Ethereum continues to point out indicators of weak spot, failing to construct any vital restoration regardless of holding above native help. Market individuals are displaying hesitation, probably on account of broader uncertainty and the shortage of bullish momentum from Bitcoin. Whereas ETH hasn’t damaged down but, it additionally hasn’t managed to flip any main resistances, which retains it in a weak, range-bound state.

Technical Evaluation

By Shayan

The Each day Chart

On the every day timeframe, ETH is at present buying and selling under the important thing $3,300–$3,700 provide zone, the place the 200-day (orange) and 100-day (blue) transferring averages are performing as main dynamic resistance. This zone has constantly rejected the worth over the previous month, confirming it as a key battleground between consumers and sellers.

The RSI on the every day timeframe can also be caught under the 50 stage, displaying weak momentum and continued bearish strain. If ETH can not break above the talked about confluence space quickly, the chance of a deeper pullback towards the $2,700 help zone will increase. A rejection right here would additionally verify a decrease excessive on the macro construction, which isn’t a superb look heading into 2026.

The 4-Hour Chart

On the 4-hour chart, the construction has turned fragile once more after ETH failed to carry the decrease channel trendline and broke again under the ascending channel. The uptrend try close to $3,100, adopted by a decrease excessive, alerts a transparent lack of bullish power.

At the moment, the asset is hovering simply above the $2,800 help stage, which is performing as a short-term help. However there is no such thing as a follow-through or aggressive shopping for. The RSI has additionally began to twist again down, indicating fading momentum on intraday timeframes. If the $2,800 help zone breaks, a fast flush towards the $2,600 space can be probably.

Sentiment Evaluation

Open Curiosity

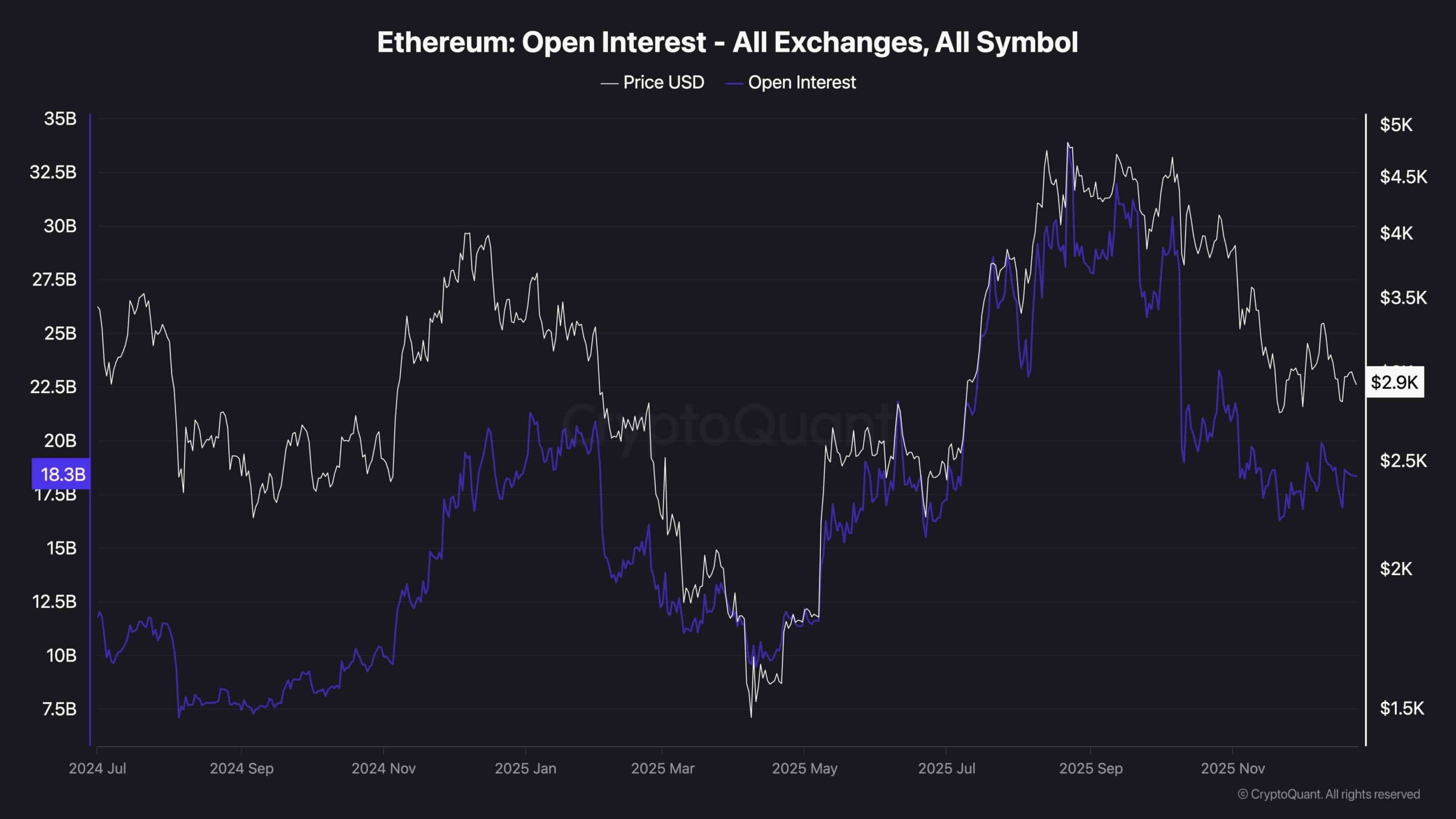

Ethereum’s open curiosity stays fairly excessive at round $18B throughout all exchanges, whilst the worth struggles to push larger. This disconnect between secure open curiosity and flat-to-downward worth motion typically alerts a build-up of speculative leverage, significantly from longs. And not using a breakout or sturdy demand to again it, this type of OI conduct turns into a danger issue, particularly if funding charges begin to present extremely constructive readings.

If ETH fails to carry key helps, this example opens the door for a protracted squeeze, the place overly optimistic positions get forcefully liquidated, accelerating the drop. Subsequently, for consumers, it’s vital that open curiosity begins dropping with the worth, or {that a} breakout confirms the build-up was justified.

The submit Ethereum Value Evaluation: ETH Hasn’t Turned Utterly Bearish, however It’s Shut appeared first on CryptoPotato.