2025 has been filled with disappointments for the cryptocurrency trade, and the “US Strategic Bitcoin Reserve” is unquestionably considered one of them.

If you wish to perceive why the “US Strategic Bitcoin Reserve” is considered as the most important coverage rug-pull of 2025, you simply want to take a look at one (clearly faux) screenshot that has been circulating on X (previously Twitter) this morning.

The facetious picture reveals a hilarious one-sided dialog of a supposed lobbyist screaming into the void of a authorities inbox.

To know the ache in that screenshot, it’s important to rewind to late 2024. The euphoria was blinding. The plan, as pitched by Senator Lummis and hyped by each influencer with a microphone, was easy: the U.S. would cease auctioning seized Bitcoin and begin actively shopping for it to offset the nationwide debt. It was imagined to be the “sovereign FOMO” occasion that may ship BTC to $500,000.

Nonetheless, the federal government by no means truly supposed to purchase it. The “Strategic Reserve” turned out to be a masterclass in ambiguity.

The White Home signed the Government Order establishing the “Strategic Bitcoin Reserve.” Nonetheless, it turned out that the administration’s definition of a “reserve” was merely holding onto the 200,000 BTC the DOJ had already seized from darkish internet busts. They did not purchase a single satoshi. They only promised to not promote what they already had without spending a dime.

The foyer, which spent lots of of tens of millions getting “pro-crypto” candidates elected, discovered itself within the place of the sender in that faux e mail.

Within the meantime, Senator Cynthia Lummis (R-WY), the undisputed “Godmother” of the Strategic Bitcoin Reserve and the trade’s most loyal ally on Capitol Hill, has introduced she won’t search re-election in 2026.

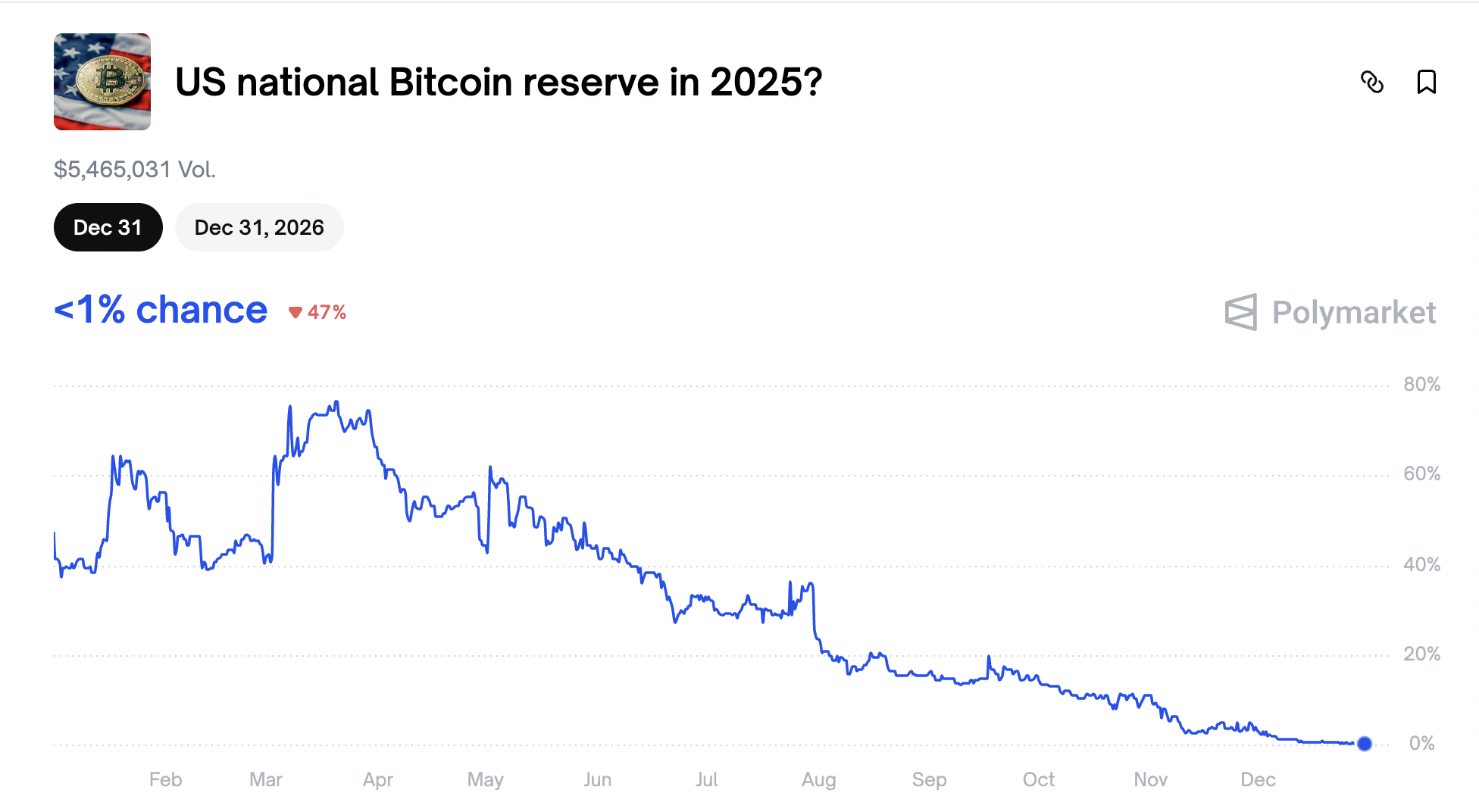

Collapsing Polymarket odds

Polymarket bettors now see solely a 28% likelihood of a Bitcoin reserve being established within the US by the tip of 2026.

The 12 months begins with cautious optimism (roughly 40%), however have a look at that vertical climb in late February main into March. The percentages surged to their all-time excessive (almost 70%) in March.

Then, the road bought uneven. It dropped from the 70% highs however finds assist across the 40-50% vary. That is the “Simply checking in…” section. The large announcement did not drop instantly, and doubts began to creep in.

Then, there was the section of acceptance. There have been no extra spikes, no extra rumors, only a sluggish realization that the “Reserve” was only a rebranding of seized property.