- Solana is attracting near-term adoption because of low charges, quick upgrades, and rising exercise in tokenized equities, now nearing $185 million in worth.

- Ethereum nonetheless dominates in complete worth locked, stablecoin utilization, and monetary depth, positioning it for long-term infrastructure relevance slightly than speedy iteration.

- Hoskinson argues the competitors is about timing: Solana captures speed-driven development now, whereas Ethereum focuses on research-heavy methods designed to matter later.

Charles Hoskinson thinks the Solana vs. Ethereum debate relies upon loads on if you’re wanting. Within the brief run, Solana has the sting. It strikes quick, ships upgrades rapidly, and doesn’t get slowed down in lengthy coordination cycles. Ethereum, then again, appears content material taking the longer highway, constructing rigorously and betting that depth will matter greater than pace over time.

That distinction is beginning to present up in how actual tasks select their properties.

Why Solana Is Successful Consideration Proper Now

Solana’s attraction is fairly simple. The community handles an enormous variety of transactions, charges keep low, and groups can transfer rapidly with out ready years for protocol modifications. Hoskinson famous that this flexibility has made Solana particularly enticing for experiments in tokenized finance.

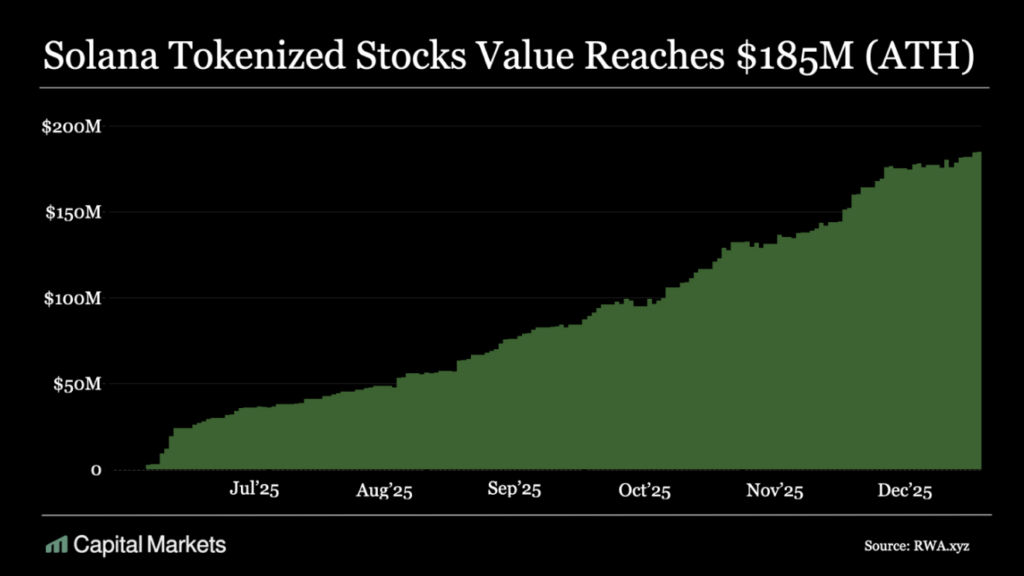

Not too long ago, tokenized equities on Solana crossed roughly $185 million in complete worth. Platforms like xStocksFi, Superstate, and Remora Markets are already dwell and pushing exercise on-chain. For merchants and establishments that care about execution pace and value effectivity, that issues. Quite a bit.

It’s not excellent, but it surely’s quick. And proper now, pace is successful consideration.

The Hole Beneath the Floor Is Nonetheless Large

Nonetheless, the numbers inform a extra difficult story. Solana’s complete worth locked and stablecoin utilization sit at roughly 10% of Ethereum’s ranges. That’s not a small distinction, it’s a structural one.

Ethereum helps a lot deeper monetary exercise, from lending and staking to large-scale stablecoin flows. These layers create stickiness. They make it simpler for complicated merchandise to exist and more durable for capital to go away as soon as it’s settled.

So whereas Solana is rising, it hasn’t but matched Ethereum’s monetary gravity.

Ethereum Is Constructing for the Lengthy Sport

Ethereum’s method is nearly the alternative. Progress is slower, coordination is heavier, and analysis takes precedence. Lots of focus goes into zero-knowledge proofs, superior scaling, and shifting validation towards cryptographic proof methods.

The concept is easy, even when the execution isn’t. Ethereum desires to turn out to be a verification and settlement layer that many different networks depend on, not only a quick execution chain. That takes time. And persistence.

Hoskinson framed it as technique versus pace. Solana can react rapidly and seize early use. Ethereum is attempting to construct one thing that lasts longer, even when it means lacking some short-term wins.

Velocity Now, Construction Later

This distinction reveals up all over the place. Solana’s management mannequin permits quicker choices and faster characteristic rollouts. Ethereum’s governance is slower, but it surely’s designed to scale back threat and prioritize correctness.

Neither method is clearly proper or unsuitable. They’re simply optimized for various outcomes. One favors speedy adoption. The opposite favors long-term reliability and deep infrastructure.

Markets will resolve which issues extra.

What This Means for Builders and Buyers

For groups chasing development in the present day, Solana typically appears to be like like the better alternative. For these constructing methods that want deep liquidity, composability, and long-term ensures, Ethereum nonetheless holds the benefit.

The $185 million tokenized inventory milestone on Solana is significant, but it surely’s tiny in comparison with conventional markets or Ethereum’s on-chain economic system. Nonetheless, it reveals momentum.

Ultimately, each networks are being examined by actual utilization now, not idea. And whichever path wins received’t be determined by narratives, however by the place customers and establishments select to function over the subsequent few years.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.