- Bitcoin is underneath short-term stress, with This fall shaping up as one in all its weaker quarters amid worry, ETF outflows, and short-term holder capitulation.

- Regardless of the drawdown, declining volatility and rising institutional adoption counsel Bitcoin is transitioning right into a extra mature, long-term asset.

- Analysts imagine this part could symbolize a structural reset, setting the stage for potential new highs within the coming years slightly than a breakdown.

Bitcoin appears to be like uneasy proper now, and there’s no level pretending in any other case. Value motion feels heavy, draw back danger remains to be on the desk, and short-term confidence is skinny. However beneath the floor, one thing extra attention-grabbing is occurring. The best way the market treats Bitcoin is slowly altering, and that shift could find yourself mattering excess of the subsequent few pink candles on the chart.

Bent, However Far From Damaged

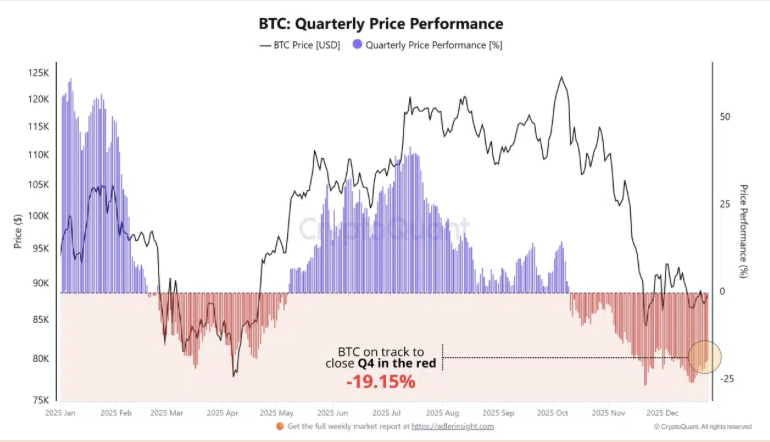

Bitcoin is on tempo to shut This fall down roughly 19%, making it one of many weaker quarters we’ve seen lately. The on-chain information backs up the ache. Quick-term holders are promoting at a loss, sentiment has slipped into “excessive worry,” and ETF outflows proceed to quietly drain liquidity. It’s the type of atmosphere the place confidence feels fragile and each bounce will get bought.

Indicators like SOPR and MVRV counsel that capitulation isn’t absolutely carried out but. That doesn’t mechanically imply a collapse, however it does level to a stretch of grinding value motion. Sideways chop, false begins, perhaps even one other leg decrease. Traditionally, these phases can final a few months, lengthy sufficient to check persistence and shake out weak fingers.

Nonetheless, this doesn’t seem like structural failure. It appears to be like extra like a market cooling off after extra.

A Totally different Bitcoin Is Taking Form

Zoom out a bit, and the longer-term image begins to vary. Bitwise just lately instructed that Bitcoin could lastly break free from its inflexible four-year cycle, with a push towards new highs probably coming in 2026 slightly than following the previous script. Their argument is easy however compelling. Halving dynamics, institutional adoption, and regular ETF demand are altering how Bitcoin behaves.

One of many greatest tells is volatility. In 2025 up to now, Bitcoin has really been much less risky than shares like Nvidia. That’s not one thing you’d have mentioned a number of years in the past. It’s beginning to act much less like a speculative toy and extra like a grown-up asset, boring at occasions, however tougher to disregard.

If that development continues, this present weak point could finally be remembered not as a breakdown, however as a transition part. Messy, uncomfortable, and sluggish, positive, however obligatory.

A Sense of Permanence Is Setting In

Lengthy-term worth isn’t about day by day candles, it’s about place. And Bitcoin’s place at this time may be very completely different from the place it was even 5 years in the past. It now sits comfortably among the many prime international property, alongside names like gold, Apple, and Microsoft. That alone says lots.

Establishments are not asking if Bitcoin survives. They’re deciding how a lot publicity is smart. That shift brings credibility, liquidity, and endurance. Cycles will nonetheless come and go, corrections will nonetheless sting, however Bitcoin’s place on the worldwide steadiness sheet feels more and more everlasting.

A decade from now, the controversy possible received’t be about whether or not Bitcoin makes it. It’ll be about the place it ranks.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.