- UNI is edging larger because the UNIfication vote approaches closure

- The proposal introduces protocol charges and a direct UNI burn mechanism

- Early outcomes present overwhelming assist, far above quorum

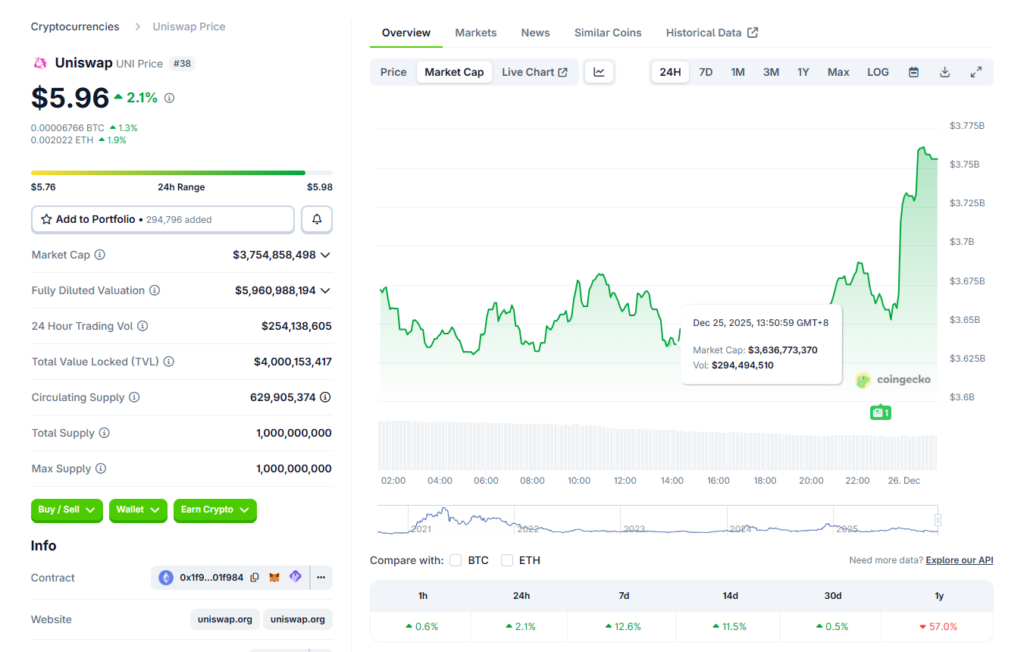

Uniswap’s UNI token is exhibiting delicate power because the neighborhood votes on the high-impact “UNIfication” governance proposal. The vote opened on December 20 and is about to shut in lower than 20 hours, with early outcomes already signaling overwhelming assist. UNI briefly jumped from round $5.4 to $6.4 shortly after voting started earlier than pulling again alongside the broader market, and is now buying and selling close to $6, up roughly 1.5% over the previous 24 hours, in line with CoinGecko information.

UNIfication Proposal Nears Decisive Approval

Voting information reveals greater than 120 million UNI tokens forged in favor of the proposal, in comparison with simply 742 votes in opposition to, comfortably clearing the 40 million UNI quorum requirement. Whereas the voting window has not formally closed, the margin strongly suggests the proposal will cross. The measure was launched collectively by Uniswap Labs and the Uniswap Basis as a part of a broader effort to reshape Uniswap’s token economics and governance construction.

Price Activation and Token Burn Take Heart Stage

If permitted, the proposal would activate Uniswap’s long-discussed protocol charges and route them right into a mechanism that burns UNI, straight lowering token provide as utilization grows. The rollout would occur progressively throughout swimming pools and supported networks to restrict disruption. As well as, the plan consists of burning 100 million UNI from the treasury and consolidating ecosystem obligations below Uniswap Labs, whereas lowering product-level charges to prioritize protocol progress.

Why Supporters See This as a Lengthy-Time period Shift

Backers argue the proposal basically strengthens UNI’s worth proposition by straight linking protocol exercise to token shortage. By aligning Uniswap Labs’ incentives extra carefully with protocol utilization, supporters consider the modifications may create a extra sustainable long-term mannequin for Uniswap, the place larger adoption interprets into lowered circulating provide and stronger governance alignment.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.