Digital asset regulation lastly shifted into gear in 2025 because the US moved towards a extra crypto-friendly authorized framework and the EU started absolutely implementing the Markets in Crypto-Belongings Regulation (MiCA) framework throughout Europe.

However crypto attorneys enter 2026 going through unresolved questions round prediction markets and tremendous apps, tax, privateness and digital market construction.

To know how crypto legislation developed in 2025 and preview what lies forward, Journal spoke with authorized specialists Catherine Smirnova and Yuriy Brisov of Digital & Analogue Companions in Europe, Joshua Chu of the Hong Kong Web3 Affiliation and Charlyn Ho of Rikka within the US.

The dialogue has been edited for readability and size.

Journal: What do you assume was crucial authorized improvement in crypto in 2025?

Ho: I might say crucial authorized developments have been the complete implementation of MiCA within the EU and the passage of the GENIUS Act and the development of the CLARITY Act within the US. The explanation I’m saying that’s not a lot simply the specifics of these items of laws, however slightly there may be laws now.

The crypto authorized panorama has change into clearer, and we’re transferring towards extra outlined regulatory frameworks.

One extra improvement can be the Trump administration’s government order on crypto. Whereas it isn’t laws, it has had an actual influence. It represents a US-first coverage that aggressively promotes and expands crypto domestically. Politics apart, it is a turning level. It’s a formal recognition that crypto is right here to remain and that it is a vital a part of the technological panorama. It strikes crypto past the notion that it’s merely a instrument for illicit exercise or fringe experimentation, and acknowledges it as a reliable expertise with broader implications past memecoins or speculative buying and selling.

Learn additionally

Options

Thailand’s Crypto Utopia — ‘90% of a cult, with out all of the bizarre stuff’

Options

2023 is a make-or-break 12 months for blockchain gaming: Play-to-own

Brisov: One other necessary improvement in US coverage was Undertaking Crypto introduced by Paul Atkins. The US performed a key position within the early blockchain revolution, however below prior SEC insurance policies, many crypto startups left the nation.

With the brand new administration below President Trump and Paul Atkins as SEC chair, the scenario has modified. We noticed a transparent reversal in 2025, with startups returning to the US.

Journal: What broader regulatory forces in 2025 influenced how governments approached digital belongings?

Smirnova: The regulation of digital markets has change into a geopolitical situation. Within the EU, a pattern that started a number of years in the past has continued, with the introduction and enforcement of tailored regulation for digital markets. This contains investigations into gatekeepers and the appliance of frameworks just like the Digital Markets Act.

The US has taken a distinct course below the present administration. In earlier years, we noticed historic investigations and selections towards corporations akin to Meta and Google. This 12 months, the brand new administration signaled that it doesn’t intend to pursue structural treatments. As a substitute, the US authorities has actively supported massive expertise corporations.

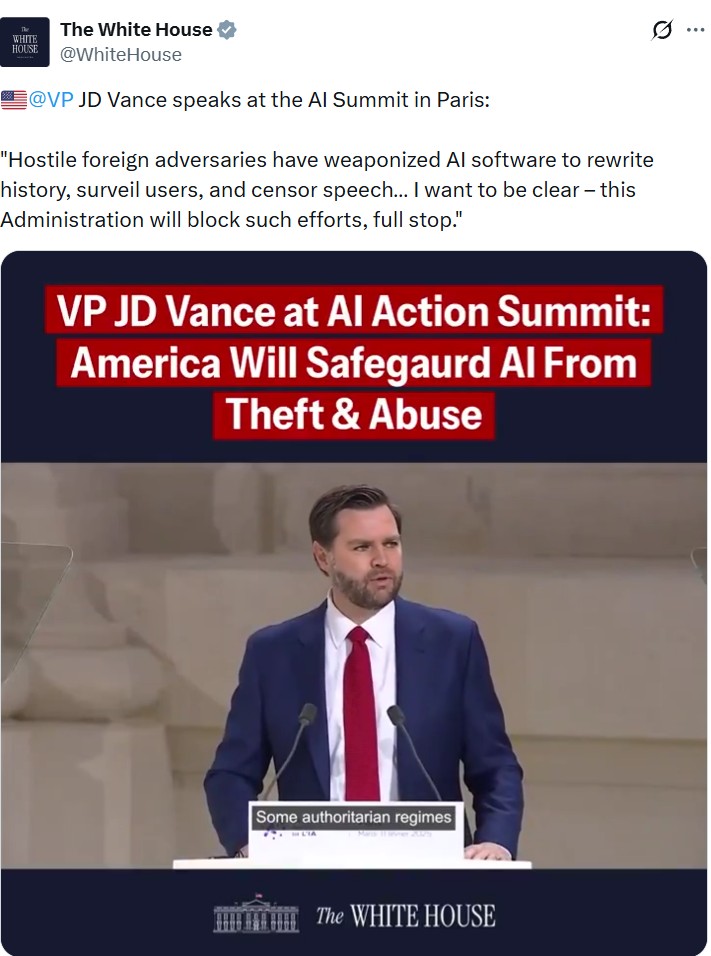

We noticed the identical dynamic in AI regulation. At a world convention earlier this 12 months, many anticipated a coordinated international method to AI governance. As a substitute, the US introduced it will not take part in worldwide regulation, preferring both its personal framework or minimal regulation so as to preserve international management and assist home corporations.

Consequently, regulation itself has change into a aggressive instrument. The EU has already responded by partially deregulating AI after seeing startups relocate to the US. This dynamic will proceed into 2026 and past.

Learn additionally

Options

We took an ETHSafari to see how crypto is understanding in Africa

Options

Which gaming guild positioned itself greatest for the bull market?

Journal: What have been crucial authorized developments in Asia in 2025?

By the center of the 12 months, significantly in Hong Kong, we noticed enforcement our bodies gaining far more expertise in coping with crypto-related issues.

We noticed the primary felony prosecutions towards core individuals within the JPEX scandal. Whereas prices have been laid, whether or not these circumstances lead to profitable prosecutions stays to be examined. That course of will prolong into the approaching 12 months because the system matures.

At a latest seminar, Justice Russell Coleman articulated this nicely. He mentioned, “Extending the rule of legislation into new areas is like shining mild into darkish corners the place individuals would possibly in any other case behave in methods unacceptable to society. Expertise adjustments, however equity and proportionality stay the guiding rules.”

I added that innovation is important if we need to defend victims of cybercrime and supply efficient authorized treatments. Expertise will not be the enemy. It allows the justice system to maintain tempo with actuality.

Journal: Wanting towards 2026, what regulatory or authorized frameworks do you count on to emerge?

One necessary improvement that deserves extra consideration is taxation.

In Hong Kong, there may be presently a public session on crypto asset reporting. Because the crypto area matures, tax regimes will inevitably catch up. Governments are working below fiscal strain, and crypto wealth is not going to be ignored.

This isn’t conventional regulatory laws however tax code evolution, which can have a a lot bigger influence. We’re more likely to see amendments to the Inland Income Ordinance and adjustments to how crypto belongings are reported below widespread reporting requirements. When crypto turns into mainstream, the result might not align with what many merchants count on.

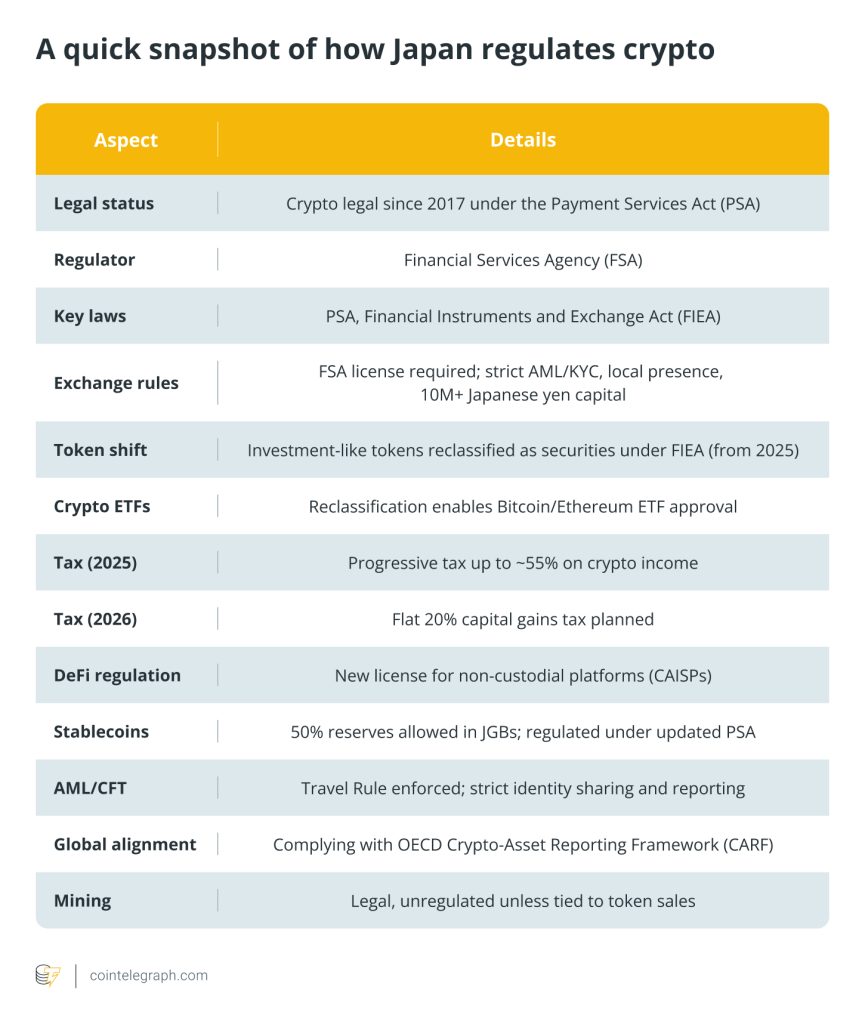

Japan is usually a helpful indicator of what’s coming, and up to date tax discussions there are value watching carefully. [Japan has proposed a 20% flat tax on crypto gains]

Brisov: One other potential spark is prediction markets, akin to Polymarket and related platforms. These are nonetheless largely unregulated, with no clear court docket circumstances or legislative frameworks but. Nonetheless, they could change into a extra important pattern in 2026.

One other main pattern will probably be the emergence of so-called tremendous apps.

Learn additionally

Options

Constructing group resilience to crises via mutual help and Web3

Options

How sensible individuals spend money on dumb memecoins: 3-point plan for fulfillment

These apps would mix a number of features akin to prediction markets, commodity buying and selling, on-ramps and off-ramps, exchanges, memecoins and real-world asset tokenization. They might additionally combine AI brokers and probably autonomous AI actors.

Regulators and legislators should adapt, very similar to they did in the course of the early days of main social media platforms. We don’t but absolutely perceive the right way to regulate these constructions.

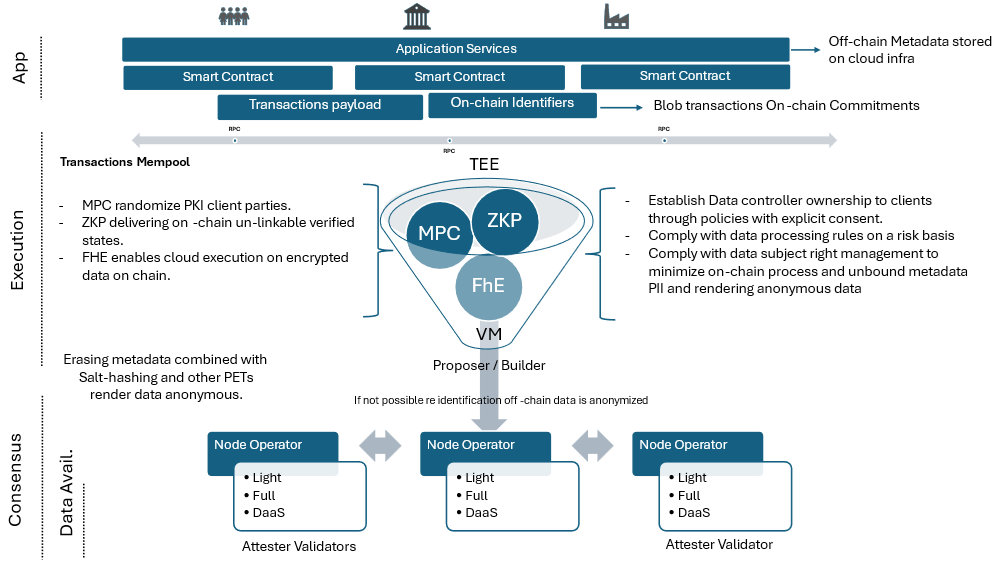

Ho: I wish to see extra progress within the areas of privateness, cybersecurity and crypto. What I’ve noticed is that current privateness legal guidelines, such because the GDPR, don’t adequately ponder decentralized methods. When GDPR was negotiated round 2012 to 2013, cloud computing was the first focus. Making use of these frameworks to crypto at this time usually ends in breakdowns or inconsistencies.

I wish to see both changes to current legal guidelines or clearer regulatory interpretations that designate how these guidelines apply to crypto. There was elevated deal with privacy-oriented developments within the area, and I hope the authorized frameworks start to replicate that actuality.

Journal: From a privateness legislation perspective, how do you view privateness tokens and their status?

Ho: I’m not positive there’ll essentially be new laws particularly concentrating on privateness tokens. What I do count on is bigger readability round their use circumstances.

Like all instrument, privacy-enhancing applied sciences can be utilized for each reliable and illegitimate functions. Banning the instrument itself is, in my opinion, shortsighted.

Public blockchains are designed to be clear, however that doesn’t imply people need all of their transactions seen to the whole world. There’s a want for selective disclosure. That is the place applied sciences akin to verifiable credentials can play a task by permitting regulators entry to vital info whereas nonetheless preserving particular person privateness.

There’s probably a center floor. Whereas I’m not a technologist, I do know there are lots of individuals actively engaged on options that stability regulatory oversight with privateness preservation.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Learn additionally

Hodler’s Digest

SEC critiques Ripple ruling, US invoice seeks management over DeFi, and extra: Hodler’s Digest, July 16-22

Editorial Workers

7 min

July 22, 2023

The SEC examines the ruling within the Ripple case, a U.S. Senate invoice seeks to control DeFi, and the poor efficiency of altcoins within the second quarter of 2023.

Learn extra

Hodler’s Digest

Caroline Ellison speaks on FTX-Binance warfare, SEC received’t attraction Grayscale BTC ETF: Hodler’s Digest, Oct. 8-14

Editorial Workers

7 min

October 14, 2023

Caroline Ellison testifies in Sam Bankman-Fried trial, reveals extra on FTX-Binance warfare; SEC reportedly has no plans to attraction on Grayscale Bitcoin ETF case.

Learn extra