The cryptocurrency market has all the time been formed as a lot by narrative as by expertise. From Bitcoin being framed as digital gold to Ethereum serving because the spine of decentralized finance, symbolic labels usually affect how traders interpret worth.

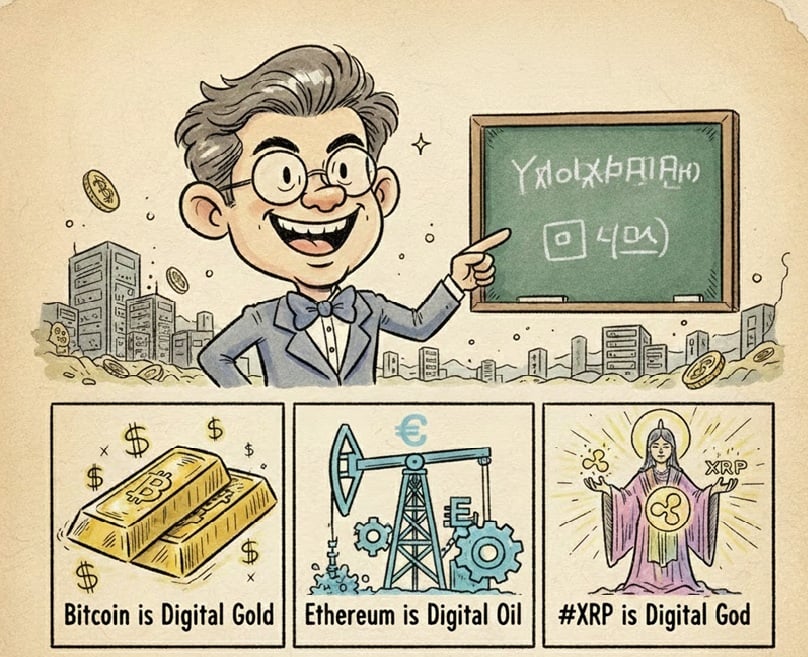

Not too long ago, a brand new comparability sparked widespread dialogue after World’s highest IQ holder YoungHoon Kim categorized main digital belongings right into a daring hierarchy, describing Bitcoin as digital gold, Ethereum as digital oil, and XRP as a digital god.

Whereas the assertion shortly went viral, its significance lies much less in provocation and extra in what it reveals in regards to the present section of the crypto market. Consideration is more and more shifting away from hypothesis and towards utility, infrastructure, and scalability.

Why Symbolic Labels Form Crypto Notion

Labels resembling digital gold or digital oil simplify advanced applied sciences into narratives which might be straightforward to grasp and keep in mind.

Bitcoin has lengthy benefited from its affiliation with shortage and store-of-value properties, whereas Ethereum is commonly framed as important infrastructure powering decentralized purposes.

Referring to XRP as a digital god doesn’t suggest divinity in a literal sense. As a substitute, it displays perceptions of dominance, liquidity, and relevance inside cross-border fee discussions.

These narratives unfold shortly as a result of they provide readability in a market that’s in any other case extremely technical and fragmented.

Nonetheless, symbolic framing can even blur necessary distinctions, notably between decentralized belongings and the organizations related to them.

Supply – Cryptonews YouTube Channel

XRP, Decentralization, and Public Misunderstandings

Probably the most persistent misconceptions surrounding XRP is the belief that it features as a company product.

Crypto commentator Mason Versluis, in a submit on X, highlighted that XRP itself is a decentralized cryptocurrency, not an organization. It doesn’t have a advertising and marketing division, promoting price range, or paid promotional construction.

This distinction is essential. Ripple is a separate company entity that develops fee options, whereas XRP operates independently on a decentralized community. Viral content material and social media amplification usually result in assumptions about paid endorsements, even when none exist.

The depth of consideration surrounding XRP illustrates how visibility alone can gasoline hypothesis, no matter intent. In lots of circumstances, the dialog turns into much less about promotion and extra in regards to the sheer engagement that XRP-related matters generate on-line.

Increasing Bitcoin’s Potential With Good Contract Performance

Because the market matures, investor focus is more and more shifting towards infrastructure initiatives that deal with basic limitations. One space receiving rising consideration is Bitcoin scalability, the place Layer 2 options goal to enhance velocity and effectivity with out compromising safety.

Bitcoin Hyper represents this shift towards sensible innovation. Designed as a Layer 2 community for Bitcoin, the undertaking seeks to allow quicker and cheaper transactions by bridge expertise.

When customers switch Bitcoin to the community, they obtain wrapped Bitcoin, permitting near-instant transactions at considerably decrease price.

Past funds, Bitcoin Hyper introduces sensible contract performance to the Bitcoin ecosystem by compatibility with the Solana digital machine.

This design expands Bitcoin’s potential use circumstances, enabling decentralized finance purposes whereas sustaining Bitcoin because the settlement layer. The native HYPER token helps gasoline charges and staking, positioning Bitcoin as a programmable asset slightly than a static retailer of worth.

The undertaking has raised near $30 million, a notable achievement given present market circumstances and decreased threat urge for food throughout the broader crypto market. This degree of participation suggests sustained curiosity slightly than short-term momentum.

Because the market appears forward to the following section of the crypto cycle, infrastructure initiatives tied on to Bitcoin could profit from renewed institutional and retail curiosity.

Capital inflows traditionally are inclined to favor networks that supply clear utility and long-term relevance, notably throughout early enlargement phases. Bitcoin Hyper sits at this intersection, and the undertaking’s concentrate on extending Bitcoin’s capabilities slightly than changing them aligns with broader market traits.

Lengthy-Time period Tendencies Shaping the Crypto Market

The broader takeaway from these developments isn’t the rating of 1 asset above one other, however the route wherein the market is transferring. Excessive-profile commentary continues to affect sentiment, but long-term capital is more and more gravitating towards initiatives that supply tangible utility.

Infrastructure, scalability, and self-custody have gotten central themes because the ecosystem prepares for its subsequent development section. Safe, non-custodial instruments resembling Greatest Pockets play an necessary position on this surroundings, notably for customers taking part in upcoming crypto presales and managing long-term holdings.

Whether or not XRP is considered as a digital god or just an environment friendly payment-focused asset, its skill to command consideration stays simple.

On the identical time, Layer 2 options resembling Bitcoin Hyper spotlight a broader transition towards performance over hype. Because the crypto market strikes towards 2026, narratives could spark curiosity, however utility is more and more figuring out the place lasting worth resides.

Go to Bitcoin Hyper

This text has been offered by certainly one of our business companions and doesn’t replicate Cryptonomist’s opinion. Please remember our business companions could use affiliate packages to generate revenues by the hyperlinks on this text.