- State of liquidity in crypto

- Open curiosity issues

The $150 billion in complete cryptocurrency liquidations looks as if a disaster at first. It’s a important determine, emotionally charged and easy to interpret as proof that the market had a horrible 12 months in 2025. Nonetheless, a better take a look at the information reveals a way more complicated image that’s, to be trustworthy, much less dramatic than it might sound.

State of liquidity in crypto

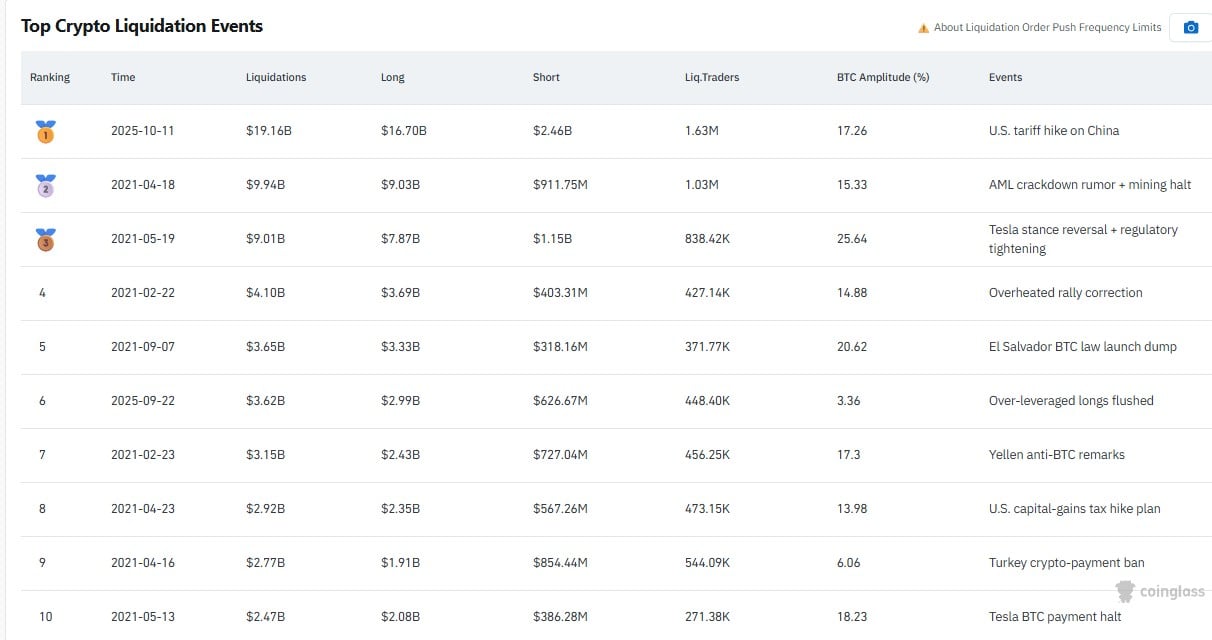

The liquidation overview signifies that the whole quantity of liquidations in 2025 was roughly $154.6 billion, with the largest every day wipeout amounting to roughly $19.1 billion. Notion is distorted by that spike alone. Significantly on a market the place leverage is deeply ingrained, a single excessive occasion doesn’t characterize all the 12 months.

Leverage has been a function of the cryptocurrency system for years; it didn’t simply grow to be careless in 2025. Over time, the liquidation distribution offers a extra lucid narrative. As a substitute of ongoing systemic stress, liquidations had been comparatively contained for almost all of the 12 months, with frequent however gentle flushes. As a result of it was the exception fairly than the rule, the large spike in October stands out.

Overleveraged merchants had been straightforward targets throughout that occasion attributable to aggressive positioning and a pointy improve in volatility. That’s, fairly than long-term capital, leverage was penalized.

Open curiosity issues

There’s a recurring sample when inspecting open curiosity and quantity charts: throughout bullish durations, open curiosity elevated in tandem with value whereas, throughout corrections, it decreased. That’s wholesome — it implies that capital didn’t flee, however fairly rotated. Development in quantity towards the second half of the 12 months additional means that after important liquidations, merchants returned, modified their threat and continued to function.

This thesis is supported by the listing of the largest liquidation occasions. The most important losses had been linked to explicit triggers, reminiscent of positioning imbalances, macro shocks, coverage headlines or regulatory rumors. These had been stress exams, not haphazard market failures. The market persevered via all of them with out disrupting its construction.

So, was 2025 a horrible 12 months? In no way. It was a 12 months of volatility, a 12 months of cleaning leverage and a 12 months wherein threat administration was really vital. Liquidations had been the value of eliminating extra, not an indication of collapse. That’s not a weak spot for a market that’s maturing. Rising up is like that.