High Tales of The Week

YouTube permits PYUSD stablecoin payouts for US creators: Report

Video-sharing large YouTube has reportedly enabled US-based creators to just accept payouts in PayPal’s stablecoin, PYUSD.

Fortune reported on Thursday that PayPal’s head of crypto, Might Zabaneh, stated the characteristic is stay, however just for customers within the US. The agency built-in the power for recipients to just accept funds in PYUSD earlier this 12 months, with YouTube finally opting to open that selection as much as its creators.

“The fantastic thing about what we’ve constructed is that YouTube doesn’t have to the touch crypto and so we can assist take away that complexity,” she stated.

PayPal has had a long-standing relationship with YouTube, permitting customers to pay by way of its companies for a few years and using it for creators’ AdSense payouts.

CFTC pulls ‘precise supply’ crypto steering, giving flexibility to exchanges

US Commodity Futures Buying and selling Fee Performing Chairman Caroline Pham has scrapped “outdated steering” on the supply of crypto, which has been applauded for providing exchanges extra flexibility.

“Eliminating outdated and overly complicated steering that penalizes the crypto trade and stifles innovation is strictly what the Administration has set out to do that 12 months,” Pham stated on Thursday.

The steering, initially finalized in March 2020, associated to when the “precise supply” of crypto occurred in a commodity transaction, however the CFTC stated in a discover that it needed to “reevaluate such steering in mild of additional developments in the course of the previous 5 years.”

The CFTC underneath Pham has labored on a extra crypto-friendly strategy, and Pham stated the steering was withdrawn on suggestions from the president’s crypto working group, which recommended the CFTC launch steering on how crypto could also be thought-about commodities and develop on prior steering relating to the precise supply of digital property.

US SEC’s Crenshaw takes intention at crypto in closing weeks at company

US Securities and Trade Commissioner Caroline Crenshaw, who is anticipated to depart the company in lower than a month, used one in all her closing public talking engagements to handle the regulator’s response to digital property.

Talking at a Brookings Establishment occasion on Thursday, Crenshaw stated requirements on the SEC had “eroded” within the final 12 months, with “markets [starting] to appear like casinos,” and “chaos” because the company dismissed many years-long enforcement circumstances, lowered civil penalties and filed fewer actions general.

The commissioner, anticipated to depart in January after her time period formally led to June 2024, additionally criticized many crypto customers and the company’s response to the markets.

Satoshi Nakamoto statue lands on NYSE in signal of adjusting instances

The New York Inventory Trade (NYSE) has turn out to be the sixth host of Valentina Picozzi’s “disappearing” Satoshi Nakamoto statue — a placing shift from only a few years in the past when crypto was nonetheless taboo on Wall Road.

Lengthy seen as a bastion of conventional finance, the NYSE known as the set up “shared floor between rising techniques and established establishments” in an X publish on Wednesday.

The statue was put in by Bitcoin agency Twenty One Capital, which started buying and selling this week. The design itself is the work of Picozzi, who wrote on X underneath her Satoshigallery deal with that seeing her newest piece in such a high-profile setting is “mind-blowing.”

State Road, Galaxy and Ondo be a part of tokenized money race with 24/7 sweep fund

State Road Funding Administration and Galaxy Asset Administration are becoming a member of forces with Ondo Finance on a tokenized liquidity fund that may push money “sweep” balances instantly onto public blockchains, creating a possible supply of 24/7 onchain liquidity.

The deliberate State Road Galaxy Onchain Liquidity Sweep Fund, or SWEEP, is designed to absorb and pay out PayPal’s stablecoin for accredited buyers, the businesses stated on Tuesday.

Ondo is anticipated to seed the fund with $200 million, tying a significant tokenized real-world asset issuer instantly into State Road’s tokenization stack. The fund shall be powered by Galaxy Digital infrastructure, whereas State Road Financial institution and Belief Firm, an affiliate of State Road Funding Administration, will act as custodian.

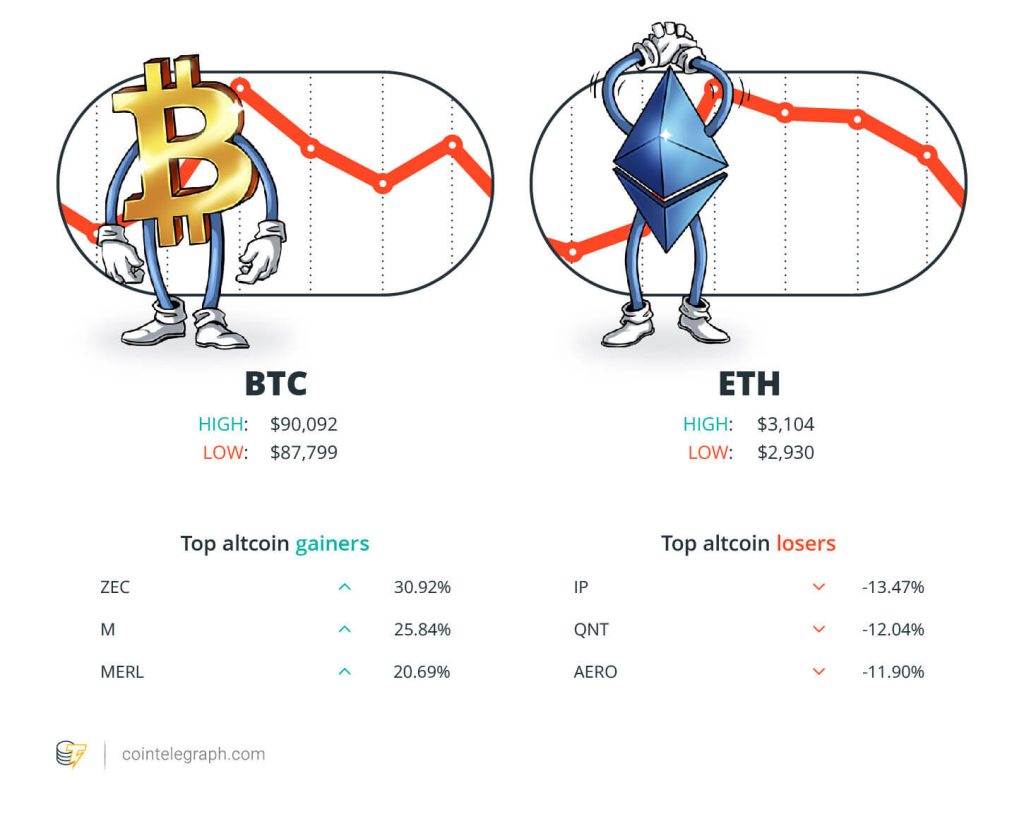

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $90,092, Ether (ETH) at $3,104 and XRP at $2.02. The whole market cap is at $3.06 trillion, in keeping with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Zcash (ZEC) at 30.92%, MemeCore (M) at 25.84% and Merlin Chain (MERL) at 20.69%.

The highest three altcoin losers of the week are Story (IP) at 13.47%, Quant (QNT) at 12.04% and Aerodrome Finance (AERO) at 11.90%. For more information on crypto costs, ensure that to learn Cointelegraph’s market evaluation.

High Prediction of The Week

Bitcoin wobbles at $92K as dealer eyes finish to ‘manipulative’ BTC worth dip

Information from Cointelegraph Markets Professional and TradingView confirmed wavering BTC worth motion after a visit to $95,500 the day prior.

Up in opposition to a number of resistance options on the each day chart, BTC/USD coiled for what some stated needs to be a breakout transfer.

“Bitcoin is doing the uneven dance. Illiquid books, and subsequently quick strikes up and down for the place on $BTC,” crypto dealer, analyst and entrepreneur Michaël van de Poppe wrote in his newest evaluation on X. “Nonetheless, I feel that we’re nonetheless in for a brand new upwards breakout within the coming days/weeks.”

High FUD of The Week

Senior Vanguard analyst says Bitcoin is not any higher than a luxurious toy

Bitcoin is a purely speculative asset and is akin to a collectible toy, in keeping with John Ameriks, the worldwide head of quantitative fairness at asset administration firm Vanguard.

“It’s tough for me to consider Bitcoin as something greater than a digital Labubu,” Ameriks stated at Bloomberg’s ETFs in Depth convention in New York Metropolis.

Learn additionally

Options

Right here’s how Ethereum’s ZK-rollups can turn out to be interoperable

Options

Shanghai Particular: Crypto crackdown fallout and what occurs subsequent

Labubus are collectible dolls within the type of rabbit-like creatures with anthropomorphic options. Regardless of Ameriks’ criticism, he stated that Bitcoin might have worth past monetary hypothesis sooner or later underneath sure circumstances.

The cryptocurrency may discover real-world use circumstances past market hypothesis in situations of excessive fiat foreign money inflation or political instability, Ameriks stated. These forces drive the adoption of different currencies.

Upbit hack places Binance’s emergency freeze coverage underneath scrutiny

In accordance with South Korean broadcaster KBS, Binance froze solely a portion of funds that police stated have been linked to a Nov. 27 hack of crypto alternate Upbit, one in all South Korea’s largest exchanges.

KBS reported Friday that investigators requested Binance freeze about 470 million Korean received ($370,000) in Solana tokens believed to be related to the incident. The alternate finally blocked about $55,000 (roughly 17% of the requested quantity) after a 15-hour delay.

In accordance with the report, Binance cited a necessity for added verification when responding to the police request.

Terraform co-founder sentenced to fifteen years in jail after responsible plea

Do Kwon, the co-founder of Terraform Labs, was sentenced to fifteen years in jail after pleading responsible to wire fraud and conspiracy to defraud.

Learn additionally

Options

Sharplink exec shocked by degree of BTC and ETH ETF hodling: Joseph Chalom

Options

UK hashish millionaire’s authorized ‘offers on wheels’ by way of crypto

In a Thursday listening to within the US District Court docket for the Southern District of New York, Decide Paul Engelmayer ordered that Kwon serve 15 years in jail for his position within the collapse of Terraform, which worn out about $40 billion from the crypto market in 2022. He’ll obtain credit score for time served within the US and 17 months of pre-extradition custody.

Prior to creating his resolution on sentencing, Engelmayer heard from a few of Terraform’s victims and questioned what sort of justice Kwon would possibly face in his native South Korea, the place authorities are additionally constructing a case in opposition to him.

High Journal Tales of The Week

Massive questions: Would Bitcoin survive a 10-year energy outage?

Assuming people truly survive a decade with out computer systems and microwave brownies — what would occur to Bitcoin?

Sei wallets in Xiaomi, Bhutan’s gold on Solana: Asia Specific

Sei to preload crypto wallets in Xiaomi smartphones, Bhutan launches gold tokens on Solana and extra.

Meet the onchain crypto detectives preventing crime higher than the cops

Pseudonymity protects them, credibility defines them, and their work determines whether or not stolen crypto is recovered or misplaced eternally.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.