Be part of Our Telegram channel to remain updated on breaking information protection

SharpLink co-CEO Joseph Chalom has predicted that the full worth locked (TVL) on Ethereum will soar 10X in 2026.

In a Dec. 26 X thread, Chalom named the rising stablecoin, tokenized RWA (real-world property), and prediction market segments because the catalysts for that anticipated surge.

Stablecoin House To Hit $500B By The Finish Of 2026

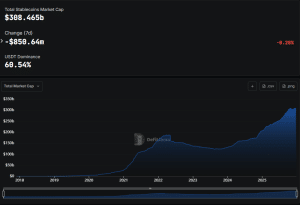

Stablecoins have seen substantial development this 12 months, with the market cap for these tokens breaking above $300 billion for the primary time this 12 months.

Stablecoin market cap (Supply: DefiLlama)

The stablecoin house’s momentum obtained a lift after US President Donald Trump signed the GENIUS Act into legislation in July, offering the house with some long-awaited regulatory readability.

Chalom expects the stablecoin house to proceed its development and attain a market cap of $500 billion by the top of 2026. This might result in extra worth shifting onto the Ethereum blockchain, which has a greater than 53% share of the stablecoin market.

“International stablecoin use circumstances, together with cross-border remittances, retail funds, and institutional transactions, will proceed to extend with Ethereum establishing itself because the foundational settlement layer for the motion of worth,” the co-CEO mentioned.

“From JPM and PayPal issuing stables to Japan and South Korea asserting their local-currency denominated variations – and EU banks accredited to problem – there are massive gamers that may enter the scene in 2026,” Chalom added.

He then went on to say that the adoption for stablecoins will lay the groundwork at every establishment for broader crypto adoption.

Tokenized RWA Market Will Increase Whereas Prediction Markets And On-Chain AI Brokers Go Mainstream

Together with stablecoins, Chalom predicted that the tokenized property market will soar 10X subsequent 12 months. He mentioned {that a} vary of property might be tokenized on-chain, starting from particular person funds, shares, and bonds to “full fund complexes.”

2/ Tokenized RWAs will hit $300B in 2026.

Tokenized property will 10X in AUM in 2026, going from tokenizing particular person funds, shares, and bonds to full fund complexes.

With Goldman Sachs and BNY Melon collaborating on tokenized money-market and liquidity funds on blockchain…

— Joseph Chalom (@joechalom) December 26, 2025

Chalom then talked about the efforts by Goldman Sachs and BNY Mellon to tokenize money-market and liquidity funds on blockchain rails. He additionally famous that Franklin Templeton and BlackRock have expressed their intentions to make comparable strikes.

The SharpLink co-CEO then shifted his consideration to prediction markets and on-chain AI brokers, two sectors that he believes will “go mainstream” and drive “important exercise on Ethereum.”

Sovereign Wealth Funds’ Holdings Will Soar 5-10X

Sovereign wealth funds are additionally anticipated to extend their ETH holdings 5-10X, based on Chalom.

“As onchain exercise booms, we’ll see ETH holdings of sovereign wealth funds improve in lock-step as they achieve publicity to the ‘trustware’ asset that secures Ethereum, the place nearly all of the innovation is concentrated,” he mentioned.

3/ ETH holdings and tokenization by sovereign wealth funds will improve 5-10X.

As onchain exercise booms, we’ll see ETH holdings of sovereign wealth funds improve in lock-step as they achieve publicity to the “trustware” asset that secures Ethereum, the place nearly all of the…

— Joseph Chalom (@joechalom) December 26, 2025

He famous that pensions, endowments, and one of many largest sovereign wealth funds on this planet gained first-time entry to crypto by way of ETF (exchange-traded funds) and spot purchases this 12 months. “In 2026 it will amplify meaningfully as aggressive dynamics take maintain,” Chalom predicted.

SharpLink Generates 460 ETH In Staking Rewards

SharpLink is the second-largest company ETH holder globally with 863.02K tokens on its steadiness sheet, based on information from StrategicETHReserve. At present costs, these holdings are valued at about $2.53 billion.

Earlier this week, the corporate introduced that it generated 460 ETH in staking rewards final week. This has pushed SharpLink’s complete cumulative staking rewards to 9,701 ETH for the reason that firm launched its treasury.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection