- XRP worth stays beneath strain, however regular institutional inflows proceed to restrict deeper draw back.

- XRP ETFs have proven unusually robust demand, with no recorded web outflow days since launch.

- Weak retail participation and long-term holder promoting may hold XRP range-bound into early 2026.

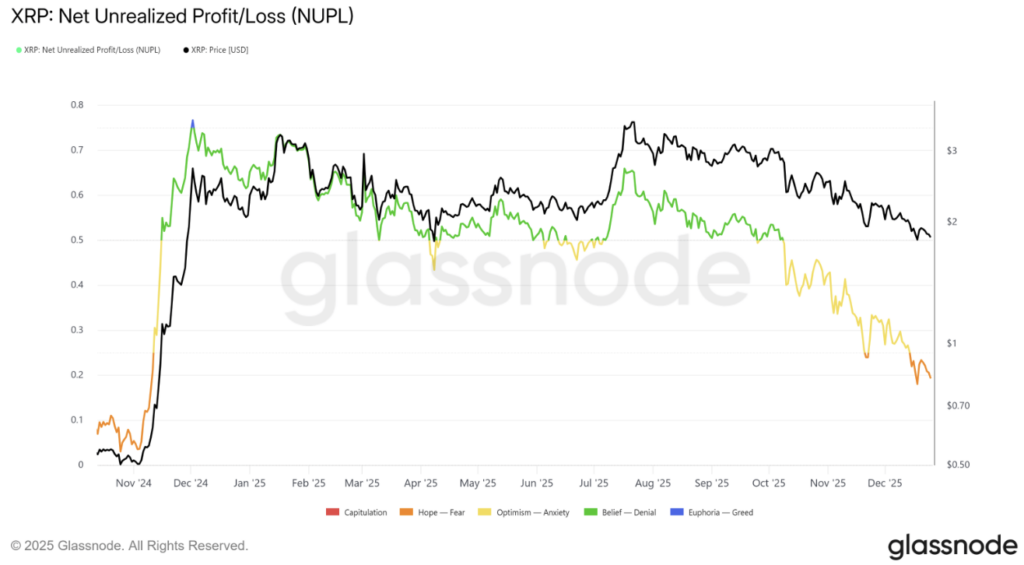

XRP has spent the previous a number of weeks beneath regular strain, with bounce makes an attempt repeatedly failing to stay. As 2025 involves an in depth, the token is wrapping up a mildly destructive yr, nonetheless leaning bearish and struggling to seek out momentum. Spot demand has been skinny, retail participation cautious, and worth motion has mirrored that hesitation fairly clearly.

But XRP hasn’t unraveled utterly. The primary cause is institutional assist, which has quietly acted as a stabilizer. Whereas sellers stay lively, deeper drawdowns have been prevented, largely as a result of greater gamers proceed to step in the place retail has stepped again.

Establishments Preserve Exhibiting Up for XRP

All through 2025, institutional traders have been XRP’s most constant backers. CoinShares information exhibits that XRP pulled in $70 million in inflows through the week ending December 27 alone. That pushed month-to-date inflows to roughly $424 million, a powerful displaying given the broader weak spot in worth.

What’s notable is how XRP stacked up in opposition to bigger belongings. Bitcoin noticed $25 million in outflows throughout the identical interval, whereas Ethereum confronted a lot heavier withdrawals totaling $241 million. On a full-year foundation, XRP attracted round $3.3 billion in inflows, underlining sustained institutional confidence regardless of volatility and lingering authorized uncertainty throughout the crypto market.

XRP ETFs Reinforce Lengthy-Time period Positioning

That assist hasn’t been restricted to conventional funding merchandise. Since launching earlier this yr, XRP ETFs have but to document a single day of web outflows. Just one session closed flat, with out inflows, which is uncommon consistency by ETF requirements.

Ray Youssef, CEO of crypto app NoOnes, defined that this habits displays deliberate, long-term positioning relatively than short-term hypothesis. He famous that early December accumulation seemed to be a strategic transfer geared toward capturing ETF-related momentum, much like what performed out through the early Bitcoin and Ethereum ETF cycles.

In accordance with Youssef, XRP is more and more being handled as a high-beta asset with a clearer worth proposition, pushed by rising institutional participation. Even with worth beneath strain, many merchants nonetheless view present ranges as affordable entry zones, betting that worth will finally catch as much as ETF-driven demand.

Lengthy-Time period Holders Start to Waver

One group to observe intently heading into 2026 is long-term holders. Traditionally, they’ve performed a stabilizing position throughout downturns, usually accumulating when sentiment turns bitter. Over the previous yr, nonetheless, their habits has been blended. Durations of accumulation alternated with distribution, reflecting uncertainty round XRP’s medium-term outlook.

By This fall 2025, promoting exercise had began to dominate. That shift suggests weakening conviction amongst traders who often trip out volatility. If this pattern continues into 2026, XRP may face elevated draw back threat, as sustained distribution from long-term holders usually precedes prolonged consolidation or deeper pullbacks.

XRP Heads Into 2026 With Muted Expectations

On the time of writing, XRP was buying and selling close to $1.87 after sliding roughly 38% throughout This fall. 12 months-to-date, the token is down about 9.7%, and December didn’t ship any significant restoration. Bearish sentiment lingered because the yr wrapped up.

Trying forward, 2026 could not convey rapid aid. Youssef prompt that January, and probably all the first quarter, may stay comparatively flat for XRP. In his view, the token could proceed buying and selling between $2 and $2.50 except a transparent macro catalyst emerges. Persistent volatility, geopolitical stress, and repeated risk-off episodes have made merchants reluctant to take robust directional bets.

The larger image stays restoration. A sustained transfer above $3.00 could be wanted to reestablish a bullish construction and reopen the trail towards the $3.66 all-time excessive. Till then, draw back dangers can’t be ignored. A decisive break under the $1.79 assist stage would possible expose the $1.50 zone, firmly shifting the narrative again in favor of the bears.

Seasonality doesn’t supply a lot consolation both. XRP underperformed in December amid weak liquidity, lowered threat urge for food, and broader sell-offs tied to macro stress and the fading AI hype commerce. Traditionally, January has delivered modest common features for XRP, however the median return tells a distinct story, with frequent underperformance.

Until sentiment improves meaningfully and investor habits shifts, XRP could wrestle by the early months of 2026 earlier than a clearer path lastly takes form.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.