As famous by VanEck’s Matthew Sigel, Bitcoin’s long-term holders have became internet accumulators. This seemingly implies that their largest promoting spree since 2019 is probably going over.

Earlier right this moment, the main cryptocurrency spiked to an intraday excessive of $89,201, CoinGecko knowledge exhibits.

A significant promote strain occasion

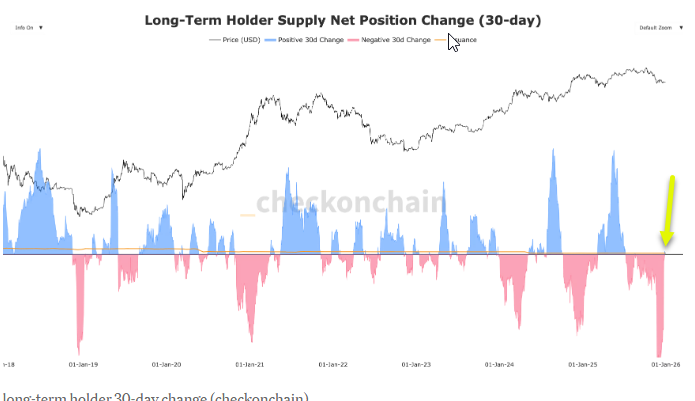

The chart shared by Sigel measures the 30-day change within the provide held by Lengthy-Time period Holders. In on-chain evaluation, an LTH is often outlined as an entity that has held cash for 155 days or extra.

When the bars are blue and above the zero line, LTHs are shopping for and locking away cash. This often occurs throughout bear markets or value dips. Conversely, when the bars are crimson and beneath the zero line, LTHs are promoting their cash into the market. This often occurs throughout bull markets when costs are excessive.

LTHs are likely to do the alternative of the retail crowd. They purchase when everyone seems to be fearful and promote when everyone seems to be grasping.

The arrow signifies that the interval of heavy profit-taking by LTHs is actually over. They’ve completed promoting the stock they supposed to dump at these value ranges.

When LTHs cease promoting, an enormous supply of sell-side strain is faraway from the market. If demand stays fixed or will increase, there’s extra potential for a considerable rally since there are fewer “whale” sellers suppressing the value.

Throughout earlier cycles, a return to the zero line after heavy promoting usually marks a consolidation section or a transition again into accumulation.

Bitcoin is up to now down 5.19% on a year-to-date foundation. Yearly that the flagship cryptocurrency has had a crimson yearly candle, the next 12 months has been inexperienced with a mean yearly return of 124.5%.

That mentioned, as famous by Mike Novogratz, Bitcoin bulls first must reclaim the $100,000 degree for Bitcoin to flip bullish.