This 12 months, traders decisively selected treasured metals akin to gold to hedge towards the potential erosion of paper cash worth, sidelining bitcoin .

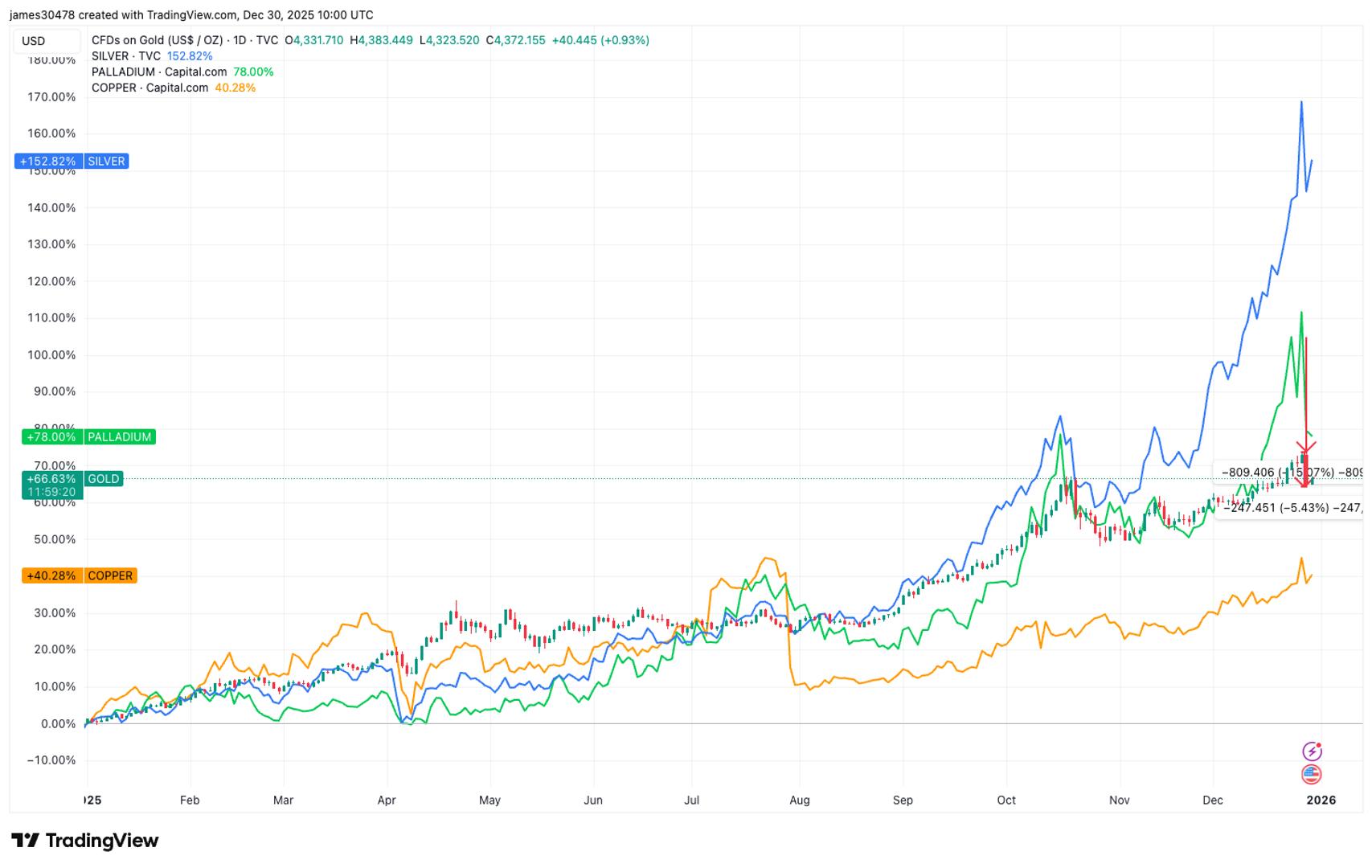

Gold has risen nearly 70% since Jan. 1 and silver about 150%, far outpacing the most important cryptocurrency, which has fallen about 6%.

Analysts attributed the rally to the so-called “debasement commerce.” That is an funding technique that entails shopping for perceived store-of-value belongings and ready for the fiat foreign money to devalue, or debase. The depreciation, the results of ultra-easy financial insurance policies and monetary deficit, results in a lack of buying energy and drives up the worth of the asset.

Early this 12 months, BTC bulls made daring predictions, citing the debasement commerce as a key catalyst driving their year-end forecasts. Bitcoin’s rally, nevertheless, abruptly ran out of steam above $126,000 in early October. Since then, it has pulled again to beneath $90,000.

Report rally in gold

Gold’s rally has been notably notable from the angle of technical evaluation, in accordance with The Kobeissi Letter.

The metallic has remained above its 200-day easy shifting common, a extensively adopted long-term pattern indicator that smooths worth motion over roughly 9 months, for round 550 consecutive buying and selling days. This marks the second-longest streak on document, trailing solely the roughly 750-session stretch that adopted the 2008 monetary disaster.

Nonetheless, the bitcoin bulls aren’t phased. Crypto analysts count on the cryptocurrency to meet up with gold subsequent 12 months, residing as much as its tendency to rally with a lag.

“Gold has been main BTC by roughly 26 weeks, and its consolidation final summer season matches Bitcoin’s pause at this time,” Lewis Harland, a portfolio supervisor at Re7 Capital, advised CoinDesk. “The metallic’s renewed power displays a market more and more pricing in additional foreign money debasement and monetary pressure into 2026, a backdrop that has constantly supported each belongings, with Bitcoin traditionally responding with larger torque.”

The predictions market appears aligned with that view. As of writing, merchants on Polymarket assigned a 40% chance of BTC being the best-performing asset subsequent 12 months, with gold at 33% and equities at 25%.