Few subjects divide the crypto business greater than politics. Donald Trump is also known as “America’s first crypto president,” whereas the Biden administration earned a repute for being hostile towards the sector.

However when rhetoric is stripped away and changed with market information, the image turns into extra nuanced. The important thing query shouldn’t be which administration spoke extra favorably about crypto, however beneath whose management Bitcoin in the end carried out higher.

Bitcoin Efficiency: The Numbers Inform a Clear Story

Within the 2024 United States presidential election, Trump positioned himself as a pro-crypto candidate, vowing to make the US the “crypto capital of the world.” He promised to halt anti-crypto actions, rein in SEC crackdowns, and, in his personal phrases:

“Finish Joe Biden’s warfare on crypto and we’ll be sure that the way forward for crypto and the way forward for Bitcoin shall be made in America.”

This fueled optimism available in the market and ignited hopes for a bull run. Quick ahead to close the tip of 2025, and Bitcoin is down almost 5%.

Sponsored

Sponsored

By comparability, throughout Biden’s first 12 months as president, the world’s largest cryptocurrency gained roughly 65%. Efficiency weakened in 2022, however momentum returned within the following years.

Bitcoin rebounded strongly, rising roughly 155% in 2023 and an extra 120.7% in 2024.

| Yr | Bitcoin return (%) |

| 2021 | 65% |

| 2022 | 64.2% |

| 2023 | 155% |

| 2024 | 120.7% |

| 2025 (As of December 26) | -5% |

When analyzing Trump’s first time period as president, an analyst famous that it was “the best crypto bull run” in historical past, throughout which the overall cryptocurrency market capitalization elevated by roughly 115 instances from the start of his time period to its finish.

“Biden’s time period returned 4.5x from starting to finish, and even on the worst second, it by no means went under the annual open for his time period. Trump’s 2nd time period to date is under annual open, however 3 extra years to go,” the pseudonymous analyst wrote.

Bitcoin Beneath Trump

So what truly occurred this 12 months? The pullback shouldn’t be one thing that may be understood by taking a look at headline 2025 returns alone.

In January, momentum was broadly on Bitcoin’s aspect. Forward of Trump’s inauguration, BTC rallied above $109,000, marking a brand new all-time excessive on the time. There have been additionally developments on the regulatory aspect, with the SEC making a job pressure to supply a clear regulatory framework for digital belongings.

Nonetheless, Trump’s subsequent strikes erased all these features. After he introduced tariffs on the EU and later expanded on them at Liberation Day, cryptocurrency markets declined alongside equities.

Notably, the announcement of a pause led to a modest restoration. This highlighted the market’s sensitivity to broader macroeconomic developments and pointed to elevated volatility.

Sponsored

In the meantime, adoption continued to rise as state-level Bitcoin reserve initiatives and institutional involvement elevated. Bitcoin’s worth continued to pattern larger, posting constructive returns for 4 consecutive months from April by way of July.

A key pattern throughout this era was the emergence of digital asset treasuries (DATs). Public firms more and more started adopting Bitcoin as a reserve asset, following the playbook popularized by Micro (Technique).

Bitcoin benefited from this shift, as many consultants argued institutional involvement may assist scale back volatility and sign the asset’s maturation inside conventional finance.

As confidence grew, so did the danger urge for food and using leverage. Excessive-risk, extremely leveraged merchants drew widespread consideration. On the macroeconomic entrance, the Fed slashed rates of interest in September. This was once more bullish for threat belongings.

Bitcoin went on to achieve a brand new all-time excessive in October, peaking at $125,761 on October 6. Many projected additional upside, with targets starting from $185,000 to $200,000 by year-end.

This optimism was supported by favorable macroeconomic catalysts and Bitcoin’s traditionally sturdy efficiency in the course of the fourth quarter.

BeInCrypto reported that on October 11, Trump’s announcement of 100% tariffs on China pulled the market decrease. Over $19 billion in leveraged positions have been worn out, leading to vital losses for a lot of merchants.

The broader downturn persevered within the coming months, amplified by leverage.

“It additionally seems to be a structural and mechanical downturn. All of it started with institutional outflows in mid-to-late October. Within the first week of November, crypto funds noticed -$1.2 billion of outflows. The issue turns into extreme ranges of leverage AMID these outflows…Extreme ranges of leverage have resulted in a seemingly hypersensitive market,” The Kobeissi Letter posted in November.

Bitcoin dropped 17.67% in November and has since misplaced a further 1.7% of its worth this month, based on Coinglass information.

Sponsored

Sponsored

From Bitcoin ETFs to Altcoins: Regulatory Modifications and Market Response

The Trump and Biden administrations differed on a number of key points, certainly one of which was crypto ETFs. Beneath the Biden administration, the SEC initially took a much more cautious strategy to the crypto sector. This stance prolonged to crypto ETFs.

Nevertheless, the regulatory place shifted following a ruling by the US Courtroom of Appeals for the DC Circuit, which ordered the SEC to rethink Grayscale Investments’ software to transform its flagship GBTC fund right into a spot Bitcoin ETF.

Thus, the SEC authorised spot Bitcoin ETFs in January 2024 and later greenlit spot Ethereum ETFs in July.

Notably, after Gary Gensler’s departure from the SEC, asset managers have been fast to file a number of purposes for altcoin ETFs. Corporations together with Bitwise, 21 Capital, and Canary Capital, amongst others, submitted filings to launch a spread of crypto-based funding merchandise.

In September, the SEC authorised generic itemizing requirements, eliminating the necessity for case-by-case approvals. Following this shift, ETFs linked to belongings equivalent to SOL, HBAR, XRP, LTC, LINK, and DOGE entered the market.

In November, Canary Capital’s XRP ETF noticed $58.6 million in buying and selling quantity on its first day, rating because the strongest debut amongst greater than 900 ETFs launched in 2025. Bitwise’s Solana ETF additionally attracted vital curiosity, producing $56 million in first-day quantity, whereas different merchandise recorded comparatively decrease exercise.

From a regulatory standpoint, the ETFs have elevated market entry, and the ruling diminished obstacles for issuers. Nevertheless, early efficiency information counsel that the introduction of further crypto ETFs has not but translated right into a proportional improve in combination market inflows.

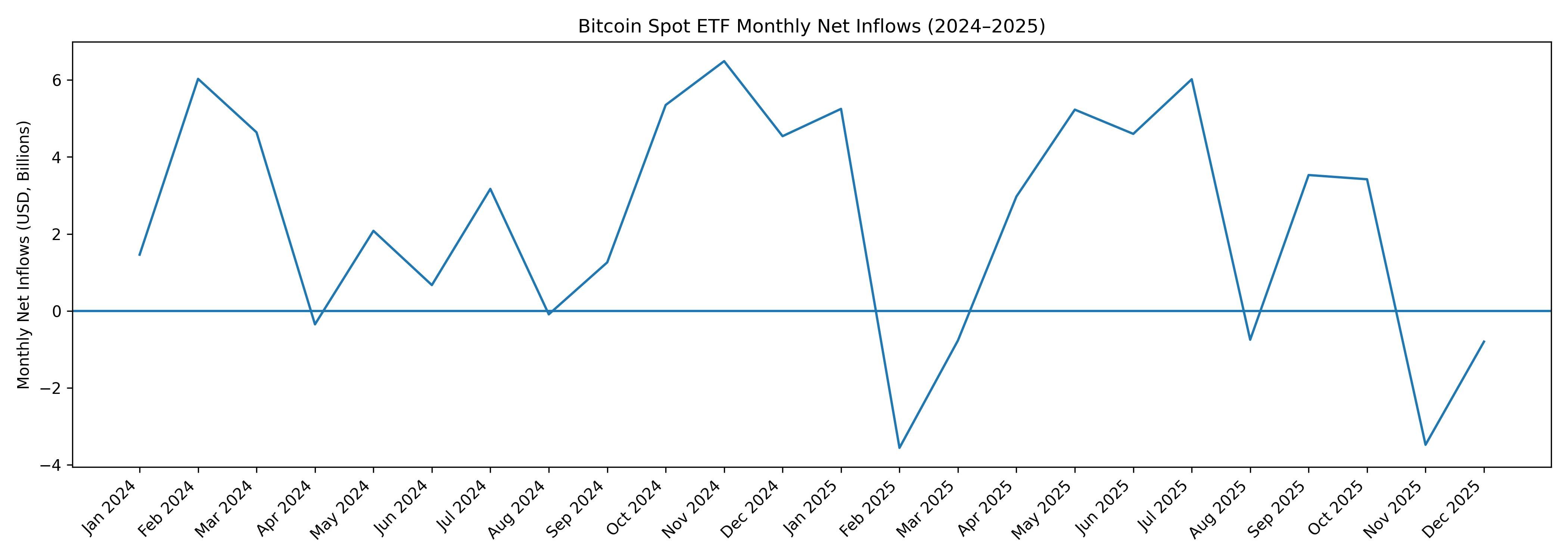

In 2024, spot Bitcoin ETFs attracted roughly $35.2 billion in internet inflows. In 2025, inflows into Bitcoin ETFs slowed to $22.16 billion based on SoSoValue information. This divergence means that the expansion in ETF choices might have coincided with a redistribution of capital throughout merchandise relatively than an growth of complete crypto publicity.

Sponsored

Sponsored

Contained in the Trump Household’s Crypto Empire

Though Donald Trump’s affect available on the market is obvious, he has additionally turn into immediately concerned within the crypto area. In January, the president launched a meme coin, quickly adopted by a intently resembling token launched by Melania Trump.

In March, US President Donald Trump’s sons, Eric Trump and Donald Trump Jr., partnered with Hut 8 to launch American Bitcoin Corp.

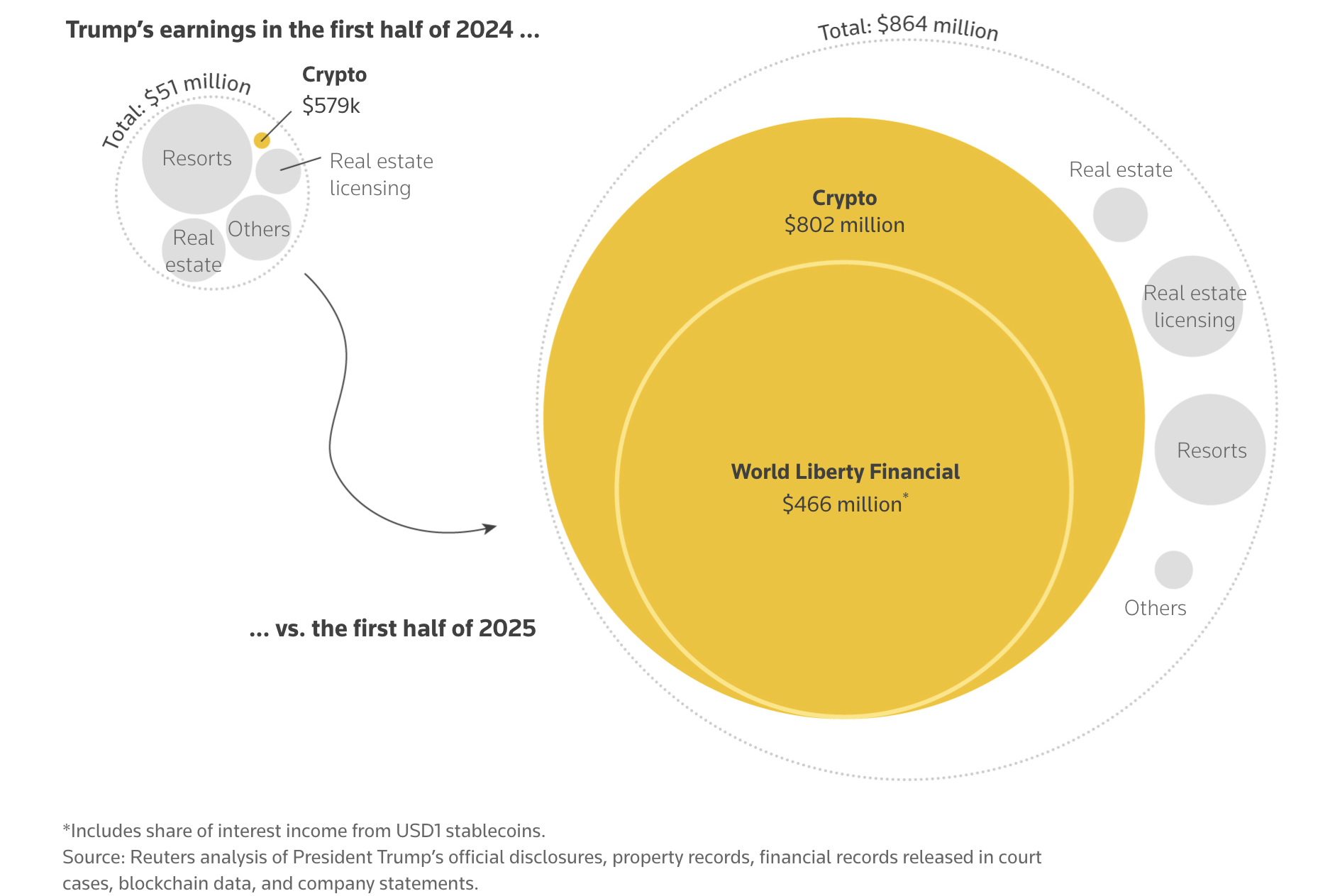

These ventures have generated vital wealth for the US president and his household. In line with a Reuters evaluation, they earned greater than $800 million from crypto asset gross sales within the first half of 2025 alone,

One may argue that these strikes helped legitimize the sector and speed up adoption. Nonetheless, Trump’s direct and oblique involvement in crypto-related ventures raises issues round optics, governance, and market integrity. Whereas meme cash usually are not new to the crypto area, their affiliation with a sitting US president is unprecedented.

These actions have additionally drawn sharp criticism from regulators and customers alike. The Trump meme coin, WLFI, and American Bitcoin Corp have all suffered steep declines, leading to vital losses for supporters.

Conclusion

Taken collectively, the information counsel that the reply to who helped crypto essentially the most will depend on how “assist” is outlined. Beneath Trump, crypto has benefited from a friendlier regulatory tone, diminished enforcement strain, and sooner approval of latest funding merchandise.

These modifications lowered obstacles for issuers and expanded market entry.

Nevertheless, market efficiency tells a special story. Bitcoin’s strongest features occurred earlier, throughout Joe Biden’s presidency.

In the meantime, Trump’s first 12 months again in workplace has been marked by heightened volatility.