- Ethereum reveals rising on-chain conviction as staking demand rises and liquid provide tightens.

- Value continues to construct a base above key help regardless of remaining beneath main resistance ranges.

- Institutional accumulation and enhancing construction reopen long-term upside situations towards $5,000.

Ethereum is beginning to really feel fascinating once more. After months of drifting sideways, a mixture of on-chain alerts, technical construction, and institutional conduct is lining up in a method that’s exhausting to disregard. Merchants who tuned out throughout consolidation are slowly coming again, not as a result of worth is exploding, however as a result of the groundwork appears to be like completely different now.

That shift has reopened long-term conversations, together with whether or not ETH may finally revisit the $5,000 space. It’s not a name for tomorrow, however the dialogue is again on the desk as community exercise improves and worth holds regular round key demand zones.

Staking Information Factors to Conviction, Not Worry

One of many quieter however extra vital alerts is going on inside Ethereum’s staking system. Validator queues on either side are busy. Greater than 772,000 ETH is at the moment ready to enter staking, with activation delays stretching past 13 days. On the similar time, exit queues maintain roughly 288,000 ETH.

That stability issues. Heavy exits usually present stress. Heavy entries present dedication. Seeing each suggests regular churn slightly than panic. In different phrases, long-term holders seem like adjusting positions, not speeding for the door.

Ethereum’s validator rely continues to climb as properly. Practically a million validators now safe round 35.5 million ETH, representing over 29% of the full provide. Staking yields sit close to 2.85%, modest, however regular. That yield, mixed with lengthy lockups, retains a significant chunk of ETH off the open market throughout unsure circumstances.

Value Holds the Base Whereas Momentum Cools

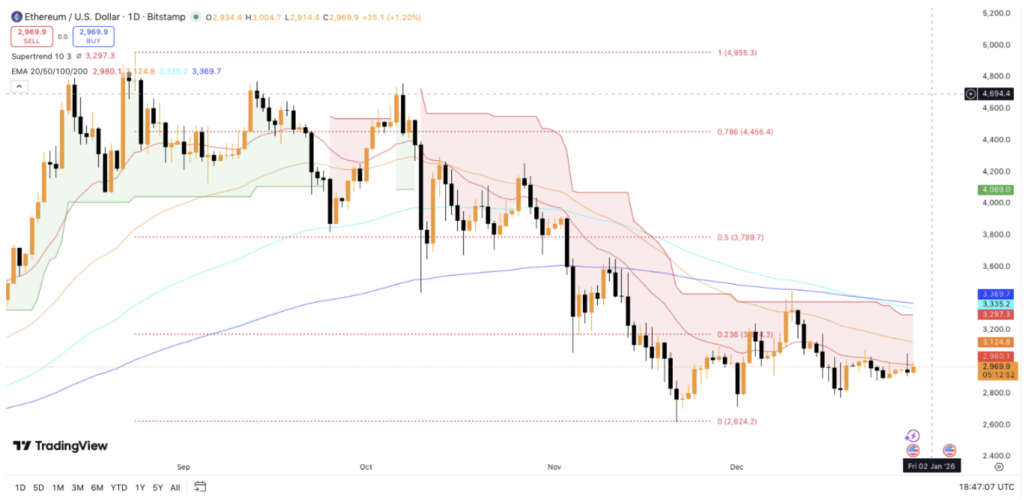

From a worth perspective, Ethereum is buying and selling close to $2,970 after small day by day and weekly positive aspects. The broader pattern continues to be corrective, and there’s no pretending in any other case. ETH stays beneath its main transferring averages, with the 200-day EMA close to $3,369 appearing as heavy overhead resistance. The Supertrend indicator additionally stays bearish, reinforcing warning within the quick time period.

Nonetheless, one thing has modified. Draw back momentum is slowing. Value continues to defend the $2,950 to $3,000 zone and stays comfortably above the prior cycle low close to $2,624. That conduct leans extra towards base-building than distribution. Merchants are watching resistance ranges now, not bracing for contemporary lows.

Technically, the roadmap is pretty clear. A day by day shut above $3,125 would trace at early pattern enchancment and open room towards $3,350 to $3,400, roughly 13% upside from present ranges. Reclaiming the 200-day EMA can be extra significant, doubtlessly unlocking a transfer towards $3,790.

Past that, consideration shifts to the $4,450 to $4,800 zone. A sustained break there would deliver long-term targets again into focus, together with the $4,955 to $5,000 area that when felt distant, and these days, feels much less so.

Analysts and Establishments Lean Into the Construction

A number of analysts have highlighted Ethereum’s present positioning. Titan of Crypto has pointed to a deep retracement from ETH’s prior impulsive transfer, noting $2,750 as a key stage throughout consolidation. Traditionally, comparable retracement zones have preceded sturdy recoveries in previous cycles.

Bitcoinsensus, in the meantime, sees a Wyckoff Accumulation construction forming on increased timeframes. That setup usually alerts late-stage consolidation, the place power quietly builds earlier than increasing. Section D traits, when confirmed by quantity, have a tendency to indicate up earlier than decisive reversals.

Institutional conduct provides weight to the story. Tom Lee’s Bitmine has aggressively elevated its Ethereum publicity, including greater than 44,000 ETH in a latest buy price roughly $130 million. That brings its whole holdings to round 4.11 million ETH.

Bitmine has already staked over 408,000 ETH and plans to develop validator operations by way of the MAVAN community beginning in 2026. The method is evident, accumulate, stake, and optimize yield over time. That sort of technique doesn’t chase short-term worth strikes. It aligns with endurance, and proper now, Ethereum’s on-chain information appears to reward precisely that.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.