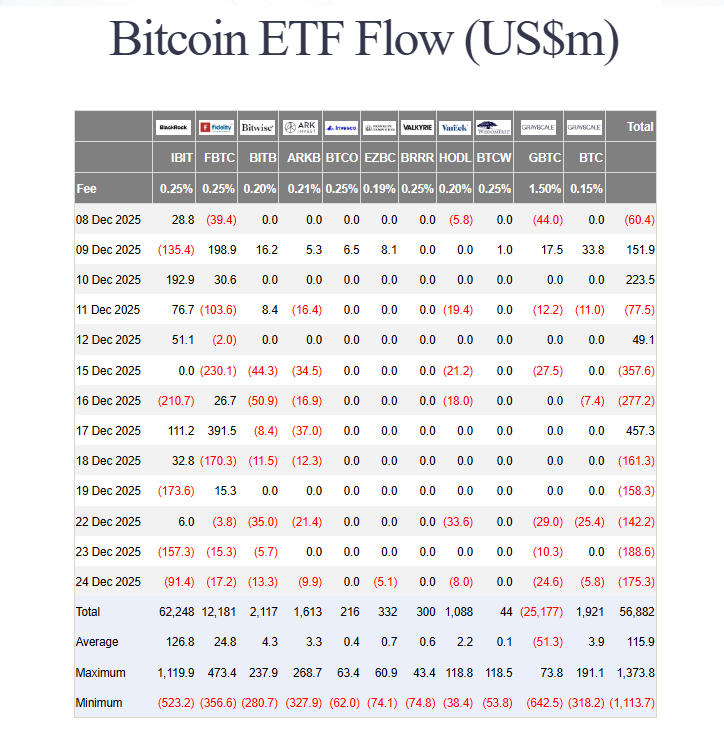

In response to knowledge from Farside Buyers, institutional cash flowed out of US spot Bitcoin ETFs proper by means of the final full buying and selling day earlier than Christmas.

Internet outflows on Christmas Eve reached somewhat over $175 million. That was a part of a string of weak periods: whole internet outflows for the prior 5 buying and selling days added near $826 million. Since December 15, each buying and selling day closed with internet promoting besides December 17, which drew inflows of $457 million.

Institutional Outflows

Market contributors pointed to routine year-end strikes as a significant factor. Studies have disclosed that tax-loss harvesting — the place merchants promote positions to understand losses for tax functions — has been heavy this month.

One dealer on X, utilizing the title Alek, mentioned most promoting is tied to tax causes and will fade inside per week. Merchants additionally flagged a file choices expiry on Friday as a drive that may sap urge for food for threat forward of enormous settlements.

US spot Bitcoin ETF whole outflows. Supply: Farside Buyers

Strain In US Buying and selling Hours

Knowledge confirmed draw back was strongest throughout US buying and selling periods. The Coinbase Premium — a measure evaluating Coinbase’s BTC/USD worth to Binance’s BTC/USDT — spent a lot of December under zero, signaling weaker shopping for within the US market.

Crypto analyst Ted Pillows summed up the move sample, saying the US had turn into the most important vendor whereas Asia performed the position of the primary purchaser. That break up can restrict how excessive Bitcoin holds throughout rallies if US demand doesn’t return.

Liquidity Inactive

Different merchants contend that adverse ETF move numbers don’t imply the cycle is over. Based mostly on experiences shared on social channels, the trail again often goes worth first, flows then.

Worth finds a base after which flows flatten, earlier than recent inflows seem. On this view, present liquidity seems inactive somewhat than damaged. That leaves room for a bounce as soon as seasonal promoting subsides.

Since early November, the 30-day transferring common of US spot ETF internet flows has stayed adverse for each Bitcoin and Ethereum.

Which means, on common, extra capital has been leaving these ETFs than coming into them for a number of weeks in a row.

That is essential as a result of ETFs are… pic.twitter.com/qR1bMQNqxe

— BitBull (@AkaBull_) December 24, 2025

On-Chain Indicators

On-chain metrics provide some consolation. Lengthy-term holders usually are not dashing to promote without delay. Realized positive factors present some profit-taking, however not the form of excessive that marks a terminal peak. That sample suits the concept promoting is being absorbed by different fingers. If promoting is close to exhaustion, bigger patrons may step in when ETFs flip impartial or constructive.

Outlook For The Coming Months

Buyers will watch ETF flows intently after the vacations. If flows transfer towards impartial, worth may stabilize after which climb without having big new demand. The combination of tax promoting and options-related positioning suggests a few of the present weak spot could also be non permanent. Nonetheless, merchants ought to count on uneven strikes whereas US patrons stay sidelined.

Featured picture from Pexels, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.