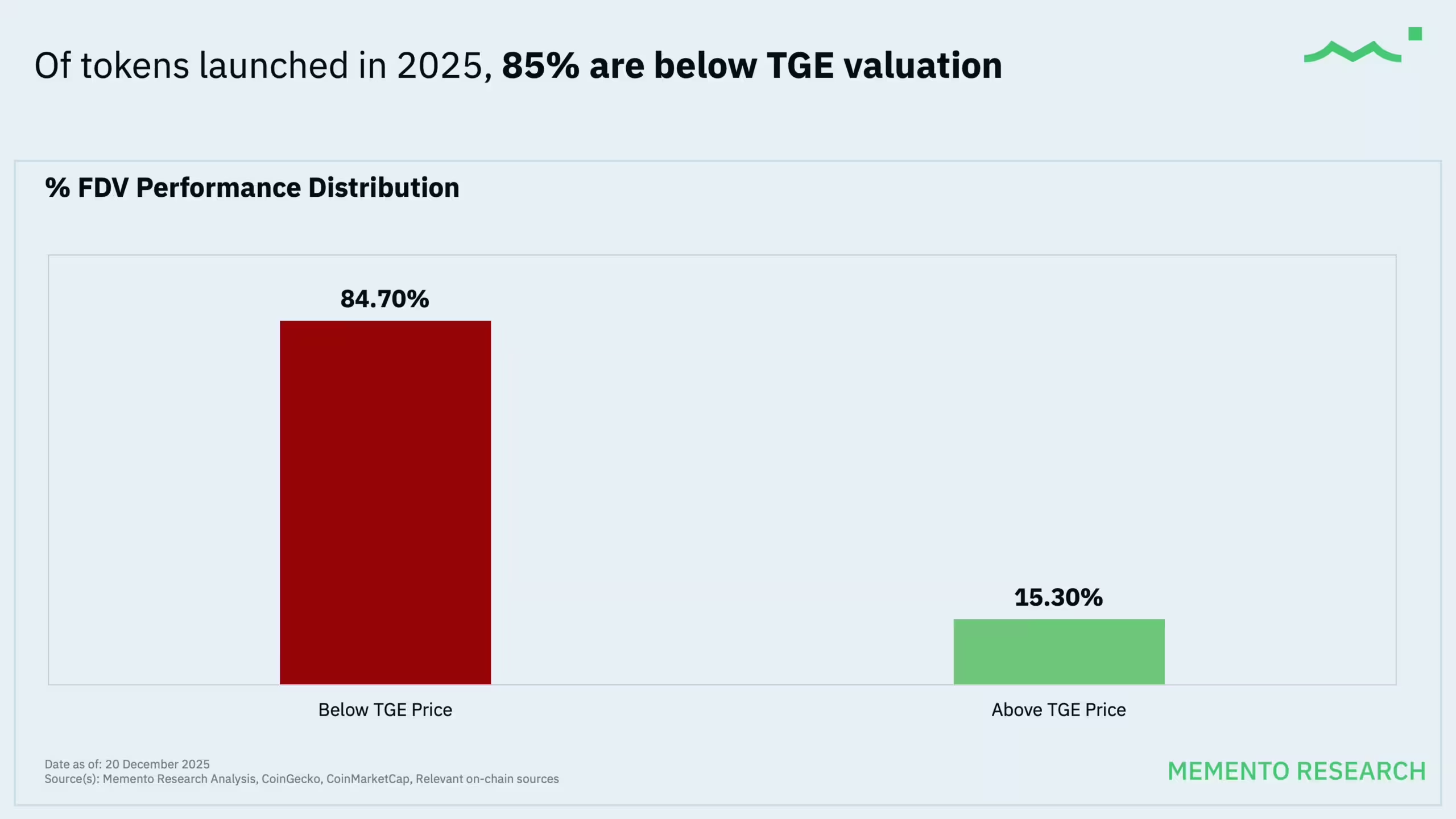

Business-wide evaluation seems to bolster these conclusions. Memento Analysis analyzed 118 token technology occasions in 2025 and located that 84.7% of launched tokens are at the moment buying and selling beneath their TGE valuation.

Sponsored

Moreover, 65% of these tokens have misplaced round 50% of their worth. On the identical time, over half are down 70% or extra.

The report identified that initiatives that debuted with excessive totally diluted valuations (FDV) carried out notably poorly. Of the 28 launches that began with an FDV of $1 billion or extra, none are at the moment inexperienced at present.

“Once you break up the yr by beginning FDV quartiles, the sample is obvious: the most cost effective and lowest FDV launches had been the one bucket with a significant survival fee (40% inexperienced) and a comparatively delicate median drawdown (~-26%), whereas the whole lot above mid-pack mainly received repriced into the ground with median losses of ~-70% to -83% and nearly no greens,” the report learn.

Sponsored

An analyst famous that many crypto initiatives purpose for billion-dollar valuations no matter product maturity or utility. Many tokens open buying and selling at ranges far faraway from their elementary or honest worth, resulting in speedy repricing as soon as market forces take over.

“Whoever isn’t promoting most of this drops at tge is retarded or doesn’t perceive how valuation works,” he acknowledged.

Airdrop Fatigue Grows as Mechanics Worsen and Belief Erodes

Past persistent value stress, investor curiosity in airdrops has been fading in 2025 for structural causes. Market members more and more argue that the airdrop mannequin itself has change into overly complicated, exclusionary, and susceptible to abuse.

Crypto commentator Maran illustrated this shift by contrasting previous and current airdrop mechanics. In earlier cycles, airdrops usually required minimal participation, comparable to connecting a pockets, and distributed comparatively giant allocations.

Sponsored

In 2025, many initiatives apply stricter eligibility standards, together with longer engagement durations, technical necessities, registration home windows, or vesting schedules.

“4 figures was fairly straightforward again then. Now 4 figures are the highest,” the consumer added.

One other analyst claimed that airdrops are “utterly damaged” in 2025. Zamza Salim emphasised that Sybil assaults compromised a number of high-profile airdrops in 2025 regardless of anti-farming measures.

“Airdrop meta in 2025 is cooked. Don’t waste month grinding for scrap whereas farmers eat 20%,” Salim remarked.

Taken collectively, latest knowledge highlights a recurring sample of post-launch underperformance amongst airdropped tokens, whereas additionally pointing to broader structural challenges throughout the airdrop mannequin. Though some tokens do handle to retain or develop worth over time, the mix of excessive preliminary valuations, market repricing, and evolving distribution mechanics has made outcomes fairly unsure.