- XRP’s high-timeframe momentum has absolutely compressed, a uncommon sign that beforehand marked the top of main downtrends

- Lengthy-term chart patterns are intently mirroring the construction seen earlier than XRP’s final historic breakout

- Whereas value stays cautious, draw back strain seems restricted as accumulation quietly replaces distribution

XRP has drifted again right into a value zone that feels unusually acquainted to long-time merchants. It’s the identical sort of setting that existed earlier than its final historic breakout, when curiosity was low, momentum was flat, and endurance mattered greater than hype. Proper now, promoting strain seems drained, not aggressive, and longer-term holders look like quietly absorbing provide. Value motion continues to be cautious, certain, however the construction beneath is beginning to elevate eyebrows once more.

A Uncommon Momentum Reset on Increased Timeframes

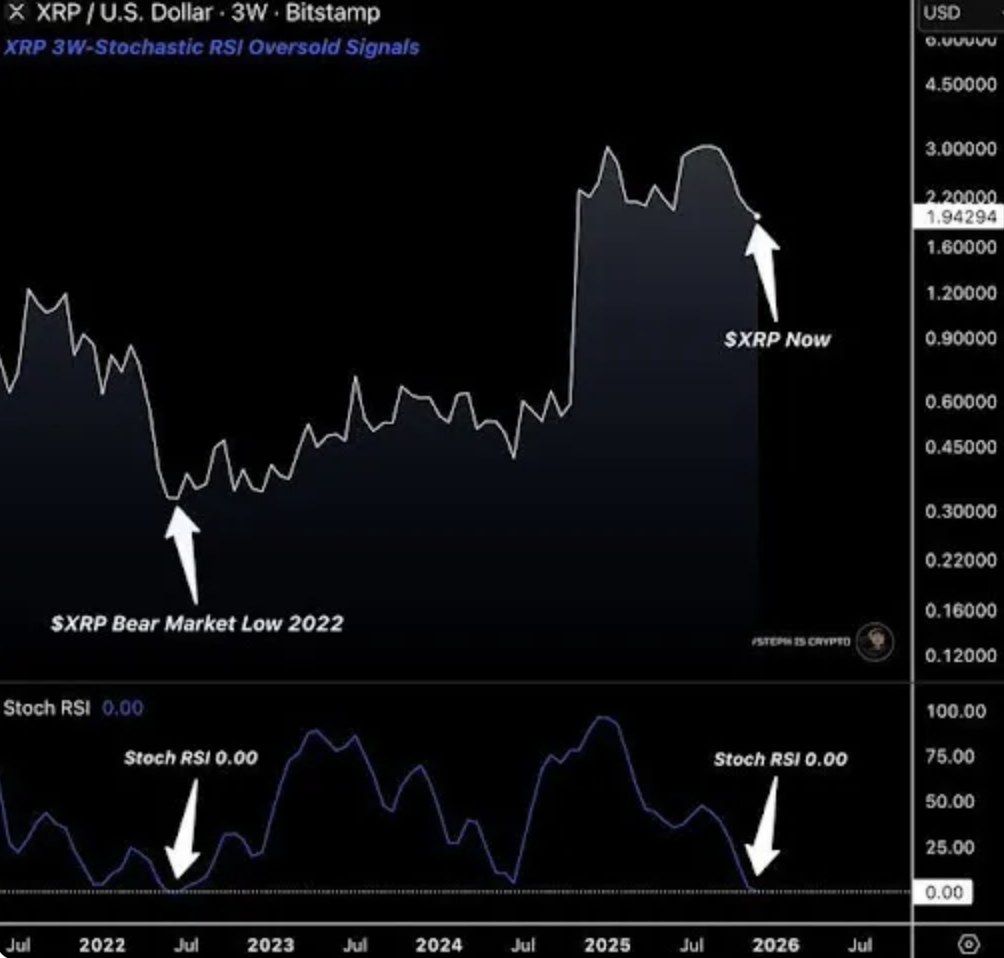

One of many extra attention-grabbing developments is occurring far above the short-term noise. On the 3-week chart, analyst Steph is Crypto identified that XRP’s Stochastic RSI has dropped all the way in which to 0.00. That’s not simply oversold, that’s complete compression. It’s a stage the indicator virtually by no means reaches.

Actually, this actual sign has solely proven up as soon as earlier than in XRP’s historical past, throughout the deepest a part of the 2022 bear market. When momentum indicators absolutely flatten like this, it often means sellers have spent their vitality. There’s no urgency left, simply exhaustion. That doesn’t imply value immediately rips larger, and it by no means has. What it tends to sign as an alternative is the beginning of an extended, quiet section the place sensible cash builds positions whereas the broader market seems elsewhere.

Again then, XRP didn’t explode upward straight away. It stabilized, moved sideways, and slowly shaped a base. Solely later did that groundwork flip into a robust upside transfer. Seeing the identical situation kind once more suggests draw back danger is changing into restricted at present ranges. It additionally hints that the market could also be shifting away from distribution and towards strategic accumulation, even when it doesn’t look thrilling but.

A Acquainted Rhythm Returns to XRP’s Lengthy-Time period Construction

Including to that image, analysts at Altcoin Pioneers have flagged a fractal sample on XRP’s longer-term charts that intently resembles its 2016–2017 cycle. On the 3-day timeframe, the similarities are onerous to disregard. Each durations function an extended ABC corrective construction, drawn-out and irritating, adopted by a pointy breakout as soon as the correction absolutely resolved.

Within the earlier cycle, XRP spent months grinding by that last leg decrease earlier than momentum flipped decisively. The present construction, spanning 2024 into 2025 and now early 2026, seems to be tracing a really comparable path. The ultimate C-wave appears to be urgent into the $1.87 space, barely sooner than final time, however structurally acquainted.

If that fractal continues to play out, XRP might be nearing the top of its shakeout section. Traditionally, that is the stage the place weaker fingers surrender and long-term contributors step in quietly. Nothing dramatic occurs at first. Then, all of a sudden, it does. Merchants who lived by the final full XRP cycle know this rhythm effectively, it by no means broadcasts itself loudly.

For now, XRP stays subdued, buying and selling close to $1.86 with no rush in both course. However beneath that calm floor, momentum compression, historic construction, and long-term holder habits are lining up in a method that doesn’t occur typically. Whether or not the broader market cooperates continues to be the massive unknown, however structurally, XRP is beginning to look much less prefer it’s breaking down, and extra prefer it’s setting the stage.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.