Bitcoin and the broader crypto market enter the New Yr beneath renewed stress after the Federal Open Market Committee launched its December assembly minutes.

The FOMC minutes make it very clear that there’s little urgency to chop rates of interest once more in early 2026.

Sponsored

Increased-for-Longer Charges Weigh on Crypto Sentiment

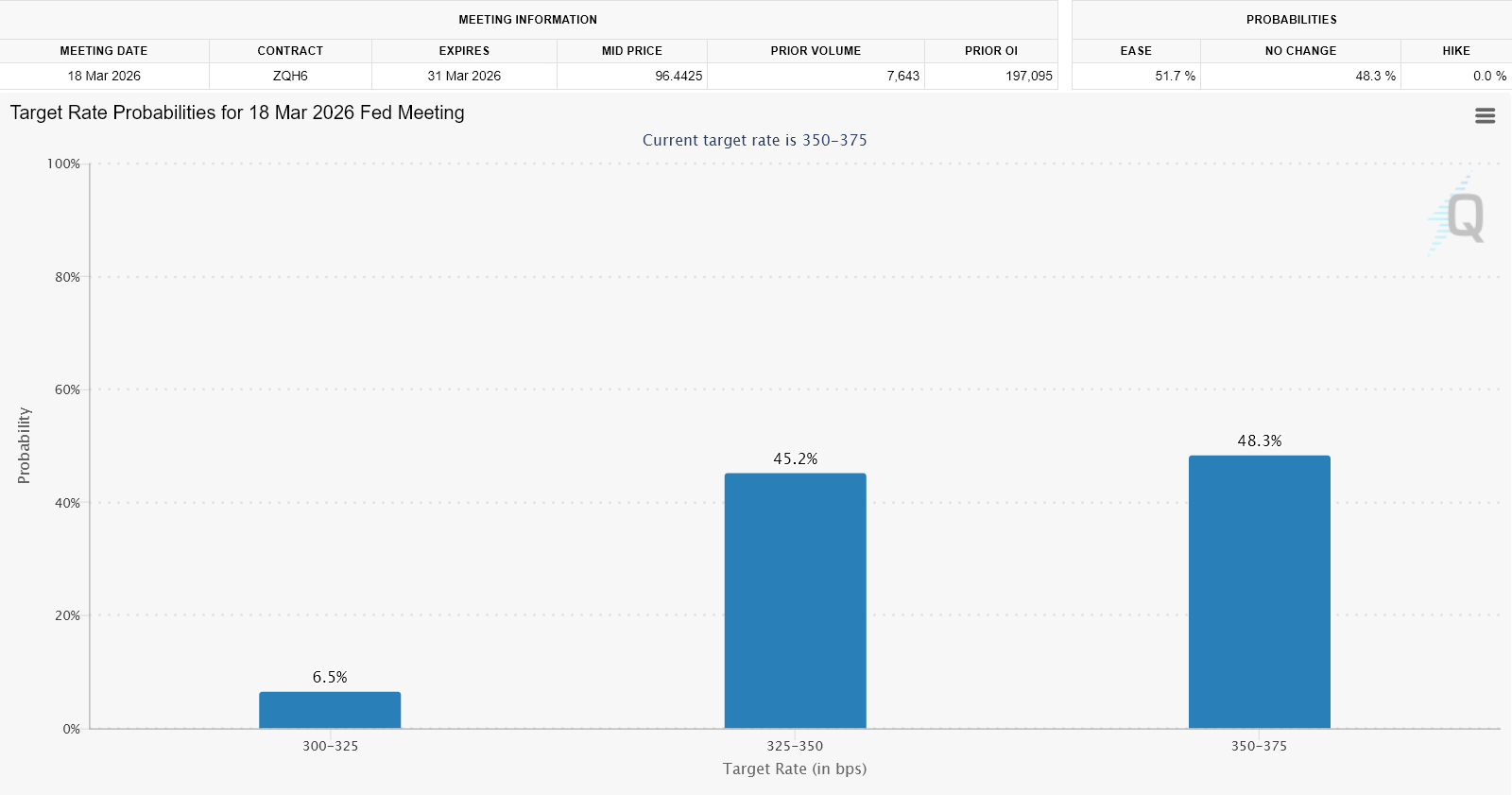

The minutes, printed December 30, recommend policymakers favor a pause following December’s 25-basis-point minimize, pushing expectations for the following discount towards March on the earliest.

Markets had already priced out a January transfer, however the language bolstered that view. The FOMC minutes even shadowed fee minimize hopes for March 2026.

So, the clear earliest rate of interest minimize might are available in April.

Bitcoin has traded in a good vary between roughly $85,000 and $90,000 in latest weeks.

Sponsored

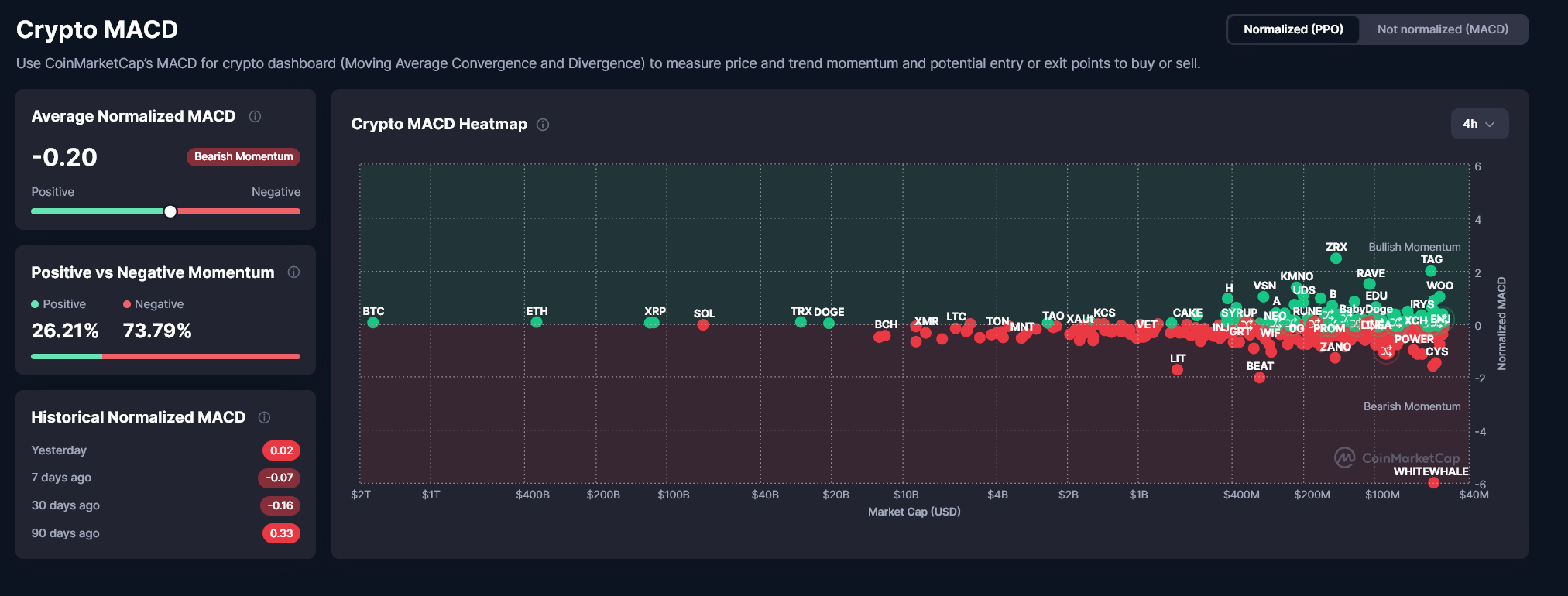

Worth motion stays fragile after failing to reclaim larger resistance ranges, whereas sentiment indicators level to warning fairly than conviction.

General, each day crypto buying and selling volumes stay skinny. Danger urge for food has but to recuperate meaningfully after December’s pullback.

In line with the minutes, a number of officers argued it will be “applicable to maintain the goal vary unchanged for a while” to evaluate the lagged results of latest easing.

Others described the December minimize as “finely balanced,” underscoring restricted urge for food for follow-up motion with out clearer inflation progress.

Inflation stays the central constraint. Policymakers acknowledged value pressures “had not moved nearer to the two % goal over the previous 12 months,” at the same time as labor market circumstances softened.

Sponsored

FOMC cited Tariffs as a key driver behind cussed items inflation, whereas providers inflation confirmed gradual enchancment.

On the identical time, the Fed flagged rising draw back dangers to employment. Officers famous slowing hiring, muted enterprise plans, and rising concern amongst lower-income households.

Nonetheless, most contributors most popular to attend for added information earlier than adjusting coverage once more.

Sponsored

For crypto markets, the message is simple. With actual yields elevated and liquidity circumstances tight, near-term upside catalysts stay scarce.

Bitcoin’s latest consolidation displays that rigidity, as traders stability expectations for eventual easing in opposition to the truth of higher-for-longer charges.

Trying forward, March now emerges as the primary reasonable window for one more minimize, assuming inflation cools and labor circumstances weaken additional.

Till then, crypto markets might battle to regain momentum. Costs are prone to stay susceptible to additional draw back if macroeconomic information disappoints early in 2026.