Bitcoin stays below structural strain as worth continues to commerce inside a well-defined corrective setting. Current worth motion exhibits hesitation and compression somewhat than development continuation, suggesting the market is ready for a decisive catalyst earlier than the following directional transfer.

Technical Evaluation

The Every day Chart

On the each day timeframe, Bitcoin continues to be respecting a broader descending construction following the latest impulsive selloff. The value is at the moment confined between a well-defined demand zone within the $82K–$80K vary and a significant resistance band close to $95K–$96K. The repeated failure to reclaim the mid-range resistance highlights persistent sell-side management, whereas the decrease highs construction confirms that bullish momentum stays weak.

The market is now buying and selling nearer to the decrease half of the vary, the place patrons have beforehand stepped in to defend the value. Nonetheless, the absence of sturdy bullish displacement from this zone means that demand is reactive somewhat than initiative-driven. So long as BTC stays beneath the $95K resistance and the descending development construction stays intact, the each day bias stays impartial to bearish, with consolidation or gradual draw back continuation nonetheless favored.

The 4-Hour Chart

The 4-hour chart supplies clearer perception into the present market habits. The first cryptocurrency is consolidating inside a good vary following a chronic selloff, forming a compression zone beneath the rising short-term wedge and overhead resistance. This worth motion displays equilibrium between patrons and sellers somewhat than accumulation, as BTC repeatedly fails to interrupt larger with conviction.

Current upside makes an attempt have been rejected rapidly, indicating that provide stays lively on minor rallies. On the identical time, draw back strain has slowed close to the $85K–$86K area, the place short-term demand continues to soak up promote orders. This worth habits suggests a range-bound setting, with liquidity being constructed on each side earlier than an enlargement. A clear breakdown beneath the consolidation would open the trail towards the $82K demand zone, whereas a sustained reclaim above the short-term resistance could be required to shift the intraday bias to the bullish aspect.

Till such a decisive breakout happens, nevertheless, the 4-hour construction helps continued uneven worth motion and liquidity-driven strikes somewhat than development growth.

Sentiment Evaluation

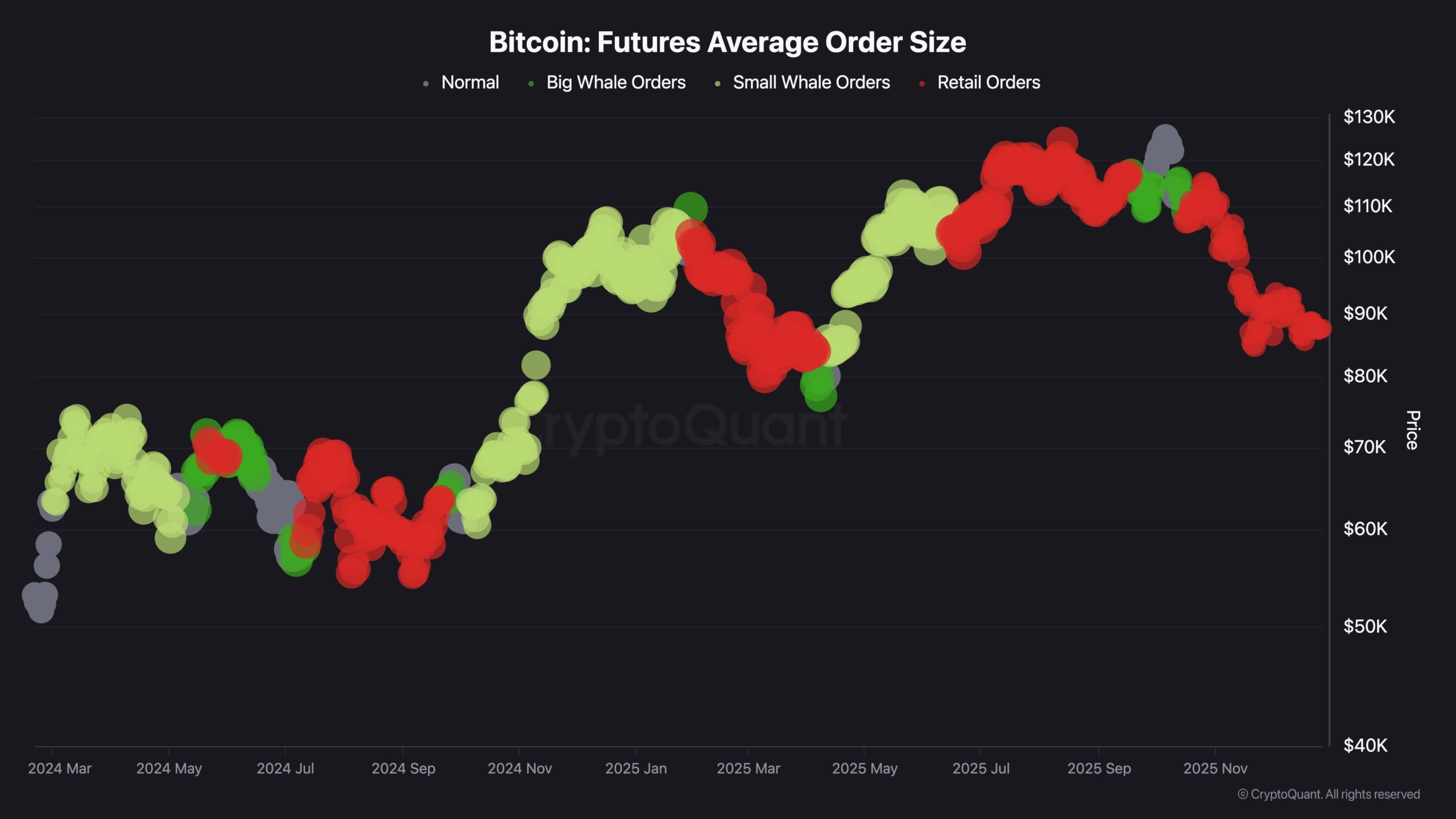

The futures common order dimension knowledge highlights a transparent shift in market participation, with latest exercise more and more dominated by smaller merchants. As worth oscillates beneath latest highs, the chart exhibits a visual rise in retail-sized orders, whereas whale exercise has notably cooled off. This habits sometimes displays late-stage participation, the place smaller merchants grow to be extra lively after main directional strikes have already performed out.

Throughout the earlier bullish phases, bigger order sizes had been extra constantly current, indicating stronger institutional or whale involvement driving worth enlargement. In distinction, the present setting exhibits an absence of sustained massive orders, suggesting that sensible cash participation has both paused or moved right into a extra defensive stance. With out constant whale-sized orders coming into the market, upside momentum tends to weaken, leaving the value extra weak to volatility and draw back strain.

The dominance of retail-sized futures orders across the present worth area reinforces the concept latest rebounds aren’t being supported by sturdy conviction from bigger gamers. Traditionally, any such order circulation imbalance usually precedes prolonged consolidation or additional corrective strikes, as retail-driven rallies battle to soak up overhead provide. Except a transparent resurgence in massive order exercise emerges, the on-chain construction continues to align with a cautious to bearish short-term outlook for Bitcoin.

The submit Bitcoin Technical Evaluation: Demand at $82K Holds Key to Brief-Time period Bias appeared first on CryptoPotato.