- Tron’s day by day perpetual futures quantity exceeded $1 billion for 2 straight days

- Weekly perps quantity jumped 176% to $5.7 billion, defying broader market slowdown

- TRX worth stays subdued, suggesting positioning could also be forward of a bigger transfer

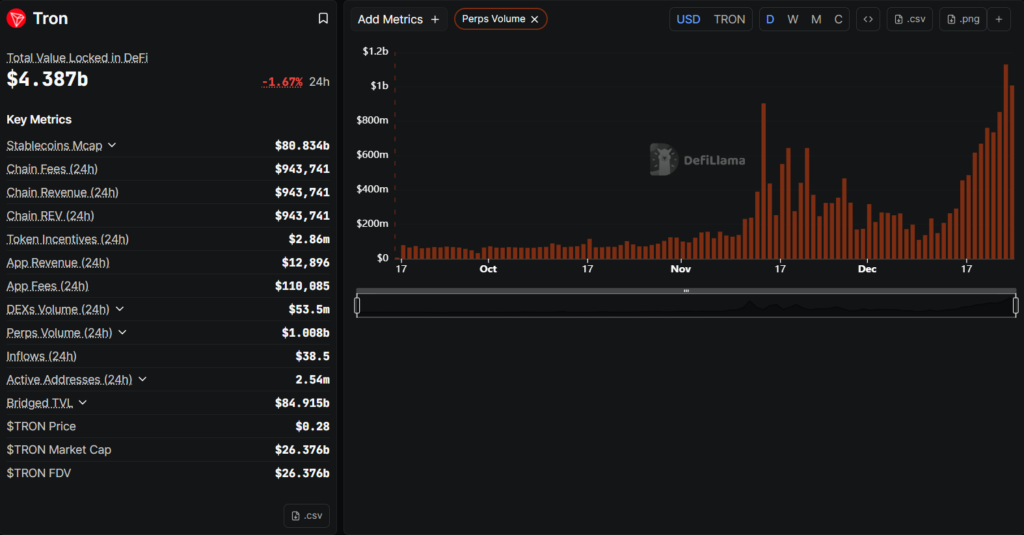

Tron is quietly seeing a surge in derivatives exercise, even because the broader crypto market struggles to seek out route. In accordance with DefiLlama information, Tron’s day by day perpetual futures buying and selling quantity crossed $1 billion for 2 consecutive days, a uncommon transfer at a time when on-chain buying and selling is slowing throughout most blockchains. The leap indicators rising curiosity in Tron-based DeFi and derivatives platforms regardless of ongoing market uncertainty.

Buying and selling Exercise on Tron Practically Triples Week Over Week

Over the previous seven days, whole perpetual futures quantity on Tron reached $5.7 billion, marking a 176% improve in comparison with the earlier week. This surge stands out as a result of it comes whereas many different networks are seeing declining derivatives exercise as merchants pull again danger. The information means that liquidity and speculative curiosity are more and more concentrating on Tron’s ecosystem.

This rise in exercise might level to enhancing infrastructure, higher capital effectivity, or merchants rotating into networks they view as undervalued relative to bigger chains. Whereas the broader market stays cautious, Tron seems to be capturing consideration from extra lively merchants.

Outperformance Comes as Broader Market Stalls

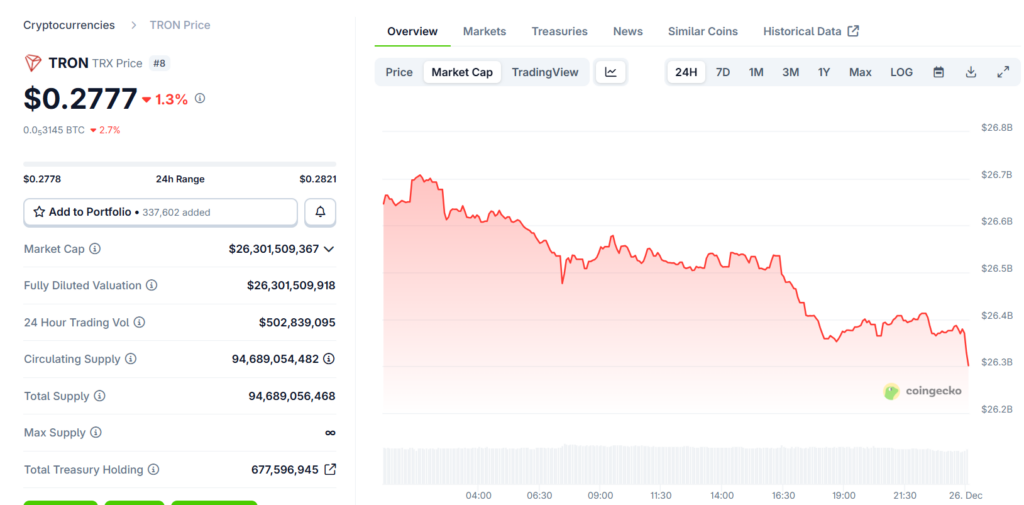

The rise in Tron’s buying and selling quantity comes as Bitcoin stays largely range-bound close to the $87,000 stage, limiting momentum throughout most crypto belongings. Regardless of the spike in derivatives exercise, TRON’s native token TRX has not but mirrored the surge in worth, buying and selling round $0.28 and down almost 2% over the previous 24 hours, in accordance with CoinGecko.

This divergence between community exercise and token worth suggests merchants could also be positioning forward of a possible transfer, or utilizing Tron-based platforms primarily for short-term buying and selling slightly than spot accumulation. If elevated quantity persists, it may finally translate into stronger worth motion.

Why Tron’s Exercise Issues Proper Now

In intervals of market weak spot, rising derivatives quantity on a single community typically indicators shifting dealer conduct slightly than broad hypothesis. Tron’s means to draw perps quantity whereas others decelerate might point out rising confidence in its DeFi stack or decrease buying and selling friction in comparison with competing chains.

Whether or not this momentum holds will depend upon total market circumstances and whether or not Tron can maintain person exercise past short-term positioning.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.