Be part of Our Telegram channel to remain updated on breaking information protection

The AAve value is up 2% within the final 24 hours as of 01:13 a.m. EST with the day by day buying and selling quantity down 3% to $391 million.

This comes as Aave founder and CEO Stani Kulechov deny claims that he bought $15 million in AAVE tokens to sway a controversial group vote. Kulechov emphasised that the tokens weren’t used within the current vote and that his funding displays private conviction in Aave quite than an try to affect governance.

He additionally acknowledged that Aave Labs has not clearly communicated the financial alignment between the corporate and AAVE token holders, promising larger transparency sooner or later concerning how Aave Labs’ merchandise create worth for the DAO and its members.

The current DAO vote has wrapped up, and it has raised vital questions in regards to the relationship between Aave Labs and $AAVE token holders. It is a productive dialogue that’s important for the long-term well being of Aave.

Whereas it has been a bit hectic, debate and disagreement…

— Stani.eth (@StaniKulechov) December 26, 2025

The controversy arose round a proposal to switch Aave’s model belongings to the decentralized autonomous group (DAO), which governs the Aave protocol. The proposal adopted claims by DAO member EzR3aL that charges from a current integration with DEX aggregator CoW Swap have been directed to an Aave Labs-controlled pockets as an alternative of the DAO.

This sparked important debate throughout the group, with many arguing that the DAO ought to have been consulted earlier than charges have been redirected. The group vote resulted in over 55% opposing the proposal, with greater than 41% abstaining and solely 3.5% in favor. A number of members criticized the method, saying it was rushed and bypassed regular governance procedures.

Notably, Ernesto Boado, former Aave Labs CTO, was listed because the proposal’s writer however claimed it was submitted with out his information or consent and that he wouldn’t have authorised its publication. The state of affairs highlights ongoing tensions between Aave Labs and the DAO over governance, transparency, and mental property management.

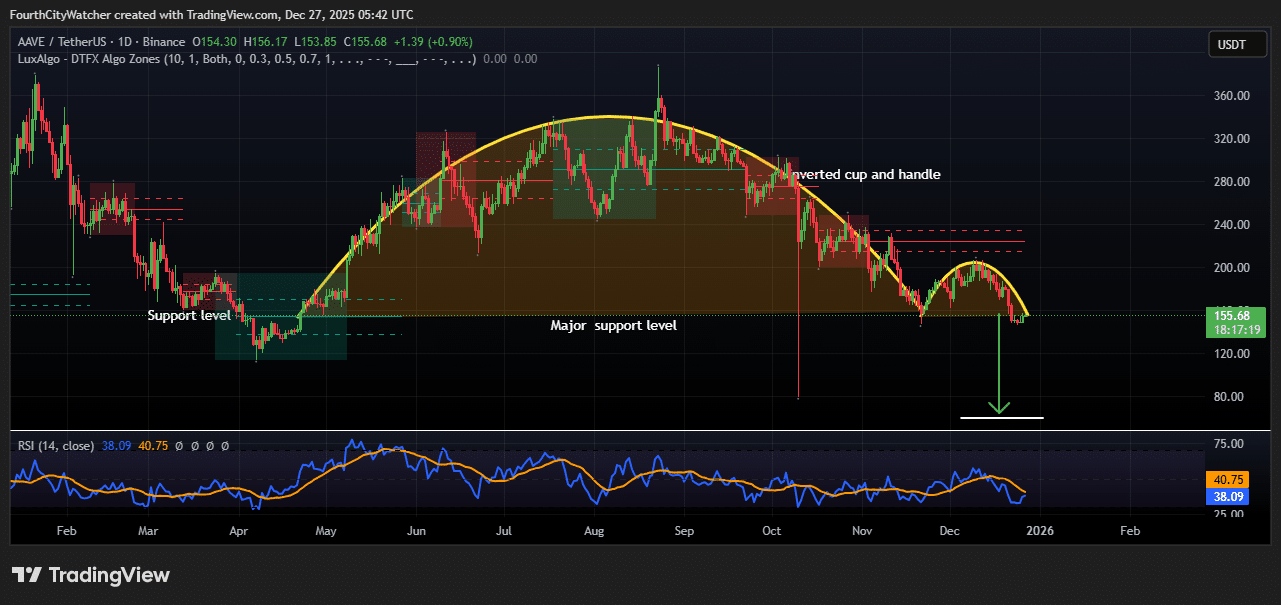

AAVE/USDT Eyes Key $155 Assist as Bears Dominate, RSI Indicators Warning

The day by day chart of AAVE/USDT reveals the worth at the moment testing a key help degree at round $155. The general development has been bearish after forming an inverted cup and deal with sample, which normally indicators additional draw back if the help breaks.

Earlier within the yr, AAVE discovered robust help close to $150, which held a number of occasions between March and Could. This led to a restoration above $350, forming a rounded high. The rounded high signifies that purchasing momentum weakened after a protracted upward transfer, setting the stage for the current decline.

At the moment, the RSI (Relative Power Index) is at 38, under the impartial 50 degree. This means that promoting strain is stronger than shopping for, however the token isn’t but oversold (under 30), that means there may nonetheless be extra downward motion if the help fails. A rebound at this degree may provide short-term shopping for alternatives.

If the $155 help holds, AAVE may bounce again towards the $200–$220 vary, the place earlier resistance aligns with the highest of the deal with. Nonetheless, if the help breaks, the subsequent main goal is round $120, as indicated on the chart.

The inverted cup and deal with factors to potential additional losses, whereas the RSI reveals weakening momentum however no excessive promoting but. A break may result in additional draw back towards $120, whereas a powerful rebound might enable for a short-term restoration. Correct danger administration is important as a result of volatility of DeFi tokens, particularly when costs method important historic help.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection