- No Santa Claus rally for Ethereum ETFs this yr

- Bitcoin ETF outflows exceeded $4 billion in two months

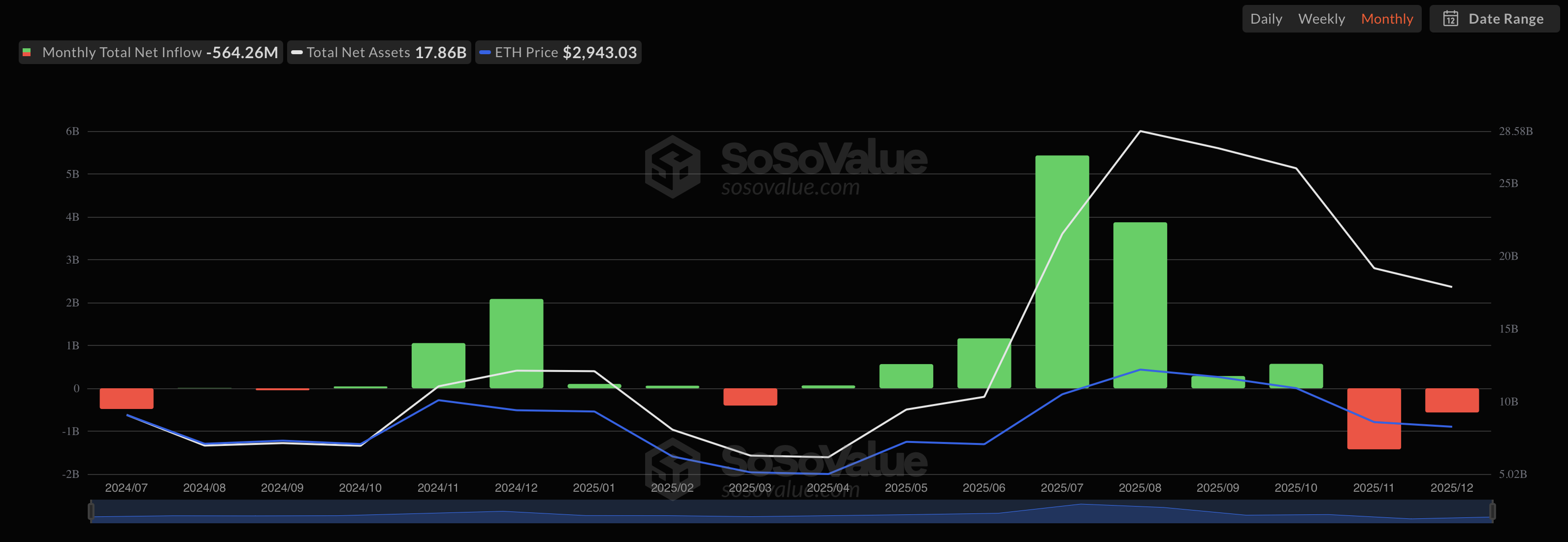

Alternate-traded merchandise based mostly on spot Ether have been witnessing a large outflow within the final weeks. With solely three buying and selling classes left in 2025, Ethereum ETFs are nearly able to print the second worst month within the historical past of this asset class.

No Santa Claus rally for Ethereum ETFs this yr

In December 2025, spot Ethereum ETFs in the USA noticed their traders withdrawing liquidity en masse. Outflows exceeded $564 million in equal, as per SoSoValue’s information.

The cumulative USD-denominated liquidity quantity in Ether ETFs is again to ranges unseen since June. As of right now, $17.86 billion is locked in all ETFs, which is 37.5% decrease in comparison with August 2025 highs.

December 2025 has all possibilities to change into the second worst month in your complete historical past of Ethereum ETFs as an asset class. It already introduced extra ache in comparison with July 2024 and March 2025 with their $460 million and $408 million in outflows, respectively.

Uber-bearish November 2025 stays probably the most brutal month for the Ethereum ETFs scene, with internet outflows exceeding $1.42 billion.

Within the corresponding interval, Ethereum’s (ETH) worth dropped from the $4,953 excessive to the $2,800-$3,300 zone it has been caught in for the final seven weeks.

Bitcoin ETF outflows exceeded $4 billion in two months

As of printing time, Ethereum (ETH) is altering palms at $2,926, being 41% down from its all-time excessive and 13% down YTD.

The spot Bitcoin ETFs section can be dealing with large outflows this month. With $804 million misplaced, it’s the third worst month within the two-year historical past of spot Bitcoin ETFs.

Mixed with the devastating November 2025, the sphere misplaced over $4 billion or 3.5% of its USD-denominated TVL.

Grayscale’s GBTC and Constancy’s FBTC recorded the most important outflows right here.