- XRP is dealing with mounting strain as establishments reportedly extract liquidity from retail holders

- Repeated failed value predictions are worsening investor confusion and distrust

- Regulatory readability in 2026 may reshape XRP’s market construction and restore steadiness

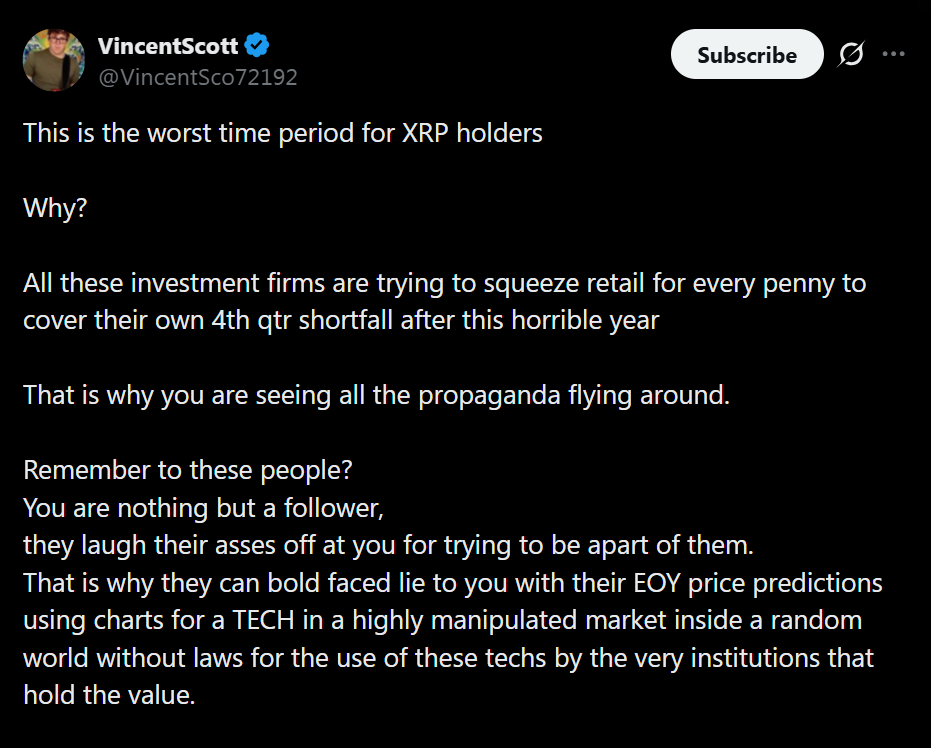

XRP is as soon as once more below heavy scrutiny as considerations develop that retail traders are being squeezed throughout one of many token’s most tough phases in years. Analyst Vincent Scott argues that this isn’t a typical market cycle however a liquidity extraction section, the place massive funding corporations are pressuring retail holders to offset their very own fourth-quarter losses. As XRP trades under $2 and sentiment weakens, many are questioning whether or not this can be a shopping for alternative or a structural lure.

Institutional Strain Is Shaping XRP’s Worth Motion

Based on Scott, the present XRP downturn is being pushed much less by fundamentals and extra by institutional habits. He claims main gamers are intentionally pulling liquidity from retail contributors to restore steadiness sheets after a poor 12 months. This dynamic, he argues, explains the flood of aggressive narratives and emotional messaging surrounding XRP, which tends to peak in periods of stress somewhat than natural progress.

This setting makes it more durable for retail traders to navigate value volatility, as value discovery could also be distorted by strategic positioning somewhat than real demand. For a lot of holders, this has turned the present section into what Scott describes because the worst interval for XRP participation.

Worth Predictions Are Shedding Credibility

Scott can be essential of the broader XRP value prediction panorama. He factors out that many bullish forecasts rely closely on chart extrapolation with out accountability when targets fail to materialize. When predictions break down, reassurance narratives usually change evaluation, permitting the identical cycle to repeat.

This sample retains retail traders locked into hope-driven decision-making somewhat than knowledgeable danger evaluation. Consequently, figuring out whether or not XRP is an efficient purchase turns into more and more tough, particularly in periods dominated by concern, uncertainty, and shifting narratives.

Why 2026 Regulation Might Change Every little thing

Regardless of the grim near-term outlook, Scott believes regulation may ultimately reset the enjoying subject. He highlights upcoming U.S. legislative efforts, together with the CLARITY framework anticipated to advance in 2026, as a possible turning level. If enforcement turns into constant and clear throughout establishments, the present imbalance between retail and huge gamers may ease.

Till then, Scott expects strain on retail holders to proceed. Whether or not XRP stabilizes or enters one other accumulation section might rely much less on value ranges and extra on how regulatory requirements evolve over the subsequent 12 months.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.