- Bitcoin rebounded from $86,561 to above $88,600 throughout vacation buying and selling

- Spot Bitcoin ETFs recorded 5 consecutive days of web outflows

- Aave governance tensions resurfaced as a key proposal was voted down

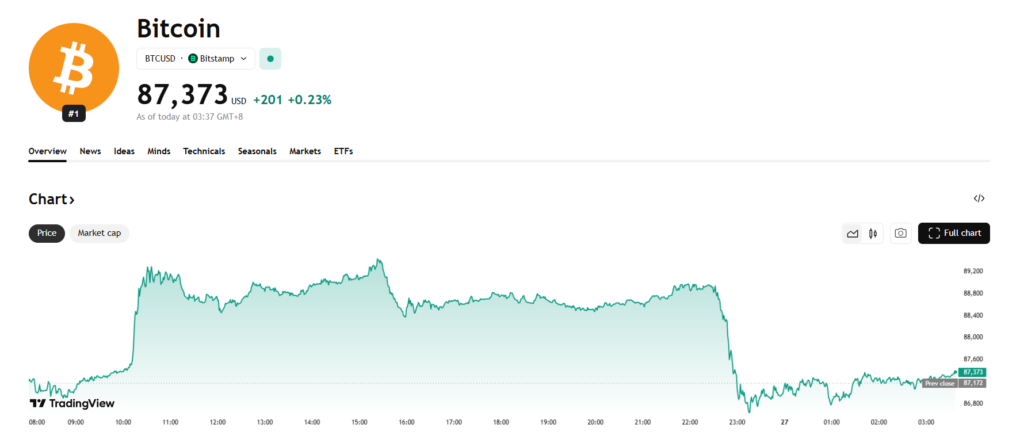

Cryptocurrency markets noticed a light rebound late final week as buying and selling exercise slowed throughout the vacation interval, providing a short pause after current draw back stress. Bitcoin dipped to a weekly low close to $86,561 on Tuesday earlier than recovering above $88,600 by Friday, in line with TradingView knowledge. Whereas the bounce supplied some short-term aid, underlying indicators counsel sentiment stays fragile.

Bitcoin Rebounds, however ETF Demand Stays Weak

Bitcoin’s restoration got here after a comparatively sharp midweek dip, however the transfer lacked robust conviction. Spot Bitcoin ETFs continued to see capital leaving the area, with $175 million in web outflows recorded on Wednesday alone. That marked the fifth straight day of ETF outflows, in line with Farside Buyers, reinforcing the view that institutional demand stays cautious heading into year-end.

The mix of sunshine vacation liquidity and chronic ETF promoting suggests the rebound was extra technical than demand-driven. With out renewed inflows, Bitcoin’s upside might stay capped within the close to time period.

Altcoin Developments Add to Market Unease

Past Bitcoin, tensions surfaced throughout the Aave ecosystem. Members of the Aave group pushed again in opposition to what they seen as a rushed try and advance a governance proposal associated to model property and mental property. The proposal aimed to shift management of those property again to a DAO-managed construction.

After debate, the proposal was rejected on Friday, with a majority voting in opposition to it. Whereas the choice resolved the instant situation, it highlighted ongoing governance friction inside main DeFi protocols at a time when investor confidence is already below stress.

A Cautious Pause, Not a Clear Turnaround

Total, the market’s late-week bounce seems extra like a short lived stabilization than the beginning of a broader restoration. Skinny vacation buying and selling, continued ETF outflows, and inner disputes throughout DeFi level to a market nonetheless looking for course. As liquidity returns after the vacations, merchants might be watching intently to see whether or not this rebound holds or fades.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.