- Bitcoin continues to commerce in a good $86,500–$90,000 vary, with analysts suggesting a protracted consolidation might result in a decisive breakout.

- A short Binance flash crash was attributable to skinny liquidity in a distinct segment buying and selling pair, not by systemic market stress or liquidations.

- Lengthy-term projections stay bullish, with some forecasts pointing to $110K–$160K in 2026 if adoption and market construction proceed to enhance.

Bitcoin continues to float sideways slightly below the $90,000 mark, irritating each bulls and bears. Value has been caught in a good vary for weeks now, and merchants are clearly ready for one thing decisive to occur.

Regardless of short-lived volatility and the occasional scare, the broader construction hasn’t actually modified. Help is holding, resistance continues to be overhead, and conviction feels… skinny.

Why This Tight Vary Might Matter Extra Than It Appears

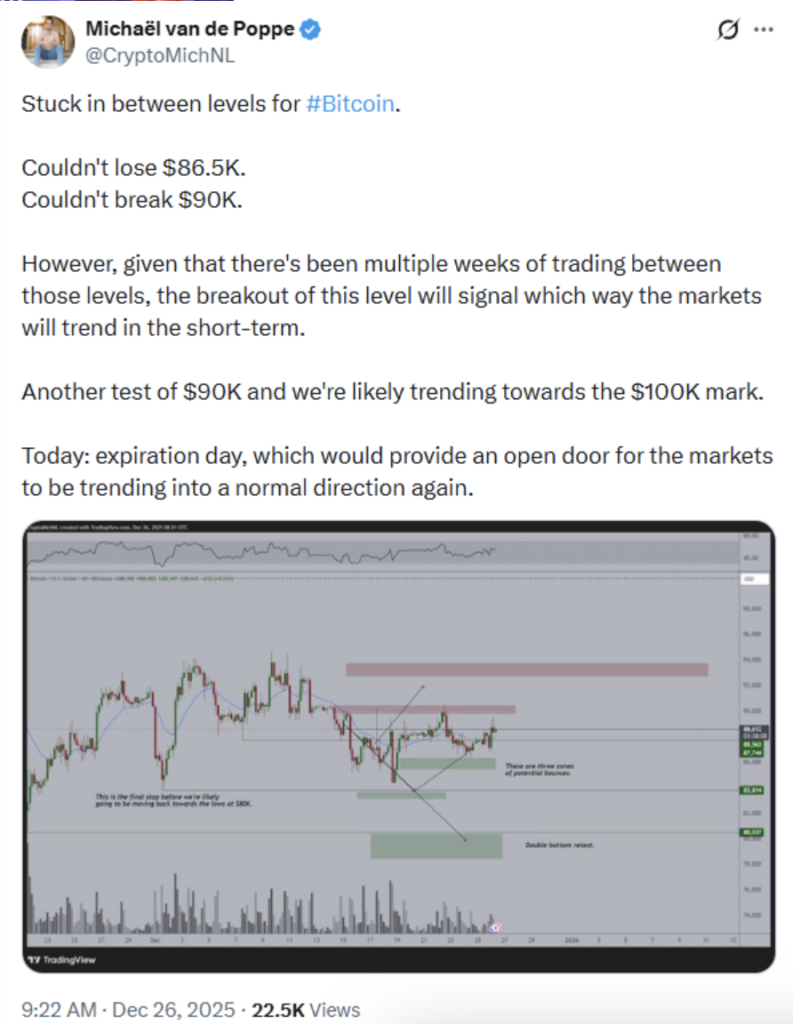

In line with analyst Michaël van de Poppe, Bitcoin has repeatedly defended the $86,500 space whereas failing to push cleanly above $90,000. This vary has survived a number of weekly closes, which is notable.

Lengthy consolidations like this typically don’t final without end. The longer worth coils, the extra aggressive the eventual transfer tends to be. Van de Poppe notes that if Bitcoin lastly clears $90,000 with robust quantity, the trail towards $100,000 turns into way more reasonable.

That stated, nothing is assured. One other rejection might merely lengthen the sideways grind. For now, the market stays balanced, nearly stubbornly so.

On the time of writing, Bitcoin trades close to $88,556, hovering near resistance however nonetheless firmly contained in the vary.

Choices Expiry and Brief-Time period Strain Reduction

One delicate issue merchants are watching is derivatives expiration. When massive possibility contracts roll off, short-term worth strain typically fades.

This will enable Bitcoin to maneuver extra organically, with out pressured hedging or pinning results. Traditionally, these intervals generally coincide with momentum shifts, although not at all times. Nonetheless, it’s one thing desks are inclined to regulate.

The Binance Flash Crash Wasn’t What It Regarded Like

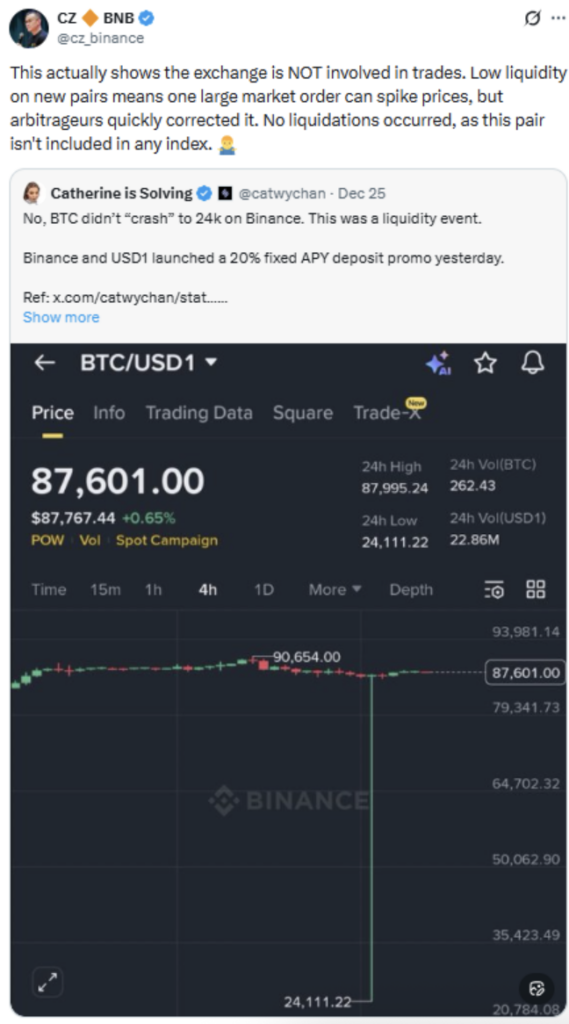

A sudden drop on Binance, the place Bitcoin briefly traded close to $24,000, triggered panic throughout social media. At first look, it appeared like a significant crash. It wasn’t.

The transfer was tied to a liquidity subject, not broader market stress. The set off was a 20% fixed-yield promotion for USD1 deposits, which triggered customers to swap USDT into USD1 at scale. That demand pushed USD1 right into a premium, an uncommon state of affairs for a stablecoin.

Some merchants borrowed USD1 utilizing Bitcoin-linked collateral and slowly bought into demand. One dealer, nonetheless, positioned a big market promote on the BTC/USD1 pair, a market with very skinny liquidity.

That single order worn out the order e-book. Algorithms instantly stepped in, purchased the discounted Bitcoin, and worth snapped again nearly immediately.

Binance founder Changpeng Zhao later confirmed that no liquidations occurred and that the pair concerned doesn’t feed into main worth indexes. Briefly, it appeared dramatic, however it wasn’t systemic.

Lengthy-Time period Bitcoin Value Expectations Stretch Greater

Trying past the noise, long-term projections stay wide-ranging. One forecast attributed to ChatGPT locations Bitcoin someplace between $110,000 and $160,000 in 2026, with a median estimate round $135,000.

That outlook assumes Bitcoin holds above prior cycle highs and avoids main macro shocks. In that situation, progress can be regular, not explosive.

Different commentators are extra aggressive, floating targets as excessive as $250,000 by 2026. The logic is acquainted: adoption builds quietly, infrastructure comes first, and worth reacts later.

Examples like Visa enabling USDC settlements on Solana for U.S. banks are sometimes cited as alerts that the plumbing is being put in, even when markets haven’t absolutely priced it but.

A Market Nonetheless Ready for Its Sign

For now, Bitcoin stays in limbo. Help and resistance are clear, volatility is compressed, and sentiment feels cautious fairly than euphoric.

Whether or not the following transfer is towards $100,000 or one other stretch of consolidation will rely on quantity, liquidity, and actual adoption momentum. Till then, Bitcoin’s worth motion displays a market that is aware of one thing large is coming, simply not when.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.