David Sacks calls CFTC, SEC picks a crypto regulation ‘dream crew’

US President Donald Trump’s AI and crypto czar, David Sacks, has signaled that the White Home might have all of the items in place for digital asset regulation following the affirmation of Michael Selig to chair the Commodity Futures Buying and selling Fee.

In a Monday X publish, David Sacks stated the US was at a “vital juncture” for crypto regulation, and that Selig and Securities and Trade Fee Chair Paul Atkins made up a “dream crew to outline clear regulatory pointers.” Sacks’ feedback had been in response to Selig saying that the US Congress was getting ready to finish work on a crypto market construction invoice.

“We’re at a singular second as a variety of novel applied sciences, merchandise, and platforms are rising, retail participation within the commodity markets is at an all-time excessive, and Congress is poised to ship digital asset market construction laws that can cement the US because the Crypto Capital of the World to the president’s desk,” stated Selig on X.

Coinbase CEO says reopening GENIUS Act is ‘pink line,’ slams financial institution lobbying

Coinbase CEO Brian Armstrong stated any try to reopen the GENIUS Act would cross a “pink line,” accusing banks of utilizing political stress to dam competitors from stablecoins and fintech platforms.

In a Sunday publish on X, Armstrong stated he was “impressed” banks may foyer Congress so overtly with out backlash, including that Coinbase would proceed pushing again on efforts to revise the regulation. “We received’t let anybody reopen GENIUS,” he wrote.

“My prediction is the banks will truly flip and be lobbying FOR the power to pay curiosity and yield on stablecoins in a number of years, as soon as they notice how large the chance is for them. So it’s 100% wasted effort on their half (along with being unethical),” Armstrong added.

The GENIUS Act, handed after months of negotiations, bars stablecoin issuers from paying curiosity straight however permits platforms and third events to supply rewards.

Bitcoin ‘by no means crossed’ $100K if adjusted for inflation, says Alex Thorn

Bitcoin got here simply shy of hitting a milestone six figures when inflation is factored in, regardless of the cryptocurrency hitting an all-time peak of above $126,000 in October, says Galaxy head of analysis Alex Thorn.

“In case you alter the value of Bitcoin for inflation utilizing 2020 {dollars}, BTC by no means crossed $100,000,” Thorn stated on Tuesday. “It truly topped at $99,848 in 2020 greenback phrases, when you can consider it.”

Thorn stated his adjusted worth excessive for Bitcoin accounted for the Client Worth Index (CPI) decline in buying energy incrementally throughout each inflation print from 2020 to immediately.

CPI measures inflation through the costs of a basket of products and providers and is calculated by the US Bureau of Labor Statistics to trace modifications in spending habits.

Prolonged crypto ETF outflows exhibits establishments disengaging: Glassnode

Bitcoin and Ether exchange-traded funds have seen a protracted streak of outflows, indicating that institutional traders have disengaged with crypto, stated the analytics platform Glassnode.

Since early November, the 30-day easy transferring common of web flows into US spot Bitcoin and Ether ETFs has turned destructive, Glassnode stated on Tuesday.

“This persistence suggests a part of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction throughout the crypto market,” it added.

Flows into crypto ETFs normally lag the spot markets for the tokens, which have been trending down since mid-October.

The ETFs are additionally thought-about a bellwether for institutional sentiment, which has been a market driver for many of this 12 months however seemingly turned bearish as the broader market has contracted.

Brazil’s dwell orchestra to show Bitcoin worth strikes into music

An experimental orchestral mission in Brazil goals to transform Bitcoin worth information into dwell music, after receiving approval to boost funds by one of many nation’s tax-incentive applications for cultural initiatives.

In response to Brazil’s Federal Register, the authorization permits the mission to hunt as much as 1.09 million reais ($197,000) from personal corporations and particular person donors for an instrumental live performance that makes use of monetary information to generate music, drawing on ideas from artwork, arithmetic, economics and physics.

The publication doesn’t specify whether or not any blockchain or onchain infrastructure will likely be used within the efficiency. The efficiency will happen on the nation’s federal capital, Brasília.

Winners and Losers

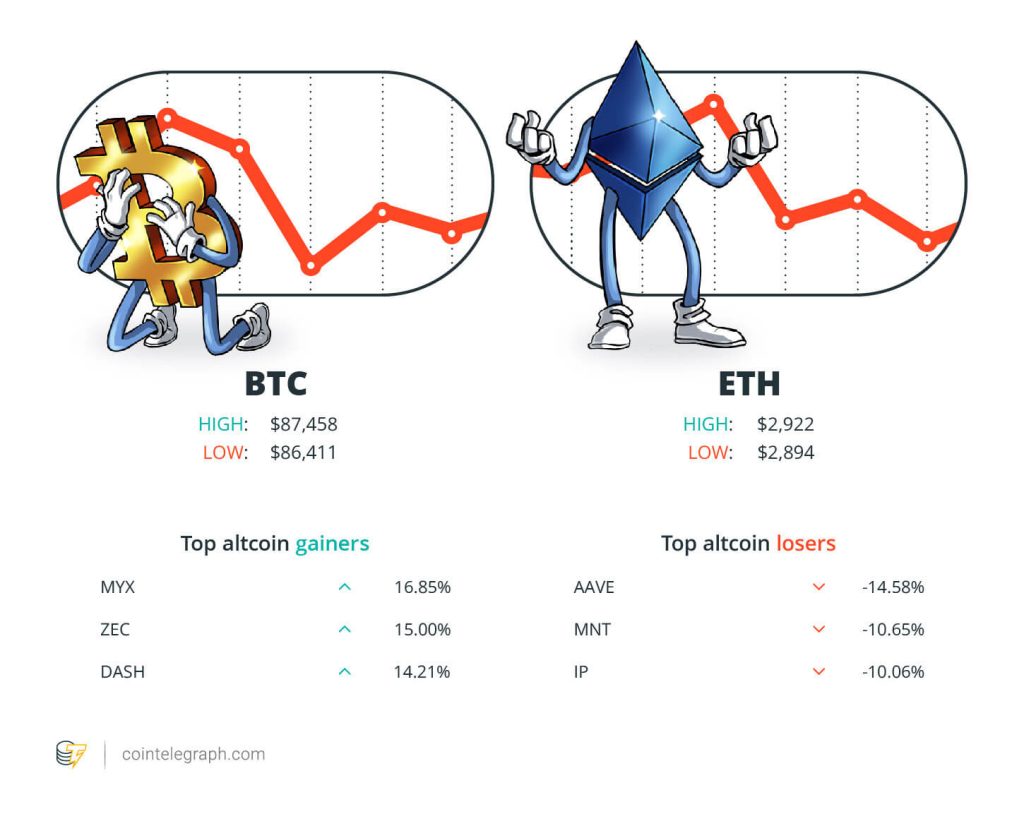

On the finish of the week, Bitcoin (BTC) is at $87,458, Ether (ETH) at $2,922 and XRP at $1.84. The full market cap is at $2.96 trillion, based on CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are MYX Finance (MYX) at 16.85%, ZCash (ZEC) at 15.00% and Sprint (DASH) at 14.21%.

The highest three altcoin losers of the week are Aave (AAVE) at 14.58%, Mantle (MNT) at 10.65% and Story (IP) at 10.06%. For more information on crypto costs, be certain that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“The basics of the market this 12 months for Bitcoin couldn’t be higher.”

Phong Le, CEO of Technique

“I wish to see inflation come all the way down to 2% with out doing undue hurt to the labor market. It’s a balancing act.”

John Williams, president and CEO of the New York Federal Reserve Financial institution

“If Bitcoin really is really in a bear market, which is what it seems like, it will be sort of exhausting for Ethereum to go up there.”

Benjamin Cowen, crypto analyst

“We’re at a singular second as a variety of novel applied sciences, merchandise, and platforms are rising, retail participation within the commodity markets is at an all-time excessive, and Congress is poised to ship digital asset market construction laws that can cement the US because the Crypto Capital of the World to the president’s desk.”

Michael Selig, incoming chair of the US CFTC

“Given the place the volatility is true now, it will be very shocking that Bitcoin’s volatility has drastically compressed and but nonetheless may get a 70% or 80% drawdown.”

Anthony Pompliano, Bitcoin entrepreneur

“I’ve seen many conditions the place somebody calls on Grok anticipating their loopy political perception to be confirmed and Grok comes alongside and rugs them.”

Vitalik Buterin, co-founder of Ethereum

Prime Prediction of The Week

Bitcoin’s present setup seems to be like 2019, says Benjamin Cowen

As Bitcoin continues to underperform gold and main fairness indices, traders are more and more questioning whether or not this cycle is unfolding in another way than anticipated. In a brand new interview with analyst Benjamin Cowen, we dig into why Bitcoin is lagging conventional markets, and why the present setup might really feel strikingly just like 2019.

Cowen factors out that whereas shares and gold are responding positively to expectations round future financial easing, Bitcoin seems much more delicate to precise liquidity circumstances quite than optimism alone.

Learn additionally

Options

Ordinals turned Bitcoin right into a worse model of Ethereum: Can we repair it?

Options

Right here’s the way to hold your crypto protected

That distinction, he explains, helps make clear why BTC has struggled to realize momentum whilst broader markets push increased. In response to Cowen, Bitcoin usually requires a clearer macroeconomic catalyst earlier than it will possibly outperform, and that catalyst might not but be in place.

A key theme of the dialogue is sentiment. Not like earlier cycle peaks characterised by widespread enthusiasm and retail hypothesis, this market has been marked by relative apathy.

Prime FUD of The Week

Memecoins go from Christmas cheer to chilly actuality, sinking 65% in a 12 months

Memecoins are buying and selling close to year-end lows, marking a pointy reversal from the speculative peak reached in Christmas 2024.

Memecoins fell 65% over the 12 months to a market capitalization of $35 billion on Dec. 19, their lowest stage of 2025, based on CoinMarketCap information. They retraced some losses on Friday, rising to about $36 billion.

Learn additionally

Options

May a monetary disaster finish crypto’s bull run?

Options

How crypto bots are ruining crypto — together with auto memecoin rug pulls

Final 12 months, memecoins thrived on Christmas Day, recording about $100 billion in valuation, based on CoinMarketCap information.

The memecoin sector’s buying and selling quantity fell alongside its worth, dropping 72% over the 12 months to $3.05 trillion, as crypto’s retail investing tendencies moved away from extremely speculative belongings.

JPMorgan freezes accounts of two stablecoin startups over sanctions issues: Report

JPMorgan Chase has reportedly frozen financial institution accounts linked to 2 venture-backed stablecoin startups after figuring out publicity to sanctioned and high-risk jurisdictions.

The accounts belonged to BlindPay and Kontigo, two stablecoin startups backed by Y Combinator that primarily function throughout Latin America, based on a report by The Info. Each corporations accessed JPMorgan’s banking providers by Checkbook, a digital funds agency that companions with giant monetary establishments.

Per the report, the freezes occurred after JPMorgan flagged enterprise exercise tied to Venezuela and different areas topic to US sanctions.

Aave founder denies shopping for tokens to affect failed DAO vote

Stani Kulechov, the founder and CEO of Aave Labs, the primary improvement firm behind the Aave decentralized finance lending protocol, denied claims that he just lately bought $15 million of Aave tokens to affect a controversial neighborhood vote that didn’t cross.

“These tokens weren’t used to vote on the current proposal, and that was by no means my intention. That is my life’s work, and I’m placing my very own capital behind my conviction,” Kulechov stated.

He additionally stated that Aave Labs has not clearly communicated the financial alignment between it and Aave token holders. “Sooner or later, we’ll be extra specific about how merchandise constructed by Aave Labs create worth for the DAO and AAVE token holders,” he added.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.