Crypto by no means absolutely sleeps, nevertheless it does get bizarre on holidays. On Dec. 25, one Binance chart delivered the type of screenshot merchants save endlessly: Bitcoin, on the world’s largest trade, with a sudden plunge that seemed like a full-on crash — besides it was not a market-wide collapse. It was a localized irregular print tied to a single buying and selling pair.

On the similar time, XRP’s weekly construction retains worsening, with the basic “dying cross” setup getting nearer on the longer timeframe. And Cardano is again in its favourite seasonal storyline: January has traditionally been pleasant, and the market is as soon as once more searching for a motive to imagine that sample can repeat.

TL;DR

- Binance BTC/USD1 printed an surprising low at $24,111.22, down 72% in only one candle.

- XRP nears dying cross that will put it straight to the 200-week shifting common at $1.3762, a 25.93% drop from $1.8580.

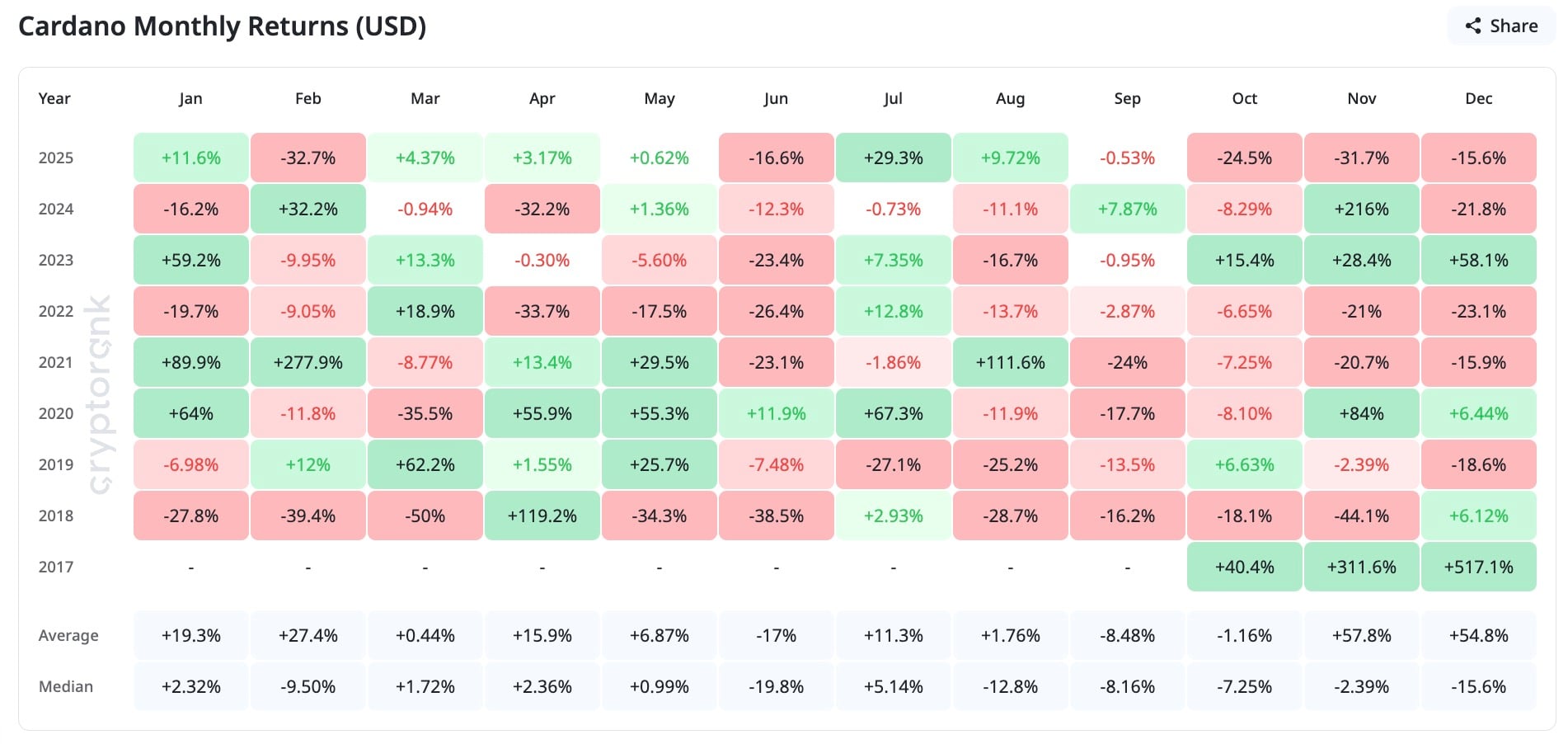

- Cardano’s January historical past exhibits +19.3% common and +2.32% median returns, preserving the “good January” narrative alive.

Binance glitch prints $24,111 Bitcoin on sudden 72% value collapse

The headline second got here from Binance’s BTC/USD1 market. On the TradingView chart, BTC/USD1 displayed its final value close to $87,611.91, with a 24-hour excessive at $87,995.24 — after which a jaw-dropping 24-hour low at $24,111.22. In plain phrases, the chart briefly flashed a drop of greater than 70% on a market that in any other case seemed regular.

This issues for 2 causes. First, it exhibits how a “flash crash” can exist with out being an actual crash. When liquidity is skinny on a particular pair, a single order can sweep the accessible bids and print an excessive final value for a second. That type of print may be spectacular on a chart, whereas leaving the huge market principally untouched.

Second, it occurred on a pair that sounds boring on paper. USD1 is framed as a fiat-backed digital asset designed to carry 1:1 parity with the U.S. greenback, launched in April 2025 beneath World Liberty Monetary (WLFI), with the stablecoin issued and legally managed by BitGo Belief Firm, a regulated belief entity based mostly in South Dakota. The thought is straightforward: dollar-like settlement in digital type.

That’s the reason the second lands as a Christmas-market parable. The pair was not some obscure token in opposition to an illiquid meme coin. It was Bitcoin in opposition to a dollar-pegged unit — but liquidity nonetheless dominated the end result.

Anybody caught promoting into that wick would have “offered BTC for $24,111.22” in USD1 phrases, and since USD1 is supposed to trace the greenback, the psychological hit is clear even when the occasion was transient.

Briefly: this was not Bitcoin “crashing to $24,000.” It was a thin-pocket dislocation in BTC/USD1, amplified by vacation circumstances.

XRP on the verge of 26% dump into dying cross

XRP’s setup is much less dramatic however extra consequential. The weekly chart exhibits the newest candle closing at $1.8580, down 3.34% on the week. The week’s vary printed a $1.9224 open, $1.9493 excessive and $1.8372 low — a typical grind decrease.

The bigger warning comes from the shifting averages, with a possible dying cross formation on the weekly timeframe, pushed by the 23-week shifting common approaching a cross beneath the 50-week shifting common. As may be seen, two key common ranges sit far overhead round $2.5937 and $2.4985, leaving XRP buying and selling beneath each.

The “-26%” headline angle is tied to the long-term security web: the 200-week shifting common sits at $1.3762. From the present weekly shut at $1.8580 right down to $1.3762 is about 26%. That degree is the plain goal that market individuals will discuss if the weekly development retains deteriorating and the dying cross sample confirms.

There may be additionally a historic hook within the offered textual content: XRP reportedly discovered a backside close to that 200-week space round Oct. 10, throughout a market episode price $40 billion in liquidations. Whether or not the precise set off issues or not, the takeaway is identical: the 200-week line has already acted as a battleground, so the market remembers it.

Cardano (ADA) teases bullish January

As for Cardano, the angle right here is seasonal, not technical. The value historical past of ADA by CryptoRank exhibits January as one of many friendlier months traditionally: +19.3% common and +2.32% median.

Thus, January has delivered some huge upside years for Cardano, pulling the common up, whereas the extra typical January nonetheless leans optimistic, in accordance with the median.

This doesn’t assure something, and the identical desk additionally exhibits how briskly the script can flip from month to month. Nonetheless, in crypto, narratives are sometimes traded earlier than fundamentals present up on a chart.

ADA continues to be framed as a high 10 identify, and the offered catalyst narrative facilities on Midnight (NIGHT) — a privacy-focused community constructed on Cardano — as a doable consideration driver into the brand new yr.

So the January pitch is easy, Cardano has a statistical tailwind on the calendar and it has a recent ecosystem headline that may assist maintain that theme alive.

Crypto market outlook

The following few classes determine what this Christmas noise turns into. After Binance’s BTC/USD1 pair flashed that $24,111 print and snapped again to the $87,000 space, the actual query is whether or not liquidity normalizes and the charts overlook it — or whether or not everybody begins treating “stablecoin pairs” as the brand new weak hyperlink to watch.

Bitcoin (BTC): Sitting close to $87,612, however bulls need $87,995 again on high — lose the grip and the following test is $87,246.

XRP: Buying and selling round $1.858; the comeback line is 2.5 — if it can not reclaim it, prepare for $1.3762, the place the 200-week shifting common is.

Cardano (ADA): January has the bullish stats, so the one factor that issues is subsequent month’s vary break and a maintain above that breakout.