- XRP promoting stress has elevated after a pointy value drop, however total trade provide continues to say no.

- Most XRP wallets maintain very small balances, whereas a big portion of provide stays locked or illiquid.

- Rising entry prices and lowered liquidity may tighten the market shortly if demand returns.

Ripple’s XRP is usually criticized for having a large provide, however that headline quantity doesn’t inform the complete story. In actuality, most of that offer isn’t simply accessible or actively traded. Thousands and thousands of wallets maintain tiny balances, whereas the quantity of XRP that may truly transfer freely by means of the market retains shrinking.

That imbalance issues. If promoting stress eases and demand even barely returns, the hole between what exists on paper and what’s truly liquid may begin to present up in value, quick.

Promoting Stress Spikes After Sharp Drop

XRP has been below heavy promoting stress following a steep decline. Worth has fallen practically 50%, sliding from highs round $3.66 right down to roughly $1.85. That type of transfer tends to shake confidence, and the on-chain information reveals it did precisely that.

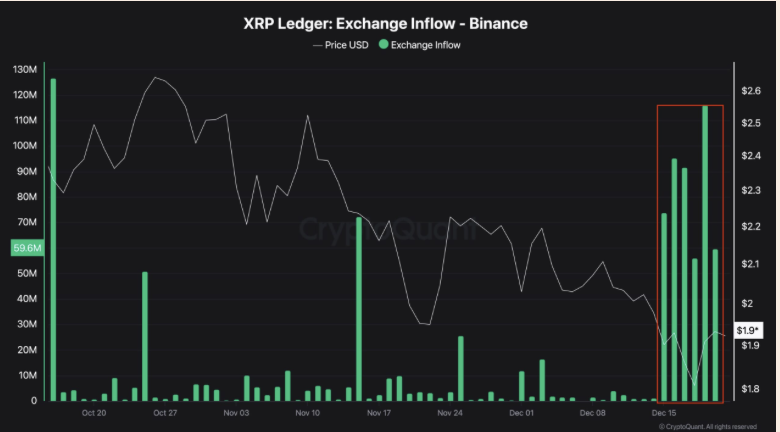

Alternate inflows jumped, particularly towards Binance, which handles the biggest share of XRP buying and selling quantity. After a comparatively calm stretch, transfers picked up round December 15. Each day inflows ranged between 35 million and 116 million XRP, a transparent sign that extra holders had been transferring cash with the intent to promote.

What’s fascinating, although, is that even with this exercise, the full quantity of XRP held on exchanges continues to development decrease. Alternate balances now sit close to 1.5 billion XRP. In different phrases, merchants are promoting into weak point, however the total pool of XRP obtainable on exchanges remains to be shrinking.

Retail Holds Much less Whereas Prices Rise

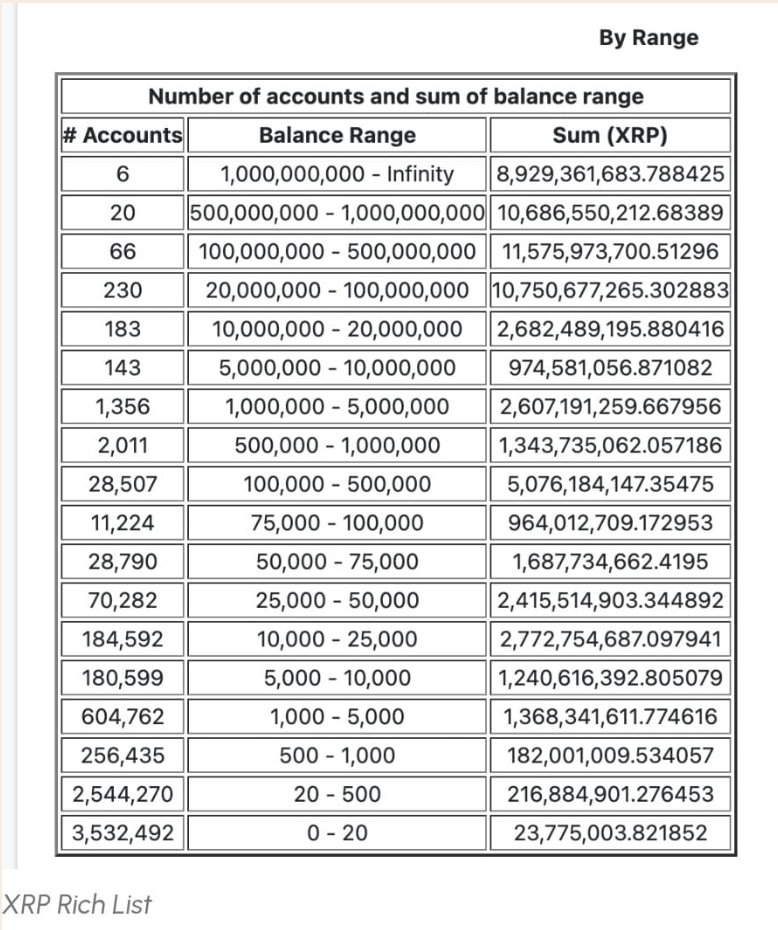

XRP’s distribution helps clarify why this stress feels uneven. Information reveals that greater than six million wallets maintain 500 XRP or fewer, inserting the overwhelming majority of individuals firmly within the small-holder class. On the opposite finish, a a lot smaller variety of wallets management tens of millions of XRP every, accounting for a big share of provide.

This implies XRP’s circulating provide seems massive on paper, however in apply, far much less of it’s truly liquid. A rising chunk of XRP is escrowed or successfully locked as a consequence of account reserves, ledger mechanics, and protocol-level necessities. That provide isn’t hitting the market anytime quickly.

On the similar time, XRP has turn into meaningfully costlier to build up. Shopping for 1,000 XRP now prices round $1,750, in comparison with roughly $500 simply over a 12 months in the past. That leap in entry value limits how aggressively retail can purchase dips, even when value pulls again laborious.

A Tight Market Can Type Rapidly

Put all of it collectively, and a transparent hole begins to kind. Retail wallets maintain much less, shopping for requires extra capital, and a large portion of XRP merely isn’t free to commerce. Whereas promoting stress is excessive proper now, the construction beneath is tighter than it seems at first look.

If demand returns, even modestly, it wouldn’t take a lot to emphasize obtainable provide. With fewer cash truly transferring and fewer individuals capable of accumulate dimension, the market may tighten quicker than many anticipate. That’s the quiet setup forming beneath the noise.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.