Be part of Our Telegram channel to remain updated on breaking information protection

Coinbase CEO Brian Armstrong says that Bitcoin is sweet for the US greenback, difficult the view that the most important crypto by market cap was designed to exchange the dollar as a worldwide reserve foreign money.

“Bitcoin is sweet for USD,” Armstrong wrote in an X put up earlier right now. “It creates competitors in a approach that’s wholesome for the greenback, which helps to supply a test and steadiness in opposition to excessive inflation and deficit spending,” he added.

Bitcoin Is Serving to Prolong The “American Experiment”

Armstrong’s X put up included a snippet of an interview he had on Tetragrammation with Rick Rubin on Thursday.

Within the interview, the Coinbase CEO mentioned that Bitcoin “gives a test and steadiness on the greenback within the sense of if there’s an excessive amount of deficit spending or inflation within the US, individuals will flee to Bitcoin in occasions of uncertainty.”

“It could be okay to have 2-3% inflation if the economic system is rising at 2-3% but when inflation outstrips the expansion of the economic system, you’ll ultimately lose the reserve foreign money standing, and that will be a large blow to america,” he mentioned.

Armstrong went on to argue that BTC not directly retains the greenback in test by making certain that the US Federal Reserve and monetary regulators keep away from actions that might undermine confidence within the US economic system.

“So I truly assume in an odd approach, Bitcoin helps lengthen the American experiment,” he concluded.

US Debt Grows Over $69K Per Second, Practically $6B A Day

Armstrong’s remarks come because the US nationwide debt continues to spiral. In line with information from USDebtClock.org, the US nationwide debt stands at over $38.538 trillion as of two:02 a.m. EST.

Moreover, the deficit has grown by $69,433.37 per second for the previous 12 months as of Dec. 17, with the mixed publicly-held and intragovernmental debt rising practically $6 billion per day, in accordance to the US Congress Joint Financial Committee’s debt dashboard.

Amid the skyrocketing debt, JPMorgan has touted Bitcoin and gold because the “debasement commerce” in early October.

Whereas Trump did signal an government order to create a US Strategic Bitcoin Reserve earlier this 12 months, there was little progress within the reserve’s creation.

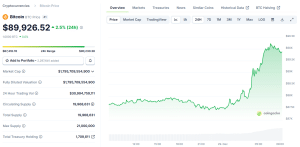

From a value perspective, BTC did handle to soar to a brand new all-time excessive (ATH) above $126K on Oct. 6, however has since corrected greater than 29%.

BTC value (Supply: CoinGecko)

In the meantime, gold has prolonged its rally, and set yet one more ATH above $4,540 per ounce on Friday.

Peter Schiff Says Greenback’s Reign Is Coming To An Finish

The US greenback’s reign as the worldwide reserve foreign money could already be coming to an finish, in line with gold investor and Bitcoin critic Peter Schiff.

In a Dec. 26 X put up, Schiff predicted that gold will take the throne from the US greenback because the “major central financial institution reserve asset.”

King greenback’s reign is coming to an finish. Gold will take the throne as the first central financial institution reserve asset. Meaning the U.S. greenback will crash in opposition to different fiat currencies, and America’s free trip on the worldwide gravy prepare will finish. Put together for a historic financial collapse.

— Peter Schiff (@PeterSchiff) December 26, 2025

“Meaning the U.S. greenback will crash in opposition to different fiat currencies, and America’s free trip on the worldwide gravy prepare will finish,” Schiff mentioned.

“Put together for a historic financial collapse,” he warned.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection