The crypto market is ending 2025 with provide administration headlines on the stablecoin facet, a seasonal tailwind argument for Bitcoin bulls, and a recent ETF submitting wave that retains increasing the trad-fi on-ramp narrative into corners like privateness cash.

None of those is a single “flip the market” change by itself, however collectively they set the tone for early January: fewer tokens right here, larger targets there and one other reminder that 2026 is being pitched as an ETF acceleration yr.

TL;DR

- Ripple Treasury burned 21,804,950 RLUSD on Ethereum — the most important burn in two weeks.

- Bitcoin trades $88,800, and $100,000 implies a 12.6% push from right here, with January worth historical past supporting the argument.

- ZEC trades $526.59 as Bitwise provides a ZEC Technique ETF submitting to a giant listing of 11 proposed technique merchandise.

Ripple retires $21,804,950 of its RLUSD stablecoin

Ripple USD simply skilled its most vital provide discount in weeks, and it occurred within the least dramatic method potential: the token’s Treasury despatched cash to the burn handle.

The Ripple Stablecoin Tracker flagged two burns tied to the RLUSD Treasury. The bigger burn moved 21,654,950 RLUSD to Ethereum’s null handle, “0x000.” Earlier that day, one other transaction burned 150,000 RLUSD. Add them up, and the New 12 months’s Eve headline quantity is $21,804,950 value of RLUSD faraway from circulation — the most important burn since Dec. 18.

The “null handle” vacation spot is necessary as a result of it’s not a switch within the conventional sense. It’s a traditional burn sample: cash go away the availability and don’t reappear in one other pockets.

The size is significant, however it’s not world-ending. RLUSD is designed to stay close to $1 with the availability round 1.33 billion RLUSD, and the asset is 52 by market cap. In opposition to this backdrop, the deletion of 21,804,950 models is a visual change, not a negligible quantity hidden inside trade flows.

Virtually talking, when a stablecoin treasury burns this a lot, it often alerts provide management, redemption exercise or balance-sheet housekeeping. If RLUSD continues to increase its distribution whereas the Treasury continues to make use of burns as a launch valve, it creates an on-chain narrative that may be tracked like a dashboard. That is very true as a result of the peg is doing what it’s designed to do.

Bitcoin to $100,000 in January positive aspects traction

Bitcoin ends the yr buying and selling at $88,800, with $80,600 standing out as a decrease reference degree. In the meantime, $107,154.99 sits on the prime as the larger “if this comes again, it is actual” space to observe in relation to reclaiming six figures.

The $100,000-in-January prediction is gaining traction as a result of the maths will not be absurd. The transfer from $88,800 to $100,000 is just 12.6%. In crypto phrases, that may be a regular swing, not a miracle.

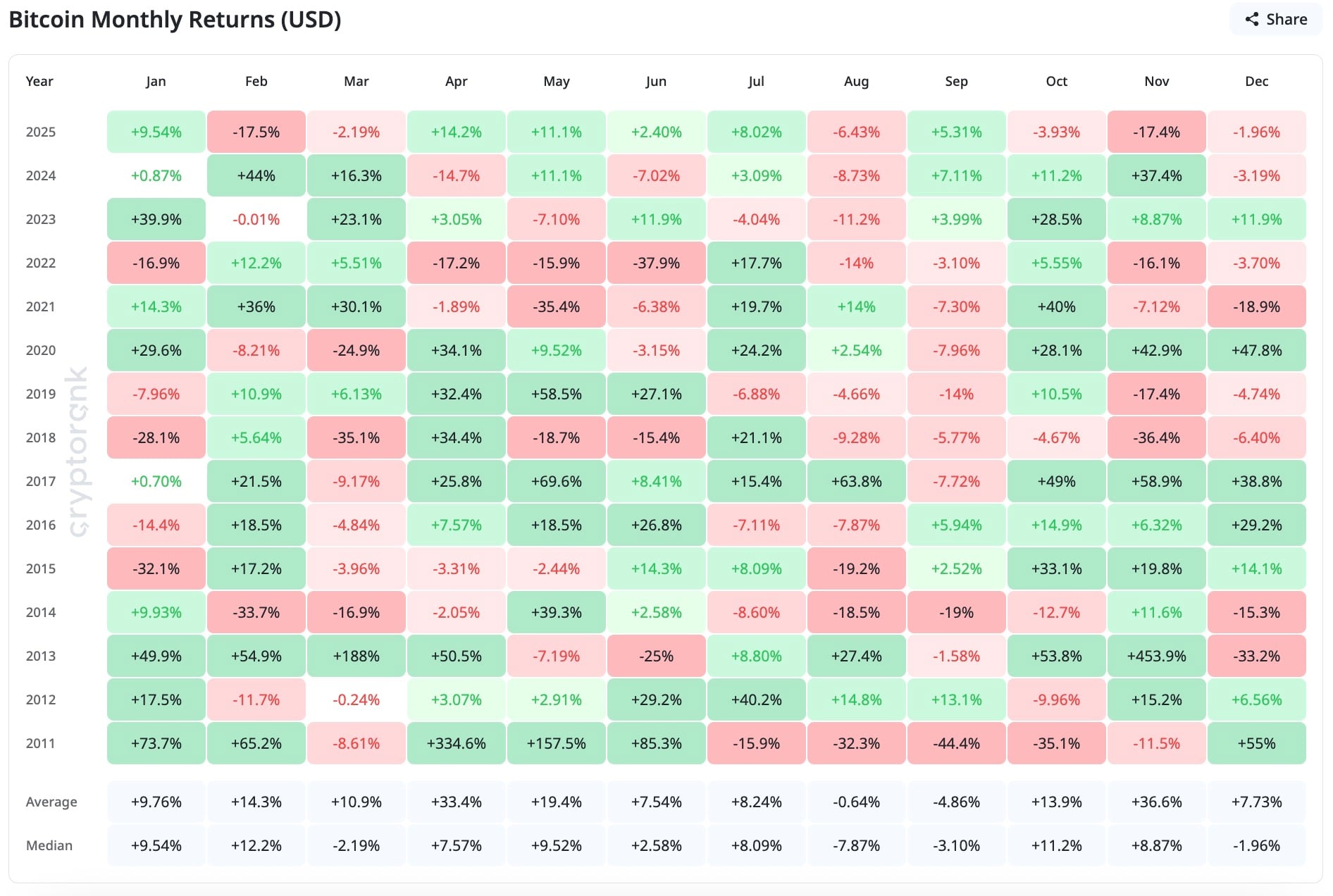

The worth historical past of the cryptocurrency by CryptoRank provides that concept further gas. Throughout the years proven, January has a mean return of 9.76% and a median of 9.54%. The yr 2025 itself began with a 9.54% January. This doesn’t assure something for 2026, but it surely explains why this month is marketed as a “recent begin” alternative, the place consumers anticipate to see a rise in bids.

Add to that the narrative from Bitwise’s latest listing of predictions. They argue that Bitcoin can break the outdated four-year cycle, pointing to the fading affect of halving every cycle, decrease fee expectations in 2026, fewer “system shock” blowups after the October 2025 liquidation wave, bettering regulation and broader institutional entry.

Moreover, the agency highlights the structural ETF bid, noting that, since January 2024, Bitcoin funds have bought 710,777 BTC, whereas the community has issued solely 363,047 BTC throughout the identical interval. This demand versus new provide imbalance has helped BTC rise 94% in that timeframe.

Mix these elements collectively, and it’s straightforward to see why persons are speaking a few worth of $100,000 as a close to goal as a substitute of a distant dream. The worth continues to be beneath that line as we speak, however the market has sufficient supporting storylines to proceed selling the thought till the chart invalidates it.

Zcash (ZEC) ETF submitting by Bitwise stuns privateness coin market

The privateness coin sector has been pulled into the ETF dialog once more, and this time, it’s extra than simply chatter. Bitwise filed for a ZEC Technique ETF as a part of a gaggle of 11 proposed ETFs, alongside names like AAVE, CC, ENA, HYPE, NEAR, STRK, SUI, TAO, TRX, UNI and ZEC.

For Zcash, the “ETF” headline issues as a result of the market has traditionally seen privateness cash as harder to promote in conventional monetary settings, even when the expertise is spectacular. A method-style submitting doesn’t routinely imply spot publicity or assure approval. Nonetheless, it alerts to merchants that an issuer believes there’s a viable route, narrative and purchaser base.

The worth motion of ZEC is already elevated. On the TradingView chart, ZEC is buying and selling at $526.59 with a minor 0.57% lower on day by day candle. The chart visually marks close by reference zones at $520.12 and $492.27. Increased areas, reminiscent of $560 and $680, sit above as the subsequent “if it runs” areas.

The setup reads like this: ZEC is holding a excessive shelf after a significant run into late 2025. An ETF submitting headline provides that assist a cause to stay defended, at the very least till the market will get bored or risk-off takes over.

Crypto market in 2026 prediction

2026 reads just like the yr crypto stops buying and selling purely on vibes and begins buying and selling on full-fledged adoption.

If ETF entry retains widening past early adopters, $100,000 Bitcoin stops being a headline and turns right into a reference line, with a brand new all-time excessive changing into the bottom case sooner or later within the yr, even when the trail contains at the very least one ugly reset.

Stablecoins get dragged into coverage debates as their footprints develop, so treasury actions like RLUSD burns turn out to be a weekly scoreboard for provide management and redemptions, not a one-off curiosity.

The ETF menu expands from majors into methods and area of interest property, and the sleeper commerce is a privateness coin primarily based on “trad-fi wrapper” optics, with ZEC getting the form of bid it hardly ever receives exterior of risk-on waves.

The principle threat is regulation plus a liquidity shock that turns early-year power right into a mid-year shakeout.