- Ethereum’s TVL stays structurally sturdy whilst whole DeFi capital pulls again from latest highs.

- Capital is turning into extra selective, concentrating round core infrastructure like Ethereum fairly than speculative protocols.

- Rising stablecoin and RWA adoption positions Ethereum as the first settlement layer for the following DeFi part.

Ethereum’s place on the coronary heart of decentralised finance doesn’t appear to be slipping, whilst the broader DeFi market cools off a bit. Whereas whole capital throughout DeFi has pulled again from latest highs, Ethereum itself remains to be holding on to a surprisingly sturdy base. That distinction issues, and it says quite a bit about the place capital feels most secure proper now.

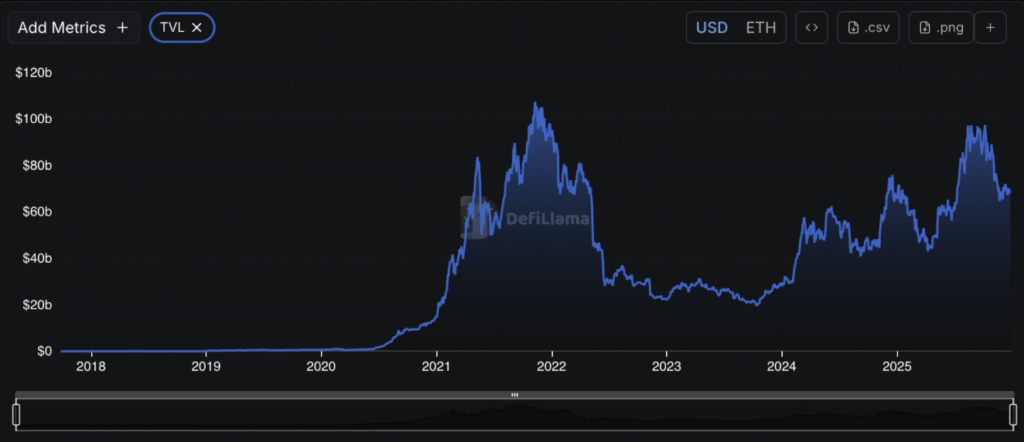

Knowledge from DeFiLlama exhibits Ethereum’s whole worth locked stays structurally elevated in comparison with earlier cycles, regardless of the volatility that’s shaken the market once more. On the identical time, broader ecosystem knowledge from Sentora paints a distinct image. Total DeFi TVL has retreated from multi-year peaks, hinting at consolidation fairly than a mass exit. Put collectively, it appears much less like capital is leaving DeFi, and extra prefer it’s getting choosy.

Ethereum TVL Holds a Greater Flooring

Wanting again at Ethereum’s TVL since 2020, the sample is acquainted. Huge enlargement, sharp contraction, then restoration. The distinction this time is the place issues settled after the 2022 drawdown. As a substitute of resetting to previous lows, Ethereum established a a lot greater baseline, one which carried by way of 2024 and into 2025 earlier than the most recent pullback. As of now, Ethereum’s TVL sits round $68.6 billion, nonetheless effectively above ranges seen in previous downturns.

That resilience isn’t unintended. Ethereum hosts most of DeFi’s core infrastructure, stablecoins, lending markets, liquid staking, restaking, the plumbing that every thing else relies on. At the same time as speculative yield performs fade out and in, these layers maintain pulling capital in. Utilization feels much less about chasing returns and extra about staying positioned in methods that really get used, day after day.

Broader DeFi TVL Tells a Completely different Story

Zooming out, Sentora’s view of whole DeFi TVL throughout all chains exhibits a clearer pullback. After hitting multi-year highs earlier this yr, whole TVL has slipped to roughly $182 billion. On the floor, that appears bearish. However the particulars matter greater than the headline quantity.

The composition of that TVL has modified. Capital is clustering round heavyweights like Aave, Lido, EigenLayer-linked protocols, and main liquid staking platforms. Smaller, extra experimental protocols are taking on much less house than earlier than. That divergence suggests buyers aren’t abandoning DeFi, they’re narrowing their focus, selecting what feels important over what feels elective.

Establishments Are Quietly Shaping the Shift

A few of this selectivity traces up with how establishments have a tendency to maneuver. SharpLink’s Joseph Chalom has identified that stablecoins, tokenised real-world property, and institutional participation are setting the stage for the following part of crypto development. In that framework, Ethereum naturally emerges as the principle settlement layer.

Stablecoins typically act because the entry level. Corporations begin there, then develop into tokenised funds, onchain cash markets, and ultimately credit score. That gradual development lowers the barrier to adoption, but it surely additionally favors networks with deep liquidity and a protracted monitor document of safety. Ethereum checks these packing containers, after which some.

If stablecoin utilization and RWA adoption speed up the best way many count on, Ethereum’s present dominance places it in a robust place. Chalom has even urged Ethereum’s TVL may develop tenfold by 2026, an formidable name, however not fully indifferent from the information.

What the Knowledge Is Actually Pointing To

Taken collectively, this doesn’t appear like a DeFi collapse. It appears extra like a reset. Capital remains to be onchain, but it surely’s shifting with extra self-discipline. As a substitute of spreading all over the place, it’s concentrating round infrastructure that feels sturdy, liquid, and confirmed.

That shift would possibly imply fewer explosive headline positive aspects in whole TVL, a minimum of for now. But it surely additionally hints at one thing extra sustainable beneath. A smaller, extra centered base can find yourself being a stronger one, even when it’s quieter alongside the best way.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.