- SUI stays down over 60% and faces added stress from an $80M token unlock.

- Spot outflows and weak quantity counsel rising warning regardless of a short-term worth bounce.

- Rising TVL and bullish derivatives positioning present some optimism forward of the unlock.

Layer-1 blockchain Sui has struggled to regain footing, remaining firmly on the bearish aspect of the market. Throughout this part, the asset is down roughly 63.9%, a drawdown that continues to weigh closely on sentiment. Because the yr winds down, that stress might not ease, particularly with bears nonetheless controlling construction and recent provide looming noteably shut.

The broader setup feels fragile. Capital inflows tied to unlocks typically arrive on the worst potential time, and in SUI’s case, the timing doesn’t look forgiving. With momentum already weak, any added stress may tip stability additional towards bulls.

Token Unlock Might Add to the Promoting Weight

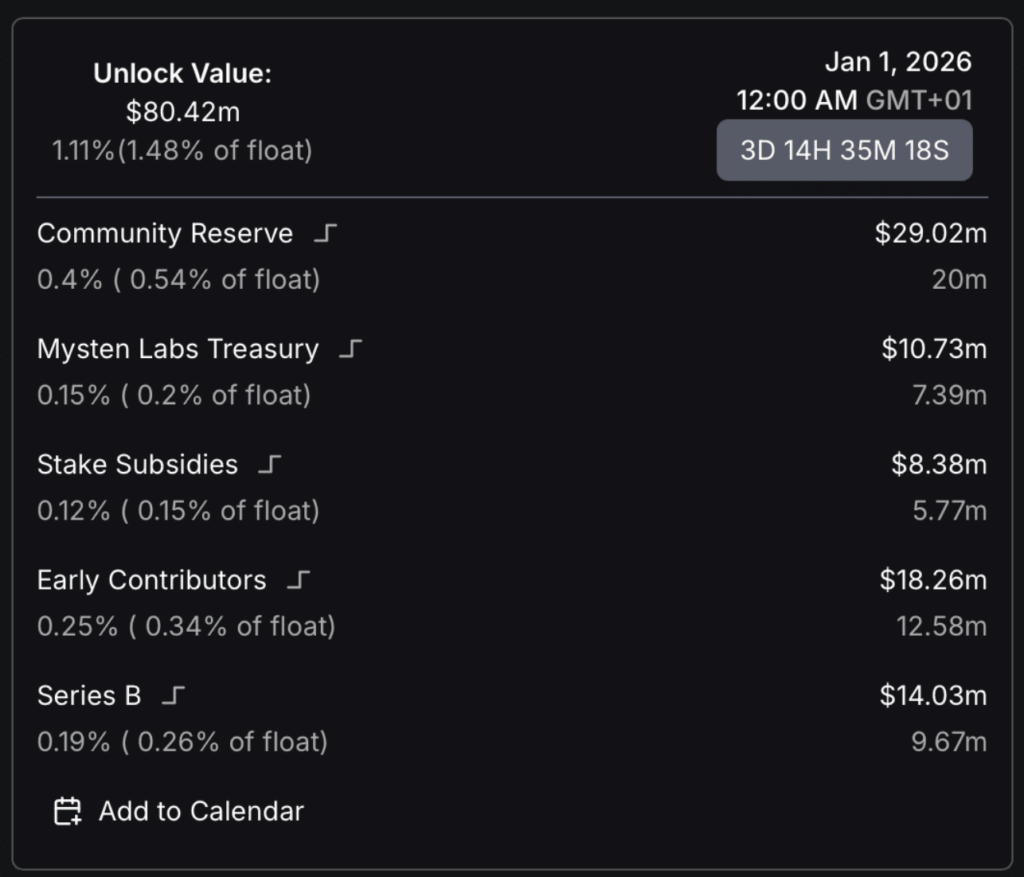

In keeping with latest information, extra SUI tokens are about to enter circulation. DeFiLlama reveals a complete unlock worth of round $80.41 million, equal to 1.11% of complete provide and roughly 1.48% of the circulating float. That’s not insignificant, particularly at present costs close to $1.41.

What stands out is the allocation to early contributors, who’re set to obtain about 0.25% of that provide, valued close to $12.58 million. Traditionally, early individuals are inclined to promote into unlocks, significantly when sentiment is already leaning bearish. If exits line up throughout a number of wallets, draw back stress may construct quick, perhaps quicker than worth has proven to date.

Worth Rises, however Conviction Appears Skinny

At first look, SUI hasn’t reacted aggressively to the looming provide improve. The token gained about 3.45% over the previous day, which could look encouraging on the floor. Nonetheless, that transfer got here alongside declining quantity, which fell practically 9% to $291.41 million.

Rising worth on falling quantity normally hints at weak follow-through. It suggests patrons are hesitant, not assured, and that the transfer may fade shortly if sellers step again in. For now, the bounce feels extra like a pause than a shift.

Spot Buyers Quietly Step Apart

Spot information provides one other layer of warning. CoinGlass reveals internet outflows of roughly $5 million over the previous 48 hours, with promoting exercise peaking on December 27. This marks the primary notable outflow in over per week, breaking a comparatively calm stretch.

That sudden change suggests traders are reassessing danger, particularly with the unlock approaching. On the charts, SUI is buying and selling right into a key resistance zone, one which has repeatedly rejected worth up to now. Failure right here may ship the asset again towards decrease ranges, reinforcing the bearish narrative.

Bulls Nonetheless Linger Beneath the Floor

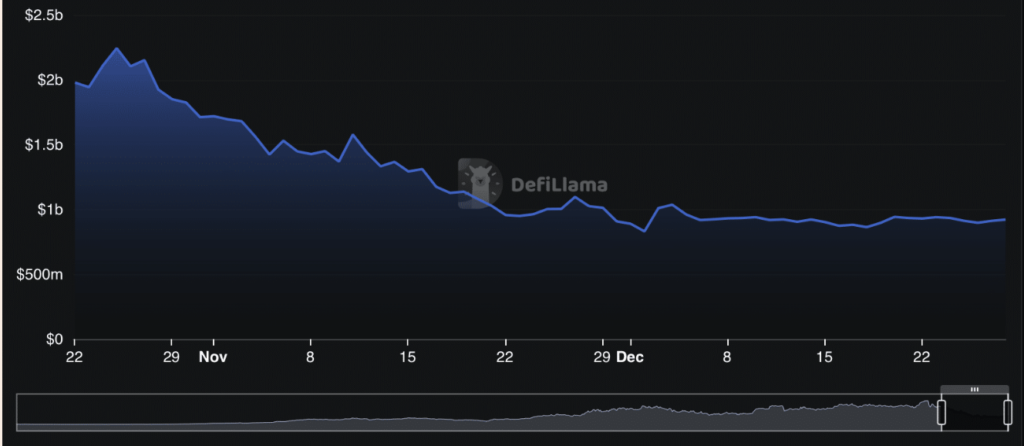

Regardless of the heavy tone, not all the things factors decrease. On-chain information reveals complete worth locked rising to about $922.25 million, with day by day inflows close to $24.8 million. That improve hints that some individuals nonetheless see worth, a minimum of within the quick time period, and are keen to deploy capital.

Derivatives markets echo that cautious optimism. CoinGlass information reveals rising lengthy positions in SUI/USDT perpetuals, paired with a constructive and rising funding price. Lengthy merchants look like leaning in, betting that worth can maintain or bounce earlier than the unlock hits. Whether or not that conviction holds is the massive query now.

Within the close to time period, SUI’s route probably hinges on how merchants place forward of the unlock occasion. If resistance breaks, a transfer again towards $3.1 turns into potential, although formidable. If sellers take management, a sweep towards the $1 zone stays very a lot on the desk.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.