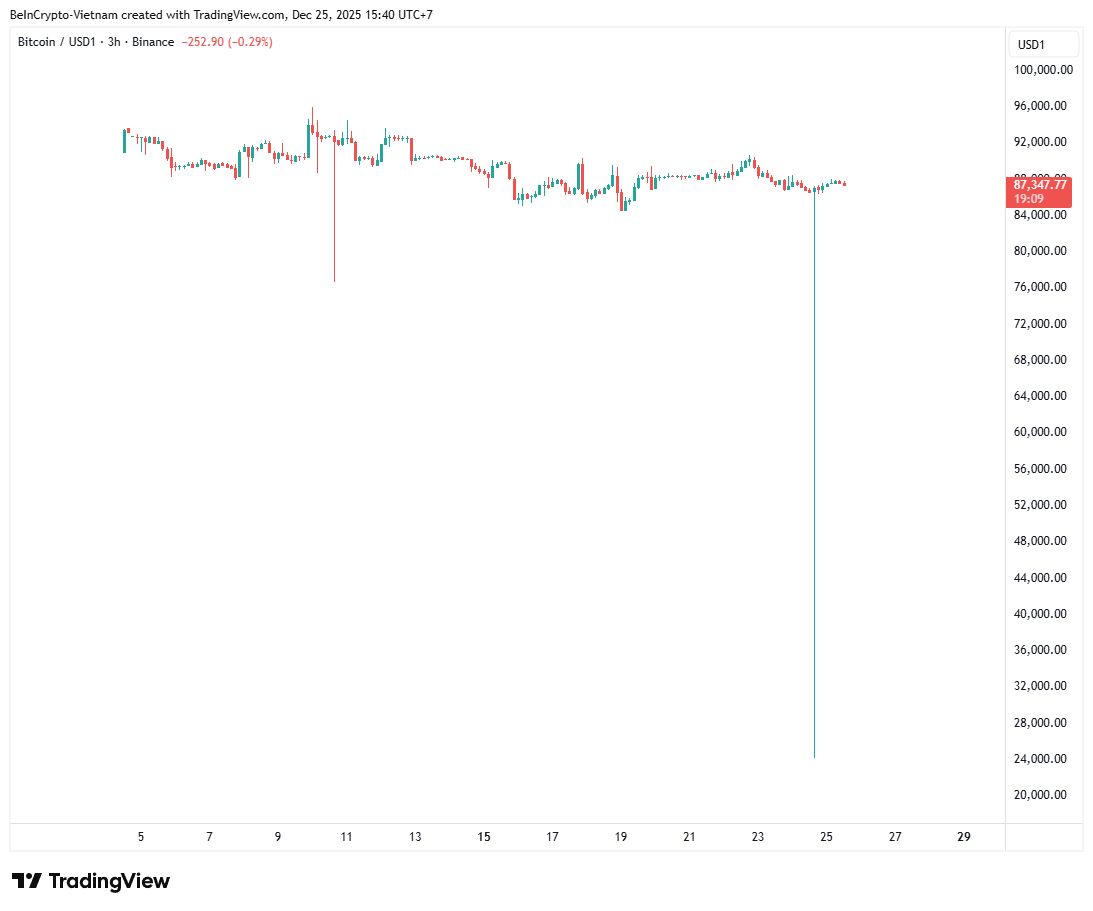

The BTC/USD1 buying and selling pair on Binance skilled a short flash crash. Bitcoin plunged to $24,000 earlier than shortly recovering.

The incident didn’t have an effect on Bitcoin costs on main pairs similar to BTC/USDT. Nonetheless, it highlighted liquidity dangers in newly launched buying and selling pairs.

Sponsored

BTC/USD1 crash to $24,000 exposes low-liquidity dangers

Based on market knowledge from Binance, the incident lasted only some seconds. The BTC/USD1 value later stabilized above $87,000.

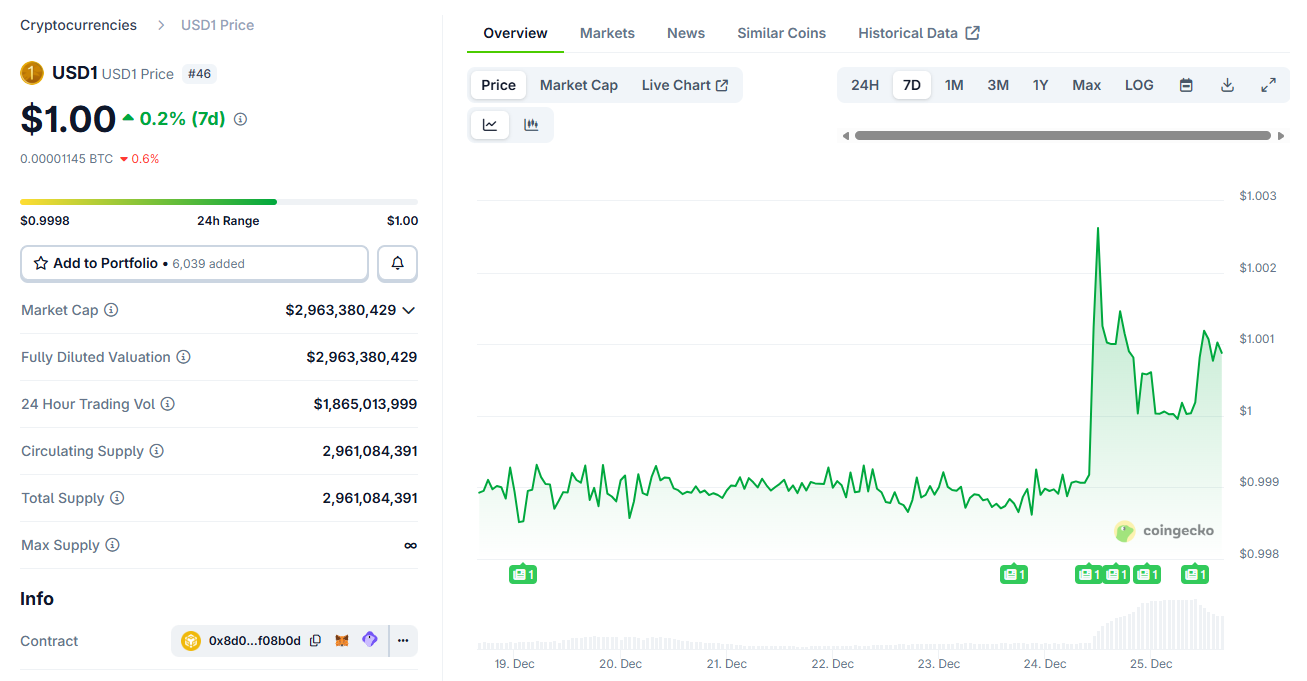

USD1 is a brand new stablecoin issued by World Liberty Monetary. The undertaking receives backing from the household of US President Donald Trump.

Charts from Binance confirmed a steep wick. The transfer didn’t set off any liquidation injury.

The incident occurred throughout the Christmas vacation interval. Buying and selling volumes dropped sharply at the moment. Some observers speculated that the transfer was a liquidity check for the BTC/USD1 pair.

Joao Wedson, founding father of Alphractal, defined that this phenomenon seems extra usually in bear markets. Capital inflows are inclined to weaken throughout these phases.

Sponsored

“Low liquidity in some buying and selling pairs throughout a number of exchanges has been inflicting sharp volatility. It results in momentary value dislocations and arbitrage points for a couple of minutes. That is extra widespread than it appears when the market is in a bearish part,” Joao Wedson defined.

One other, extra detailed clarification from the investor group linked the incident to Binance’s promotional marketing campaign for USD1. Binance lately launched a 20% APY promotion for as much as $50,000 in USD1 per person.

WuBlockchain, a good market-watching account, reported a pointy surge in USD1 provide after the launch. Provide elevated by greater than 45.6 million tokens inside a number of hours. Complete market capitalization rose above $2.79 billion.

The sudden influx of capital into USD1 pushed the stablecoin’s value up by 0.2%.

Sponsored

The X account Punk defined that many buyers tried arbitrage. They borrowed USD1 and step by step bought it on the spot market to individuals becoming a member of the promotion.

In the meantime, some merchants selected to promote via the BTC/USD1 pair. Skinny liquidity caught them off guard. Costs collapsed sharply, inflicting the end result described above.

“That is only a small fluctuation within the bear market. There isn’t a want to fret. Many related fluctuations will seem later,” investor Punk stated.

Might the same state of affairs occur to BTC/USDT?

A broader query now attracts consideration. Might the same occasion happen on the BTC/USDT pair? This pair holds the very best liquidity available in the market. A sudden drop there would trigger huge liquidation losses.

Sponsored

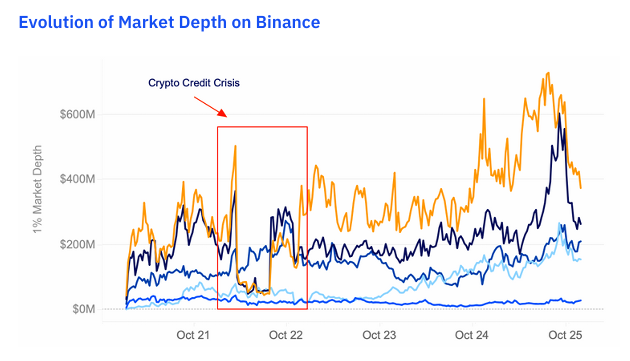

Analyst Maartunn cited Kaiko knowledge. He famous that Bitcoin’s 1% market depth has elevated considerably over time.

“Depth didn’t simply get well. It expanded. By the October 2025 highs, Binance 1% depth exceeded $600 million. That stage stands above pre-2022 crash ranges,” Maartunn stated.

He additionally emphasised that the decline in BTC/USDT costs didn’t erode liquidity. Over the course of greater than 100 days, the BTC/USDT pair fell 21.77% (from $110,291 to $86,089). Throughout that interval, common every day spot quantity reached $19.8 billion, totaling $613.5 billion.

With deeper market depth and ample quantity, the same occasion on BTC/USDT stays unlikely.

Nonetheless, the incident serves as a lesson for merchants. Cautious number of buying and selling pairs is crucial. Low-liquidity pairs could cause extreme slippage and sudden losses.