Actual-world belongings had a breakout yr in 2025, and now the query is easy. Can the momentum survive harder circumstances, or was it a peak? Liquidity, regulation, and actual utilization will determine who leads subsequent. This piece appears to be like at three RWA tokens to look at in 2026.

The listing is predicated on precise demand, smart-money conduct, and early construction on the charts.

Maple Finance (SYRUP)

RWAs have been essentially the most worthwhile crypto narrative of 2025, with common features of over 185% in response to CoinGecko. That backdrop issues as a result of Maple Finance sits within the credit score section of this pattern and ended the yr up about 109% year-on-year, with a current 7.5% climb displaying momentum remains to be alive.

Sponsored

It’s an institutional lending platform the place companies borrow capital by actual mortgage exercise, and lenders earn yield tied to on-chain credit score, not inflationary emissions. This positioning retains Maple Finance on the shortlist of RWA tokens to look at in 2026.

Bitget CMO Ignacio Aguirre Franco tells BeInCrypto completely that Maple’s 2025 efficiency have to be understood in context:

“Costs can rise a lot quicker than underlying adoption or income would justify,” he mentioned.

He provides that worth shouldn’t be the metric to belief going into subsequent yr:

“Going into 2026, we might prioritize income growth and settlement volumes as the important thing metrics to be careful for,” he highlighted

This traces up with the view from Konstantin Anissimov, International CEO at Forex.com, who believes the credit score lane nonetheless has room to develop as RWA adoption matures:

“On-chain credit score is prone to come subsequent. There may be actual demand for it… nevertheless it doesn’t develop in a straight line,” he highlighted in an unique dialog BeInCrypto.

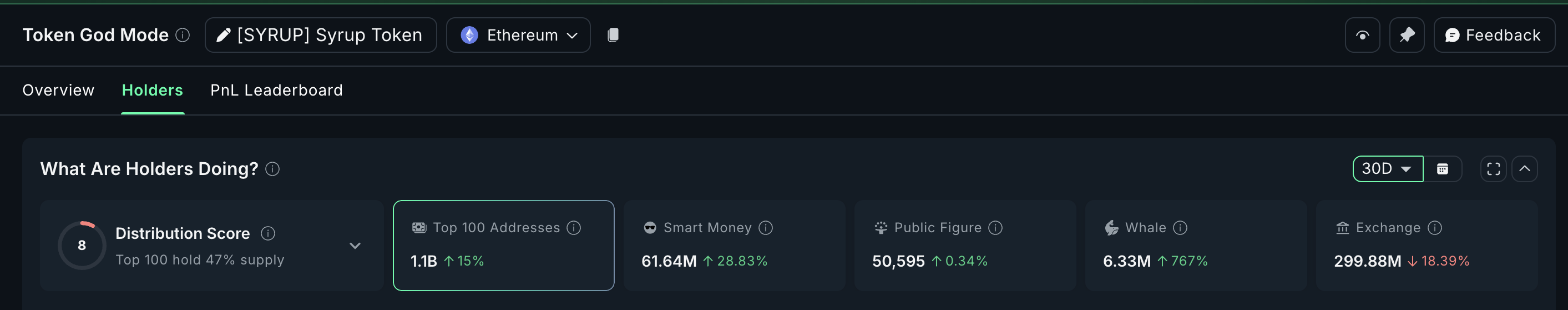

On-chain knowledge helps this curiosity. Within the final 30 days, whale holdings are up 767% to about 6.33 million SYRUP, including roughly 5.6 million tokens.

Mega-whales elevated holdings by 15%, and good cash addresses added round 28%.

The chart validates the whale and good cash curiosity. It exhibits a cup and deal with sample forming with consolidation contained in the deal with. A breakout above $0.336 begins the transfer, and clearing the sloped neckline close to $0.360 confirms it.

Sponsored

Sponsored

That projection targets $0.557 (about +60% from affirmation). Weak point emerges below $0.302, and the sample breaks below $0.235.

Chainlink (LINK)

Chainlink didn’t get pleasure from the identical breakout as application-layer RWA initiatives in 2025. It closed the yr down about 38% year-on-year and now trades close to $12.37. It has gained 1.7% within the final seven days, however the restoration is sluggish and uneven.

Even so, it stays one of many infrastructure-layer RWA tokens to look at in 2026 attributable to its relevance to institutional rails and knowledge integrity.

This positioning aligns with what Ignacio Aguirre Franco instructed BeInCrypto when requested why infrastructure initiatives could matter extra as adoption matures.

He explains that platforms like Chainlink sit nearer to the belief layer wanted for actual settlement:

“Chainlink and Stellar exist on the infrastructure layer… the previous supplies trusted knowledge and verification that different functions depend on.

Each are essential when coping with tokenized belongings tied to real-world worth. And each of those platforms have been doing their job for years, which naturally makes them engaging selections for institutional traders who gravitate in the direction of belief and stability,” he talked about

He provides that that is the place establishments are prone to gravitate:

“Establishments don’t wish to cope with experimental programs at each layer, so having trusted infrastructure beneath and versatile functions on high makes essentially the most sense as a manner ahead,” he emphasised

Sponsored

Sponsored

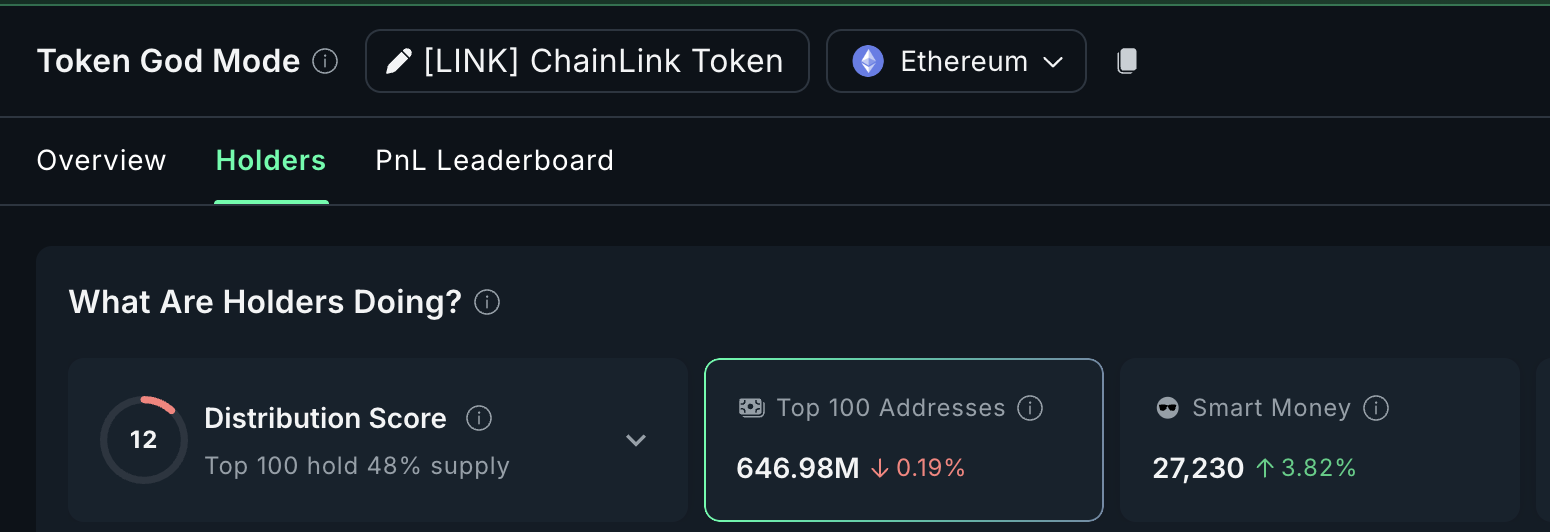

Sensible cash conduct displays that shift. Within the final seven days, good cash addresses elevated holdings by 3.82%, at the same time as mega whale balances dropped. This means selective accumulation as an alternative of broad confidence, however it’s nonetheless notable throughout a weak interval.

The chart exhibits a double backside forming close to $11.73, with RSI (Relative Power Index), a momentum indicator, posting greater lows. When worth retests a assist degree whereas the RSI rises, it indicators bullish divergence and suggests sellers are dropping energy. That is the earliest signal of a possible pattern change.

LINK has bounced a bit since.

For continued upside, LINK wants to interrupt $12.45 to verify a short-term raise. Above that, $13.76 is the subsequent key degree. It’s a resistance that stopped the final rally on December 12 and has not been reclaimed since.

If worth breaks $13.76 with continued good cash influx, LINK may transfer towards $14.24 and even $15.01, the place momentum selections are probably. A breach of the $11.75 line may weaken the bullish speculation and weaken the LINK worth construction.

Zebec Community (ZBCN)

Zebec Community sits within the real-time payroll and money-movement section of RWAs. It was probably the greatest performers of 2025 with a year-on-year achieve of about 164%, however the final three months have been tough. It’s nonetheless down round 42% in that interval and now trades close to $0.0023.

Sponsored

Sponsored

The token is flat within the final 24 hours and is attempting to regain momentum. Even so, its use case retains it on the listing of RWA tokens to look at in 2026.

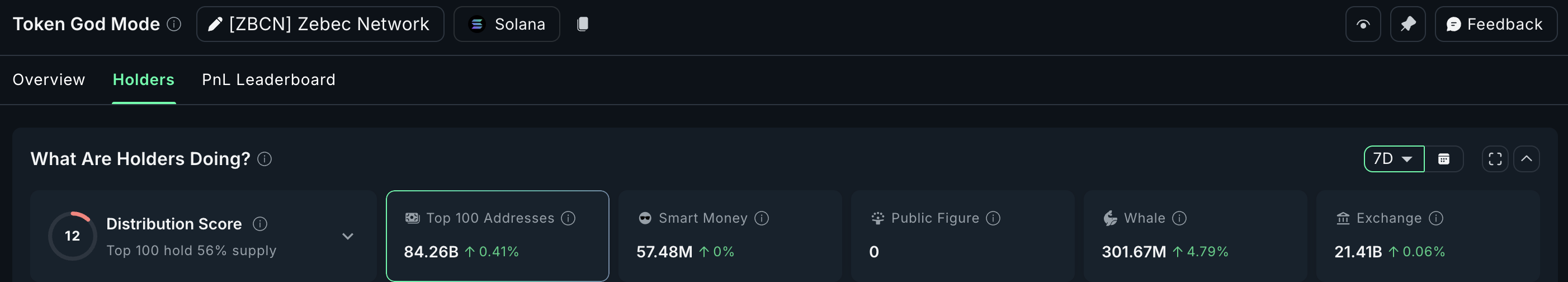

Whales just lately re-entered. Within the final 7 days, massive holders elevated their balances by 4.79% to about 301.67 million ZBCN, including round 13.8 million tokens.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

That’s occurring proper at a key assist zone (later defined on the chart). This assist would be the motive whales are testing entries right here regardless of the weak broader pattern.

Nonetheless, Konstantin Anissimov of Forex.com highlights this level about segment-based survival, pertaining to the Zebec Community:

“Actual-time payroll is the section most weak to rotation… With out steady utilization progress, this sector would battle essentially the most throughout market rotations,” he talked about

This quote issues as a result of it attracts the road for Zebec: whale shopping for helps, however actual utilization nonetheless wants to point out up.

Technically, the setup is easy. The construction turns into mildly bullish provided that ZBCN reclaims $0.0030. That degree was misplaced on November 29, and a transfer above it could be about +28% from present costs. Above that, $0.0036 and $0.0041 are the subsequent checkpoints. Holding these would verify that patrons are literally following whales into the market.

If $0.0021 breaks (the important thing assist hinted at earlier), the assist argument disappears, and whale optimism will get examined. The subsequent draw back space sits close to $0.0014, which might be the short-term invalidation of the RWA restoration case for Zebec.