- Solana is down about 12% on the month, with January historical past favoring a rebound however no affirmation but.

- ETF inflows stay regular, although demand is selective somewhat than market-wide.

- $129 is the important thing upside pivot, whereas a drop beneath $116 would invalidate the bullish January setup.

Solana has had a tough near the 12 months, down roughly 12% over the previous 30 days as promoting stress lingered by way of December. With 2026 approaching, the chart doesn’t supply a clear reply but. Some indicators trace {that a} bounce may arrive in January, whereas others warn that draw back stress might stick round if patrons fail to point out up quickly.

This type of setup isn’t uncommon for SOL. The asset has a behavior of testing persistence late within the 12 months, solely to shock merchants as soon as the calendar flips, although that sample isn’t assured, particularly in a extra selective market.

Historical past Favors January, however Flows Inform a Slim Story

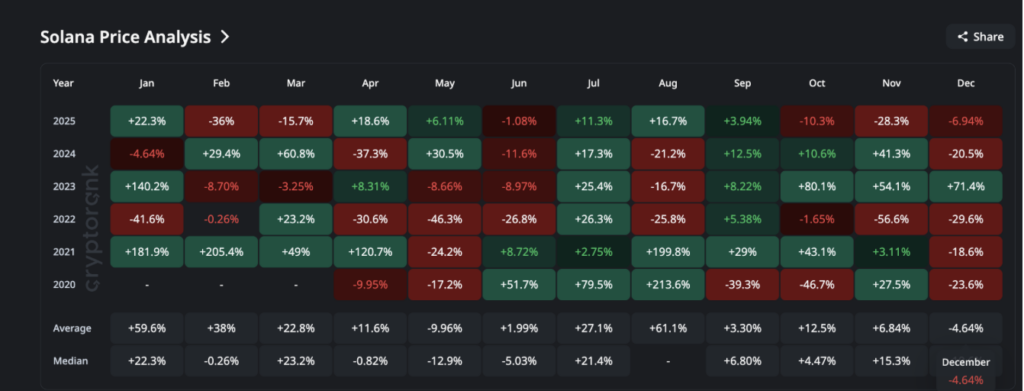

Traditionally, January has been certainly one of Solana’s strongest months. Common returns sit close to 59%, with median positive aspects round 22%, and the sample turns into extra pronounced when December closes crimson. In 2022, SOL fell almost 30% in December, solely to rally 140% in January 2023. An analogous rhythm performed out final 12 months as effectively. With SOL down once more this December, the stats lean towards one other rebound.

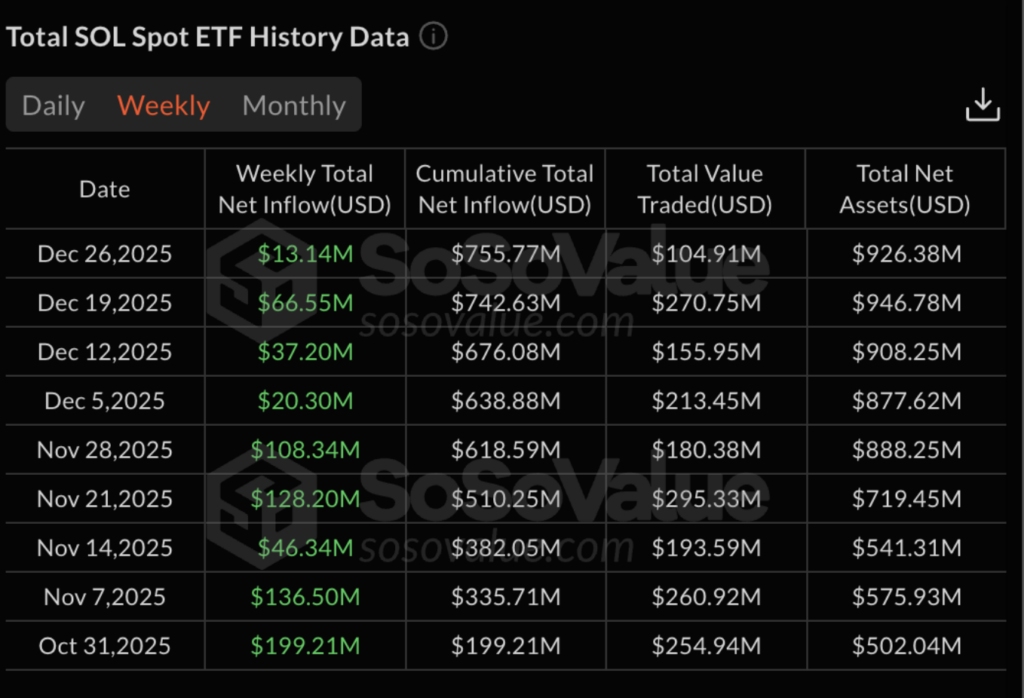

ETF flows add some help to that concept, although with a caveat. Since launch, Solana spot ETFs have but to document a single week of internet outflows. The newest week added roughly $13 million, bringing cumulative inflows to about $755 million. That regular demand suggests confidence, but it surely’s slim. Analysts at B2BinPay famous that buyers aren’t rotating broadly into altcoins, as an alternative favoring a small group of liquid names like Solana or XRP, the place danger feels extra manageable.

Bullish Divergence Seems, however Development Threat Stays

On the two-day chart, Solana printed a decrease low between late November and mid-December, whereas RSI shaped the next low. That bullish divergence usually reveals up close to early reversal zones, assuming patrons observe by way of. Momentum, at the least on that entrance, seems prefer it’s making an attempt to show.

Proper beside that sign, nonetheless, sits a warning. The 100-period EMA is near crossing beneath the 200-period EMA, a bearish setup that tends to weigh on worth. If that crossover confirms, draw back stress may lengthen into early January earlier than any restoration can actually stick. Till that danger clears, the technical image stays break up, not damaged, however not convincing both.

Derivatives Positioning Displays Warning

Derivatives knowledge leans cautious for now. On Hyperliquid, most dealer teams, together with prime addresses and whale accounts, stay internet brief over the previous week. That implies hesitation somewhat than outright panic. On the identical time, a couple of cohorts, like sensible cash and a few public figures, have begun opening small lengthy positions.

That blend factors to expectation, not affirmation. Merchants look like positioning for a possible January transfer, however they aren’t committing closely but. For SOL to construct an actual rally, that by-product bias would want to flip away from shorts, ideally alongside enhancing spot momentum.

Key Ranges Will Determine the January Story

SOL at present trades close to $124, sitting inside a dense provide zone highlighted by cost-basis knowledge. The $129 degree is the pivot. A two-day shut above it might clear a significant provide cluster and open room towards $150, with $171 coming into view if momentum and ETF inflows maintain. Above $129, resistance thins out shortly, however provided that quantity reveals up.

On the draw back, $116 stays the fail-safe. Dropping that degree would break the acquainted “crimson December, inexperienced January” sample and certain affirm continuation decrease, particularly if paired with a bearish EMA crossover. For now, Solana is boxed between these thresholds, ready for a decisive push.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.