Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value edged up by over 1% previously 24 hours to commerce at $88,445 as of 1:27 a.m. EST, on buying and selling quantity that dropped 8% to $39.3 billion.

This comes as traders betting that January charge cuts will stay the identical odds hit 87% on Polymarket, a sign that the Federal Reserve could depart them untouched.

In the meantime, most Fed officers imagine extra curiosity cuts are acceptable so long as inflation continues to chill, in line with minutes launched on Wednesday, December 30.

Based on the minutes, policymakers slashed rates of interest earlier this month to a spread of three.5% to three.75% in a 9-3 vote.

FOMC Minutes Dec 10 2025 and Key Takeaways for 2026

The Federal Open Market Committee lower the federal funds charge by 25 foundation factors to three.50–3.75 p.c at its December assembly.

The choice handed 9-3, marking inner division and differing views on the steadiness between… pic.twitter.com/Z9ZA0mnloE

— Truflation (@truflation) December 30, 2025

“A number of members pointed to the danger of upper inflation changing into entrenched and steered that reducing the coverage charge additional within the context of elevated inflation readings might be misinterpreted as implying diminished policymaker dedication to the two% inflation goal,” the minutes learn.

Bitcoin Value On A Cautious Pattern As Bears And Bulls Combat For Dominance

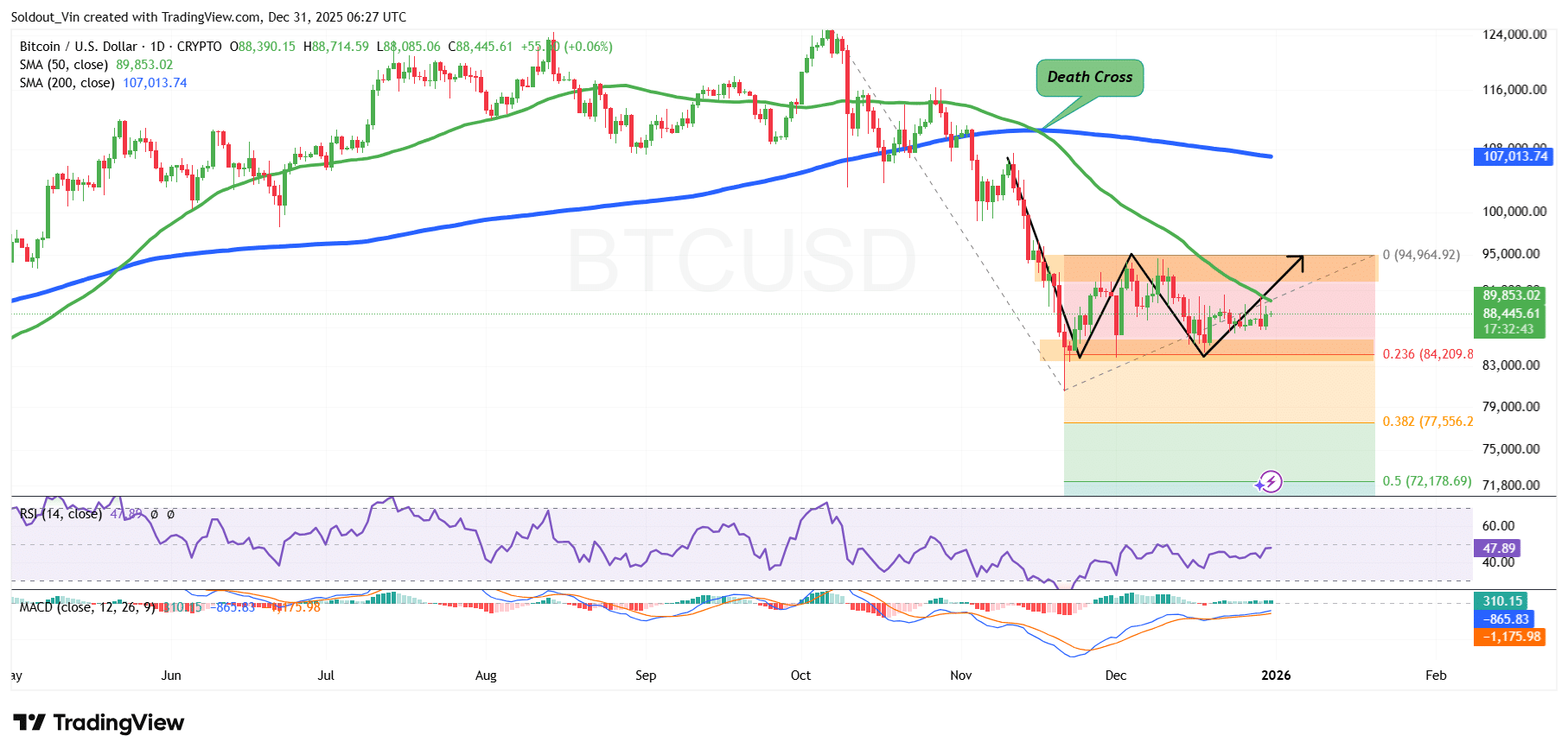

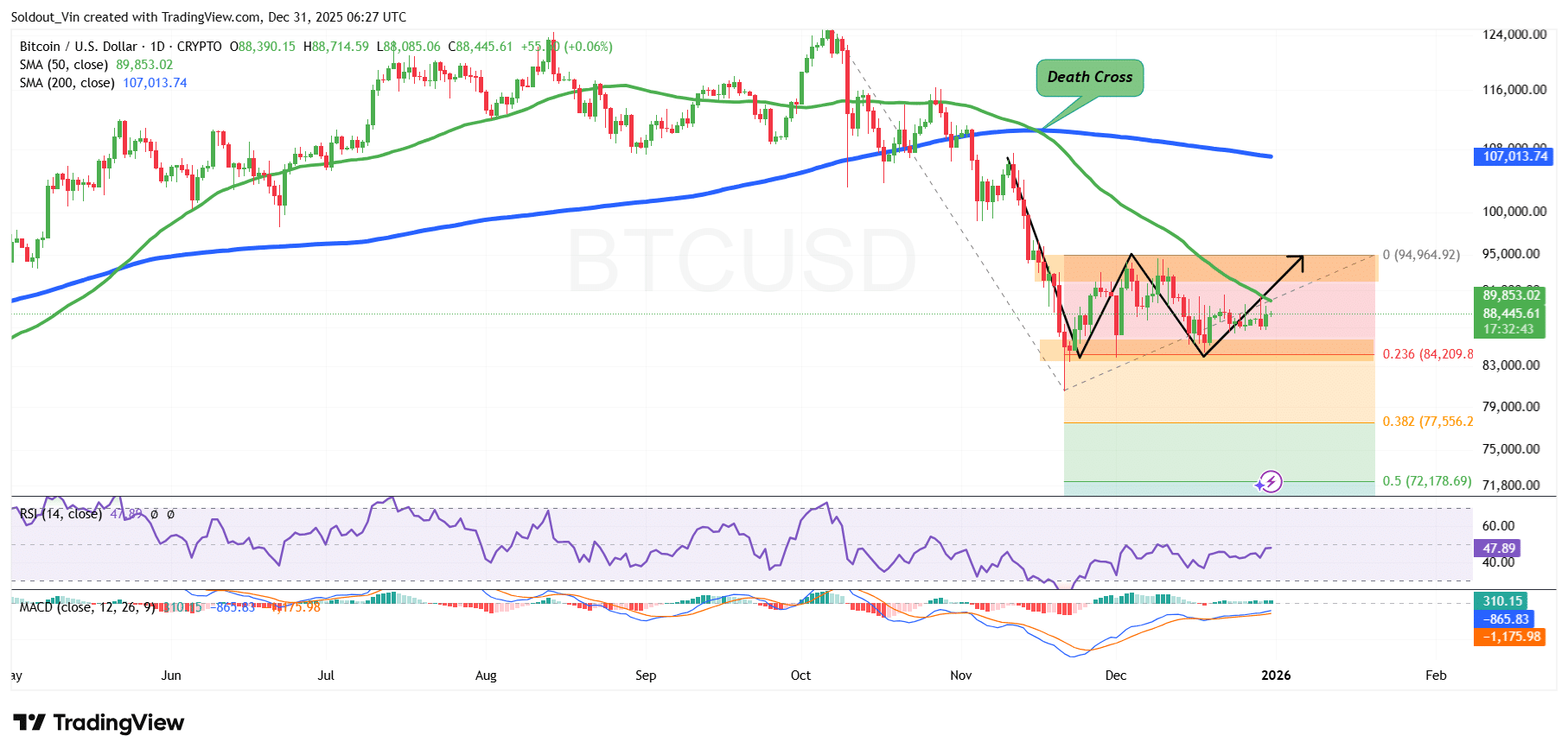

Buyers are cautious concerning the BTC value, because the asset trades in a sideways sample and indicators sign indecision available in the market.

After a surge in April and Could, the Bitcoin value consolidated above the $100,800 help space, permitting BTC to hit its all-time excessive (ATH) round $126,200.

Nevertheless, bulls couldn’t maintain the uptrend, after which bears took management, pushing the asset down and prompting traders to e-book income, as proven by the trend-based Fibonacci retracement chart.

This downtrend was additionally fueled by the Easy Transferring Averages (SMAs) forming a demise cross at $110,404, after the 200-day SMA crossed above the 50-day SMA.

BTC is now buying and selling beneath each SMAs, signaling that sellers nonetheless have some management.

After the downtrend, the worth of BTC then hit a key help space across the $81,000 zone, now performing as a big demand space. Since hitting this degree in late November, Bitcoin has been buying and selling in a consolidation part, with the $94,964 degree on the 0 Fib zone performing as a hurdle above.

Nevertheless, Bitcoin is displaying indicators of a breakout, with development indicators suggesting slight bullish strain.

The Transferring Common Convergence Divergence (MACD) has turned optimistic, because the blue MACD line has crossed above the orange sign line on the day by day timeframe. The inexperienced bars on the histogram are additionally rising above the impartial line, confirming elevated optimistic momentum.

In the meantime, the Relative Power Index has been buying and selling between the 40-50 zone, indicating continued consolidation. The RSI, at present at 47.89, reveals indicators of a rebound, with patrons settling in.

BTC Value Prediction

Primarily based on the BTC/USD chart evaluation, the BTC value is at present in a tug-of-war, with the bears and bulls preventing for dominance on the 0 and 0.236 Fibonacci Retracement ranges.

If bulls decide up from the final day by day candle to take care of the upward transfer, and in the event that they push BTC above the 50-day SMA ($89,853), the Bitcoin value may surge much more, crossing the $94,000 barrier as they aim $107,100, the earlier provide zone, and throughout the 200-day SMA.

Based on Michaël van de Poppe, a crypto analyst on X with over 816k followers, BTC is at present testing the 21-day MA (round $88,300) on the day by day chart. An in depth above this might point out a sustained bullish rally.

Nevertheless, on the draw back, if bears take management, the worth of BTC may drop again to the 0.382 Fib zone at $77,556, which is now performing as steady help in case of a sustained drop.

Associated Information

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection