- Peter Schiff claims Technique underperformed by investing closely in Bitcoin.

- Analysts argue Schiff’s calculations ignore the timing of BTC purchases.

- Bitcoin has outperformed gold over the previous 5 years regardless of inventory volatility.

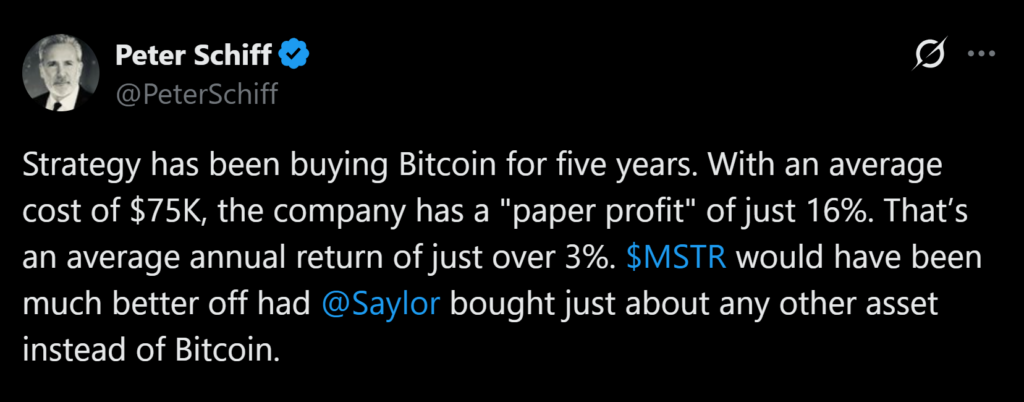

Bitcoin treasury agency Technique has as soon as once more discovered itself on the middle of debate after longtime Bitcoin critic Peter Schiff argued the corporate would have delivered stronger returns by avoiding BTC altogether. In a latest submit on X, Schiff claimed that Technique’s Bitcoin technique produced underwhelming outcomes when seen via a conventional efficiency lens. The feedback shortly stirred backlash throughout the crypto neighborhood.

Schiff Questions Technique’s Bitcoin Returns

In accordance with Schiff, Technique’s common Bitcoin buy worth sits close to $75,000, leaving the agency with a paper achieve of simply 16% after 5 years of accumulation. He framed that final result as an annualized return barely above 3%, arguing the capital may have carried out higher in different asset courses. Schiff’s critique comes as Technique’s inventory has struggled this yr, reinforcing his broader skepticism towards Bitcoin-focused stability sheets.

Critics Push Again on the Math

Market members have been fast to problem Schiff’s assumptions. Analyst Willy Woo identified that Schiff handled all of Technique’s Bitcoin purchases as in the event that they occurred on the identical time, ignoring the staggered nature of the buys. That strategy, Woo argued, considerably distorts precise efficiency. Enterprise capitalist Revaz Shmertz echoed the criticism, saying Schiff’s comparability didn’t replicate how funding returns are correctly calculated over time.

Technique Retains Accumulating Bitcoin

Regardless of the criticism, Technique continues to double down on its Bitcoin technique. The agency introduced a brand new buy of 1,229 BTC earlier at present, bringing complete holdings to roughly 672,497 Bitcoin. On the identical time, Technique boosted its money reserves to $2.2 billion, a transfer aimed toward making certain it will probably meet monetary obligations for a number of years while not having to promote any Bitcoin holdings.

Inventory Efficiency vs. Bitcoin’s Lengthy-Time period Pattern

Technique’s inventory has taken successful in 2025, down about 46% yr to this point, in line with Yahoo Finance. Usually seen as a leveraged proxy for Bitcoin, MSTR has suffered alongside broader volatility in crypto-linked equities. Nonetheless, Bitcoin itself tells a unique story. TradingView knowledge reveals BTC has surged roughly 219% over the previous 5 years, rising from round $27,400 to roughly $87,700 as of December 30. Over the identical interval, gold — Schiff’s most popular asset — gained slightly greater than 130%.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.