Crypto tax software program options assist customers handle their tax duties, whereas additionally permitting them to observe their portfolio from a single dashboard.

As use circumstances for cryptocurrencies proliferate, taxes inevitably climb the precedence and consideration ladders, accompanied by a rising year-on-year surge in adoption.

The next is an in-depth overview of ZenLedger, which has positioned itself as a number one resolution within the discipline of crypto taxes. I’ll take a more in-depth take a look at its options, the way it compares to rivals, its pricing, jurisdiction protection, and potential advantages for institutional customers.

Principal Takeaways:

- ZenLedger calculates digital asset taxes and generates up-to-date reviews.

- The dashboard integrates a number of wallets, bringing a number of accounts below one umbrella.

- Finish-to-end state and federal tax filings for customers.

- Complete API entry backed with strict compliance requirements.

- Deep service integrations for DeFi protocols, NFTs, and so on.

The Verdict

ZenLedger is a well-liked crypto tax software program that permits customers to trace their portfolios in actual time, calculate revenue taxes, and generate types.

The platform stands out for being fairly straightforward to grasp, even for customers not acquainted with tax legal guidelines within the discipline of cryptocurrencies.

It presents downloadable tax types, preserving customers up-to-date with dynamic rules. Along with these, customers are outfitted with a number of instruments to optimize crypto tax dealing with, together with tax audit and tax loss harvesting. Typically, the platform is taken into account secure for all courses of buyers following strict compliance and safety measures.

Onboarding & Consumer Expertise

Fast Abstract: Opening a ZenLedger account is easy and safe. The corporate prioritizes a pleasant interface to make sure person satisfaction. Customers can be part of with their Google or Coinbase accounts for comfort. Configuring your settings is straightforward, and as soon as completed, the platform delivers a comparatively seamless person expertise, in comparison with competing platforms like CoinLedger or Koinly.

Creating an account

To open an account, go to the web site and click on ‘Signal Up.’ You possibly can register together with your Coinbase or Google account. You can too use MetaMask. This widens person choices for simple integration on the platform.

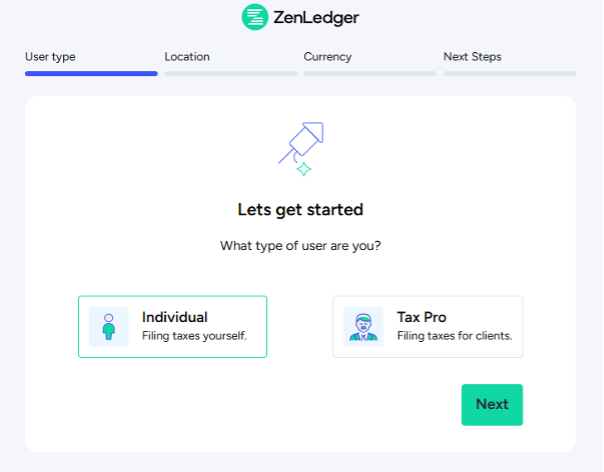

You can too join via a customized electronic mail and password and make sure particulars. After confirming your electronic mail, ZenLedger takes you to an onboarding display the place you enter sure particulars earlier than including your wallets and exchanges.

After filling in all data and person particulars, now you can proceed to person settings.

Key Account Settings

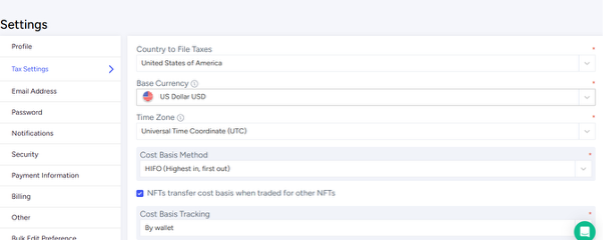

Like each crypto software program and utility, you’re suggested to customise safety controls and accounting settings. Navigate to ‘Settings’ on the higher proper nook to entry profile, tax, and safety choices.

Below ‘Tax Settings’, you may select nation, base forex, the accounting technique (FIFO, LIFO, and so on) in addition to different essential necessities primarily based in your location.

After this, I’d additionally advocate turning on safety settings like two-factor authentication (2FA) to guard your account.

Interface, dashboard, accessibility

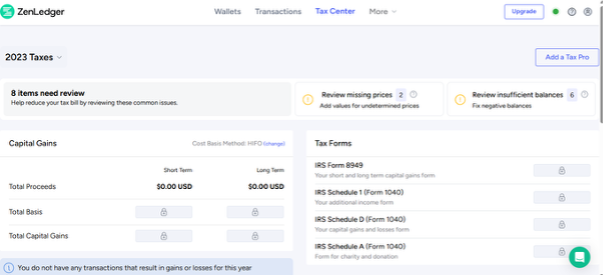

ZenLedger onboards a user-friendly interface with a glossy design, aimed toward each freshmen and skilled merchants. From the dashboard, customers can simply toggle between wallets, transactions, the tax heart, and settings.

The Pockets Part shows built-in accounts and values, whereas navigating to the tax heart will present whole proceeds, capital positive factors, tax types, and so on.

Importing wallets, change APIs, and extra

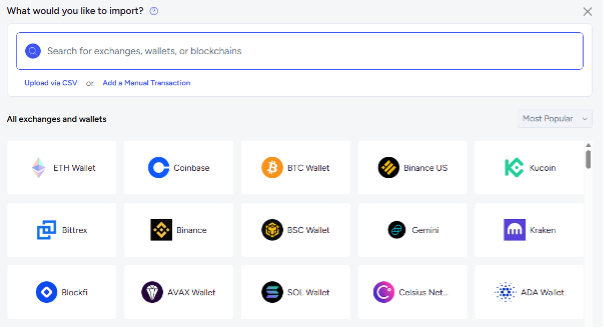

To import wallets and begin analyzing tax information, you’ll have to navigate to the ‘Wallets’ web page and choose both ‘Add Pockets/Exchanges.’ You possibly can select from two primary choices: API connection or CSV file uploads.

Subsequent, you’d see a listing of supported wallets and exchanges. These embrace fashionable platforms like Coinbase, ETH Pockets, Binance US, Kucoin, and so on. Choose the specified pockets, add the tackle, and import efficiently. It ought to be famous that non-supported wallets can nonetheless be built-in by a customized CSV file add.

To make use of this technique, you’ll must obtain the transaction historical past from the change and add it on to the platform. After integration, ZenLedger syncs information, imports transactions, and scrutinizes for potential errors.

Supported Platforms

ZenLedger built-in most crypto exchanges, together with;

- Coinbase

- Binance US

- Kucoin,

- Binance

And prime wallets like:

- ETH pockets

- BSC Pockets

- SOL pockets

- DASH Pockets

Core Options & Integrations

Fast Abstract: ZenLegder hosts plenty of options and integrations that make it a preferable selection for a lot of customers. From the simple onboarding course of to its complete instruments and capabilities, it helps for seamless tax submitting. Moreover, integrations made with third-party functions improve total person expertise whereas security and compliance options enhance belief.

Crypto Portfolio Tracker

This can be a core function for many digital asset tax options out there. It provides you an outline of all crypto holdings from linked wallets and exchanges in real-time. It helps correct accounting, and never essentially buying and selling selections. ZenLedger’s engine pulls information in line with the present market worth, providing you with a snapshot and minimalistic charts.

Who it’s finest for: Merchants who need to maintain tabs on their present holdings.

Professionals:

- A really useful gizmo for account reconciliation.

- Provides customers an correct overview throughout platforms.

- Finished routinely to scale back handbook efforts.

Cons:

- Restricted analytics since it’s not constructed for buying and selling.

- It’s not optimized for mainstream investments.

Limitless Transactions and Quite a few Integrations

The device permits you to join a number of wallets and exchanges for higher management. There are over 500 crypto exchanges and wallets, together with decentralized finance choices, so the huge vary of integrations provides customers a variety. Additionally, as a ZenLedger person, you’ve gotten entry to limitless transactions, though these choices are for the Platinum Plan at a substantial value.

Merchants can add supported wallets and exchanges in a couple of steps and get their tax assist instantly. In the meantime, unsupported wallets could be added by importing customized CSV information.

Who it’s finest for: Skilled merchants with giant quantities of transactions on a number of exchanges and wallets.

Professionals:

- No restrict on transactions permitting higher achievements.

- Extra vary since all wallets are supported.

- Helps cut back errors since every thing is linked.

Cons:

- Transactions would possibly get cumbersome and overcrowded.

- Solely obtainable for the Platinum Plan.

Tax Calculation/ Kind Technology

Evidently, that is the crux of ZenLedger’s product providing. You possibly can choose the strategy of calculating the price foundation, and the platform takes over with its automated engine. It screens each single transaction so as to decide tax occasions, capital positive factors, and losses.

Principally, it teams transactions into buys/sells, transfers between two or extra crypto wallets, and revenue from DeFi actions like staking, and so on. It then identifies the price foundation by considering the date and worth of acquisition, accounting requirements within the jurisdiction, and extra. ZenLedger works with all the hottest value foundation strategies – FIFO, LIFO, and HIFO.

Tax kind technology additionally aligns as a result of it gives normal reviews by jurisdiction, preserving customers compliant. These tax reviews embrace IRS Kind 8949, 1040 Schedule D, FBAR Report, and so on.

Who it’s finest for: All merchants as a result of being tax compliant is essential and on the prime of every dealer’s use circumstances.

Professionals:

- Automated tax calculation saves time.

- Skill to deal with very advanced transactions.

- Wide selection of downloadable crypto tax types.

Cons:

- Some particulars is perhaps difficult for freshmen.

- Lacking transactions will produce unsuitable outcomes.

Tax Loss Harvesting

Tax loss harvesting reveals you which of them of your crypto holdings have misplaced worth for the reason that time of buy, permitting you promote and declare losses in tax. In most jurisdictions, crypto doesn’t fall throughout the wash sale rule, that means you can principally promote an asset at a loss after which rebuy this asset instantly after. Basically, you “notice” the loss on paper for tax functions however you retain holding the asset in case it recovers.

The aim is to constructively cut back tax legal responsibility by figuring out these alternatives. ZenLedger accesses your crypto and NFT holdings in a number of steps, serving to you make the precise choice.

First, it compares unrealized positions with value foundation and market worth. With this, it may possibly determine positions in losses and their tax impression. In your finish, you’d see a listing of all property in unrealized positive factors or losses and the impression a sale may have in your portfolio.

Who it’s finest for: Small and lively merchants who need to maximize their tax positions

Professionals:

- Merchants can know which crypto property are within the crimson zone.

- Helps in direction of long-term planning.

- Automated evaluation of tax information

Cons:

- There may be usually a restricted analytical re-entry technique.

- Potential gross sales are usually not automated and wish handbook effort.

Safety Options

ZenLedger prioritizes person account safety via options designed to guard information. The software program doesn’t maintain funds or personal keys of consumers, making certain connections use read-only API keys. ZenLedger has a number of safety settings for customers that assist defend accounts, comparable to 2FA and session administration.

Consumer information is encrypted, making certain there’s no unwarranted third-party entry. Moreover, compliance with international requirements is top-notch. It integrates good audit trailing that traces positive factors or losses to particular accounts.

Who it’s finest for: All merchants who prioritize safety and compliance with rising international rules.

Professionals:

- Non-custodial management reduces safety dangers.

- Designed to guard merchants with giant transaction information.

- Removes compliance points confronted by many crypto customers.

Cons:

- Compliance is extra centered within the US than in different jurisdictions.

Integrations

Integrations ease up the complete workflow for crypto tax options. ZenLedger has a number of integrations, every performing a key operate within the course of. Principally, it connects encrypted information with exterior accounting instruments to make sure compliance and good reporting.

Key integrations embrace shopper tax software program like TurboTax and TaxAct, which assist streamline the workflow with fiat programs. A laudable reality about these is the safety protocols concerned to guard person information.

Who it’s finest for: Accountants and tax consultants who want fiat-like compliance in digital property.

Professionals:

- Decreased handbook entry in workflow.

- Helps cut back the danger of accounting errors.

- Increase productiveness and guarantee tighter compliance.

Cons:

- It is perhaps advanced for freshmen.

- Some integrations are usually not obtainable within the primary free model.

Pricing Plans

Fast Abstract: ZenLedger presents three plan classes, starting from free to normal paid {and professional}. You possibly can take a look at our information on free vs. paid crypto tax software program to search out out when every possibility makes most sense. Let’s have a more in-depth take a look at whether or not ZenLedger presents a great bang in your buck.

Free Plan

Price: $0

Contains: As much as 25 transactions, detailed audit reviews, tax compliance requirements, tax loss harvesting, TurboTax integration, and so on. The free plan is generally utilized by freshmen and skilled merchants to check the platform. Whereas it’s good for onboarding, it’s often restricted when it comes to options.

Silver Plan

Price: $49/12 months

Contains: As much as 100 transactions, all detailed and audit reviews, together with different elements within the free plan. The silver bundle is the primary increase from the free plan, and it’s good for smaller merchants with a couple of yearly transactions.

Gold Plan

Price: $199/12 months

Contains: As much as 5,000 yearly transactions and all different advantages of the silver plan. That is the primary plan to combine DeFi/ staking and non-fungible tokens (NFTs). It’s often ranked as the preferred plan for many customers as a result of it expands the variety of transactions, giving entry to intermediate merchants.

Platinum Plan

Price: $399/12 months

Contains: As much as 15,000 transactions per 12 months, DeFi compatibility, NFTs, and so on. This plan additional pushes up the variety of transactions and consists of different options in decrease ranges. Moreover, it comes with an added buyer assist bundle.

Premium Help Session

Price: $275/60-minute session

That is the primary possibility that the tax skilled ready plans and consists of entry to an skilled. Tailor-made questions could be requested of the tax skilled regarding your portfolio after reserving the 60-minute session.

Tax Professional Ready Plan – Single 12 months

Price: $2,800/ 12 months

The tax professional plan permits you to audit/calculate all tax-related capabilities with knowledgeable. That is primarily for big firms and merchants having so many advanced transactions.

Tax Professional Ready Plan- Multi-12 months

That is one other professionally ready plan for the long-term and the very best inside ZedLedger. It’s thought of finest for establishments and merchants with very giant volumes.

Efficiency, Reliability & Help

Fast Abstract: ZenLedger is often considered a dependable cryptocurrency tax software program due to options which can be useful to particular person and enterprise merchants, and in my use of it, this kind of checks out. The efficiency of all options for submitting tax and audit portfolios is essential to the general platform. Customer support and assist for merchants, particularly these in Tax Professional plans, have additionally bagged optimistic critiques.

Efficiency

ZenLedger can successfully handle giant crypto portfolios, making it a sensible choice for buyers. Wallets and exchanges are imported with ease, and customers have a large selection of integration with out impacting efficiency. Tax abstract and evaluation are carried out on giant information units with losses calculated precisely with out the danger of human error. Nonetheless, this isn’t to say that the software program works flawlessly. It does sometimes make errors, so I’d extremely advocate going via it manually to be on the secure aspect of issues.

Elsewhere, the device works nicely, and it does get the job completed the place it issues most.

Reliability

In line with a number of on-line critiques, together with on Reddit, Trustpilot, and different third-party evaluation platforms, ZenLedger is a dependable crypto tax software program. In my expertise, this appears to carry up. Though it does have its drawbacks in comparison with a few of its primary rivals, comparable to CoinLedger and Koinly, the platform presents nearly every thing a person would wish to successfully deal with their yearly taxes. Relying in your stage of involvement within the trade, it is perhaps a good suggestion to additionally seek the advice of knowledgeable CPA, however should you’re an informal crypto person or somebody who’s not concerned in managing very high-profile portfolios or high-frequency buying and selling, ZenLedger is extra more likely to get the job completed nicely.

Help

The corporate presents an entire assist system for customers and most of the people. Customers can contact assist for any subject and get ample help. Nonetheless, customers of the Tax Professional plan have higher entry to assist and devoted tax professionals. This helps merchants get a greater evaluation of their portfolio and file correctly.

ZenLedger Professionals and Cons

Professionals:

- Excessive-end tax session plans: ZenLedger presents plans that permit customers to fulfill with tax professionals for higher workflow.

- Customary Compliance: The platform is thought for strict normal tips in the US.

- Wider Integrations: ZenLedger has onboarded third-party accounting instruments like TurboTax to assist the evaluation of transactions and portfolios.

- Finish-to-end information encryption: Safety protocols are normal, significantly end-to-end information encryption that ensures privateness.

- Pleasant interface: The platform makes use of a simple and pleasant interface to drive adoption.

Cons:

- DeFi integration in increased plans: DeFi and NFT holdings could be onboarded however reserved for customers with increased plans.

- Advanced Options: Typically straightforward to grasp, though some high-end options is perhaps advanced.

- Solely United States tax types could be downloaded.

ZenLedger Alternate options & Comparability

Earlier than selecting a crypto tax software program, you need to weigh your choices by evaluating options, pricing, and execs and cons of various platforms. It is usually essential to verify for compliance throughout jurisdictions and the benefit of integrating wallets.

Alternate options to ZenLedger embrace CoinTracker, TaxBit, Koinly, CoinLedger, CryptoTrader, and extra.

Ceaselessly Requested Questions (FAQs)

Is ZenLedger secure?

Sure, ZenLedger is a secure crypto tax software program that deploys normal safety practices. It makes use of end-to-end encryption to guard person information and implement strict read-only entry for built-in wallets and exchanges.

Can I combine with accounting software program?

Aside from its personal third-party integrations, customers have export choices to different accounting software program. Exports are potential via CSV for wider evaluation in line with the client’s preferences.

Is ZenLedger free?

ZenLedger has a primary free plan that helps onboard customers. The free plan is an effective place to begin for freshmen; nevertheless, it’s restricted when it comes to the variety of yearly transactions and high-end options.

Is it appropriate for freshmen?

Sure, due to the free plan and pleasant interface that customers take pleasure in. A brand new dealer doesn’t want a lot complexity particularly with digital asset tax programs. The sleek and versatile course of makes it fascinating for brand spanking new entrants.

Conclusion: is ZenLedger legit?

ZenLedger is a professional crypto tax software program utilized by a number of merchants and establishments. It has been operational for years and has partnered with a number of web3 and conventional finance establishments in that interval. The actual operate that provides it legitimacy is the correct tax service it gives merchants. Moreover, safety features have additionally bolstered the platform’s credibility.

The publish ZenLedger Evaluation 2026: Pricing, Plans, and Options appeared first on CryptoPotato.