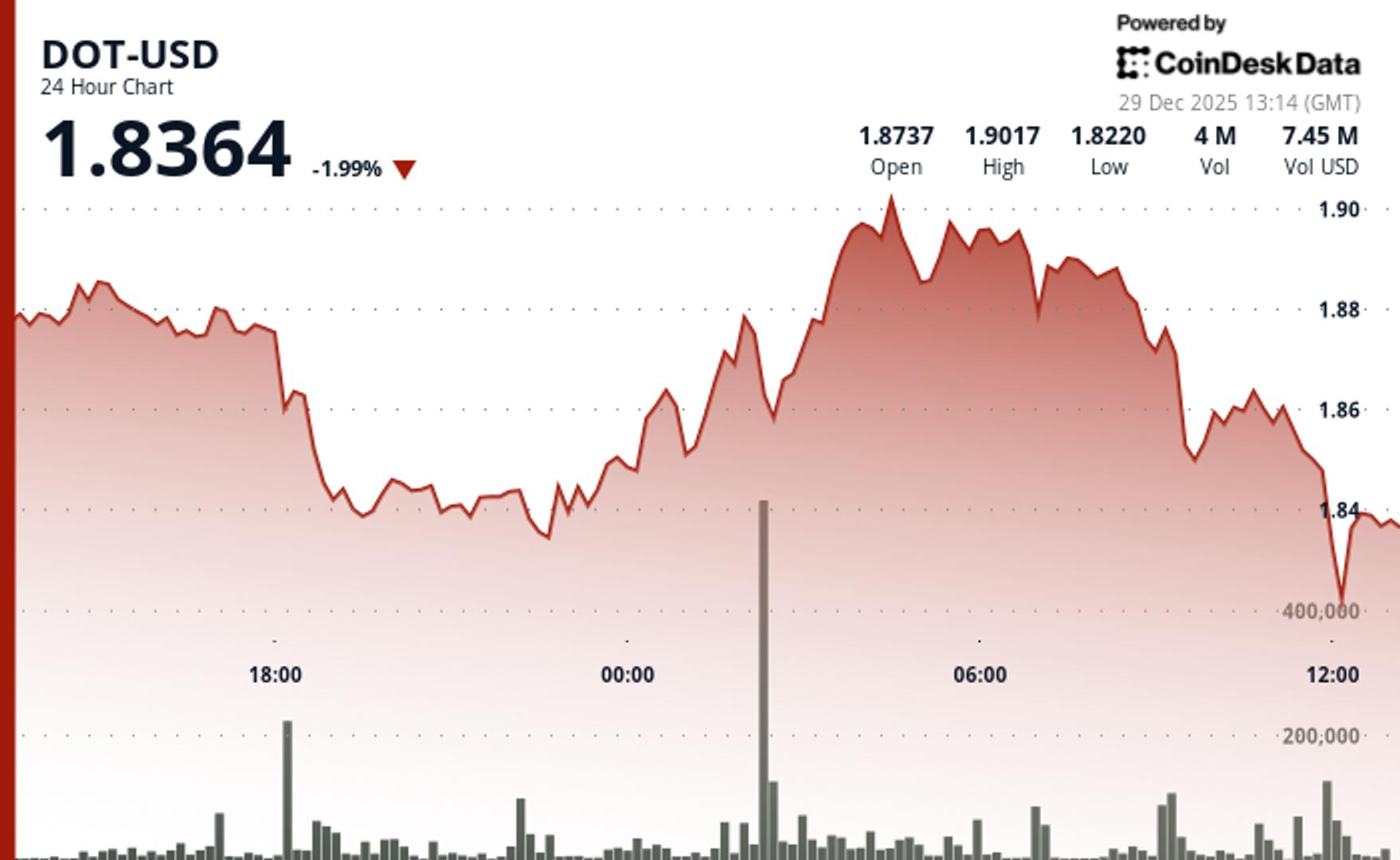

fell 2% to $1.84 during the last 24 hours.

Buying and selling volumes had been 7.8% above the seven-day shifting common at 7.76 million tokens, in response to CoinDesk Analysis’s technical evaluation mannequin.

The mannequin confirmed that the transfer in DOT occurred with out clear elementary catalysts as technical components dominated worth motion.

The token underperformed the broader crypto market. The CoinDesk 20 index was 0.6% decrease at publication time.

This modest divergence displays sector rotation dynamics relatively than elementary weak point in Polkadot’s positioning, in response to the mannequin.

Within the absence of clear elementary drivers, technical resistance at $1.88 grew to become paramount, the mannequin mentioned, as DOT labored by a unstable consolidation sample.

Technical Evaluation:

- Main resistance sits at $1.88 with confirmed promoting stress at this stage

- Help base examined at $1.83, rapid assist now at $1.825-$1.830 zone

- Upside targets recognized at $2.00-$2.50 based mostly on structural break patterns

- 24-hour quantity averaged 7.8% above seven-day shifting common indicating natural discovery

- Greater lows shaped from $1.83 base throughout preliminary consolidation part

- Brief liquidation ranges above $2.00 present potential upside catalyst

- Rapid draw back threat at $1.825-$1.830 assist zone requires monitoring

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.