- Solana trades close to $120 as ETF inflows stay regular whereas derivatives merchants lean bearish.

- Rising futures Open Curiosity paired with the next quick ratio suggests rising sell-side strain.

- SOL should defend $115 assist or break above $133 to verify its subsequent directional transfer.

Solana is attempting to remain on its toes, however it’s not precisely convincing proper now. At press time on Tuesday, SOL was hovering simply above $120 after slipping practically 2% the day earlier than. The transfer comes as SOL-focused ETFs present indicators of renewed curiosity, even after logging their weakest weekly influx not too long ago. On the identical time, derivatives knowledge is flashing a special message, one which leans extra cautious, even bearish, as futures exercise heats up.

Establishments Preserve Accumulating, Retail Turns Defensive

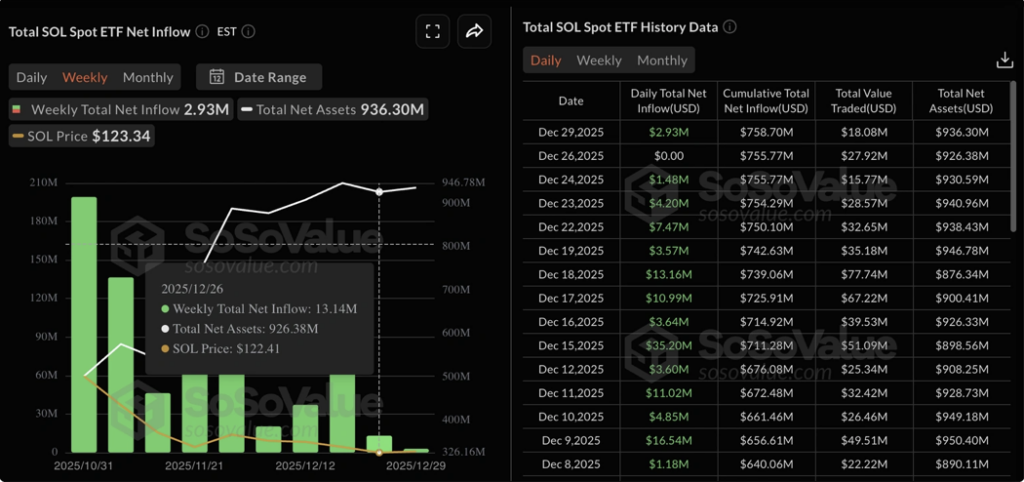

On the institutional aspect, Solana ETFs introduced in about $13.14 million final week, a pointy drop from the $66.55 million seen the week prior. That slowdown hints at softer urge for food amid broader market volatility, however it doesn’t inform the entire story. On Monday alone, ETFs nonetheless attracted $2.93 million in recent inflows, following a flat session on Friday. It’s not aggressive shopping for, however it’s regular, and that issues.

Retail merchants, nevertheless, seem far much less optimistic. CoinGlass knowledge exhibits SOL futures Open Curiosity climbing to $7.68 billion, up from $7.54 billion the day prior to this. Rising OI often indicators recent capital getting into the market, however route issues. On this case, the long-to-short ratio has tilted bearish, with quick positions now making up roughly 52.5% of open trades, up from beneath 50% only a day earlier. That implies a lot of the brand new cash is betting on draw back reasonably than a rebound.

Value Construction Stays Fragile Close to $120

From a technical standpoint, Solana is sitting in a fragile spot. On the day by day chart, SOL continues to commerce inside a descending wedge, formed by two converging trendlines. Monday’s rejection close to $130 despatched value decrease once more, elevating the chance of a deeper transfer towards the decrease assist trendline, which traces up close to $115.

If that stage offers manner, the following space to observe sits across the S1 Pivot Level close to $107. Under that, issues get much less snug, with the April 7 low close to $95 appearing because the deeper security internet. It’s not the bottom case but, however it’s on the map.

Indicators Ship Combined Indicators

Momentum indicators aren’t providing a clear reply both. The RSI is hovering round 41, drifting sideways under the impartial 50 stage, which factors to lingering bearish strain. Patrons haven’t stepped in with sufficient power to flip the indicator, no less than not but.

That stated, the MACD tells a barely extra hopeful story. It’s bouncing off the sign line and inching again towards the zero stage, hinting that bullish momentum may very well be attempting to rebuild beneath the floor. It’s delicate, not a breakout sign, however sufficient to maintain bulls .

Trying greater, SOL would want to interrupt above the descending resistance line, drawn from the November 12 and December 9 highs, round $133. Clearing that would open a run towards the 50-day EMA close to $137. Till then, Solana stays caught between cautious establishments, defensive retail merchants, and a chart that hasn’t fairly made up its thoughts.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.