Be a part of Our Telegram channel to remain updated on breaking information protection

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), the asset supervisor’s first tokenized cash market fund, has paid out $100 million in cumulative dividends since its launch.

That milestone was introduced on Monday by Securitize, the tokenized fund’s issuer and tokenization accomplice that oversees the onchain issuance and investor onboarding.

BUIDL Has Seen Sturdy Adoption

BUIDL was launched in March final 12 months, and was initially issued on the Ethereum blockchain, which has been a preferred selection for conventional finance companies who need to come onchain.

The fund invests in short-term, US-dollar denominated property. This consists of US Treasury payments, repurchase agreements and money equivalents. Via BUIDL, buyers are in a position to earn yield through a blockchain-based car whereas nonetheless sustaining liquidity.

To get entry to these yields, buyers buy BUIDL tokens, that are pegged to the US greenback. Holders then obtain their dividend distributions instantly on the blockchain, which mirror revenue that the fund generates from its underlying property.

Since debuting on the Ethereum community, BUIDL has expanded to seven further blockchains, particularly Aptos, Avalanche, Optimism, Solana, BNB Chain, Arbitrum, and Polygon.

The $100 million milestone comes as curiosity round blockchain tokenization continues to develop. BUIDL, particularly, has seen robust adoption since its launch. Earlier this 12 months, the tokenized fund surpassed $2 billion in complete asset worth.

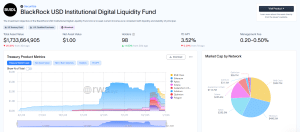

BUIDL overview (Supply: RWA.xyz)

Information from RWA exhibits that BUIDL’s complete asset worth has since dropped to round $1.733 billion, representing a greater than 25% decline from 30 days in the past. Nonetheless, there was a 1% rise within the variety of holders of the fund within the final month, pushing the entire to 98.

BUIDL’s Highest Market Cap Is On BNB Chain

When BUIDL’s market cap by blockchain community, the BNB Chain accounts for almost all of the tokenized fund’s capitalization at $502.7 million, the RWA information exhibits.

Ethereum is available in at second with $490.5 million, whereas APTOS accounts for the third-highest quantity of $295.5 million.

The Solana blockchain ranks at quantity 4, and accounts for $255.3 million of BUIDL’s capitalization.

BNB Chain making up the best portion of BUIDL’s market cap comes after Binance, the blockchain’s proprietor and the most important crypto change by 24-hour commerce volumes, introduced in the course of November that merchants can begin utilizing BUIDL tokens as off-chain collateral on its platform.

BlackRock’s BUIDL, the world’s largest tokenized RWA, is now accepted as off-exchange collateral for buying and selling on #Binance

This milestone displays our dedication to enabling establishments to entry digital property with management, yield, safety, and capital effectivity.

— Binance (@binance) November 14, 2025

The transfer was pushed by demand from institutional shoppers for yield-bearing property that can be utilized as collateral in lively buying and selling methods. Binance’s resolution additionally adopted related strikes made by Crypto.com and Deribit earlier this 12 months.

Crypto.com, a competing crypto change, began accepting collateral for margin buying and selling and superior buying and selling functions in June, permitting institutional customers and superior merchants to publish BUIDL to safe positions throughout a number of merchandise on its platform.

With reference to Deribit, merchants are in a position to put BUIDL as collateral for futures and choices buying and selling.

Extra not too long ago, the M0 stablecoin platform adopted these corporations’ lead and introduced earlier this month that it’s going to additionally begin accepting BUIDL as collateral backing for stablecoin issuers on its platform as properly.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection