Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has jumped by a fraction of a share previously 24 hours to commerce at $88,150 as of 11 p.m., on a ten% surge within the day by day buying and selling quantity to $19 billion.

The rise in BTC value occurs as Bitcoin critic Peter Schiff warns that MSTR may nonetheless do worse in 2026. He criticized the corporate’s most well-liked inventory, STRC, which now pays an 11% month-to-month dividend, calling it “determined” as a result of the corporate struggled to pay the unique 10% dividend.

Schiff mentioned this exhibits STRC is “junk” and that MSTR’s inventory may fall greater than it did final yr.

How determined are you able to be? You may’t even afford to pay 10%, since Technique is dropping cash—so now you’re going to pay 11%. This simply proves your most well-liked is junk. I’m wondering how rather more you’ll be pressured to pay by year-end. $MSTR will doubtless ship even worse returns in 2026.

— Peter Schiff (@PeterSchiff) January 1, 2026

MSTR misplaced about 50% of its worth in 2025 from a excessive above $400, with large drops within the second half of the yr as Bitcoin fell under $100,000 in November. Schiff believes that if Bitcoin drops once more, MSTR will face much more strain. He additionally mentioned that if Technique have been within the S&P 500, it could have been the sixth-worst-performing inventory, exhibiting how shopping for Bitcoin has damage shareholders.

These issues come up as MSCI will determine on January 15 whether or not corporations like Technique are thought of funding funds. If not, MSTR could possibly be faraway from world indices, probably inflicting $2.8 billion in outflows, based on JPMorgan, which might damage the inventory.

Market merchants are watching carefully. Polymarket exhibits a 77% likelihood that MSTR will probably be delisted from the MSCI index by March 31. Bitcoin’s value and the MSCI determination will probably be key for MSTR’s efficiency this yr. Schiff’s warnings spotlight worries in regards to the firm’s dividend plan, Bitcoin publicity, and index dangers.

Bitcoin Value Evaluation: Descending Wedge Indicators Potential Upswing

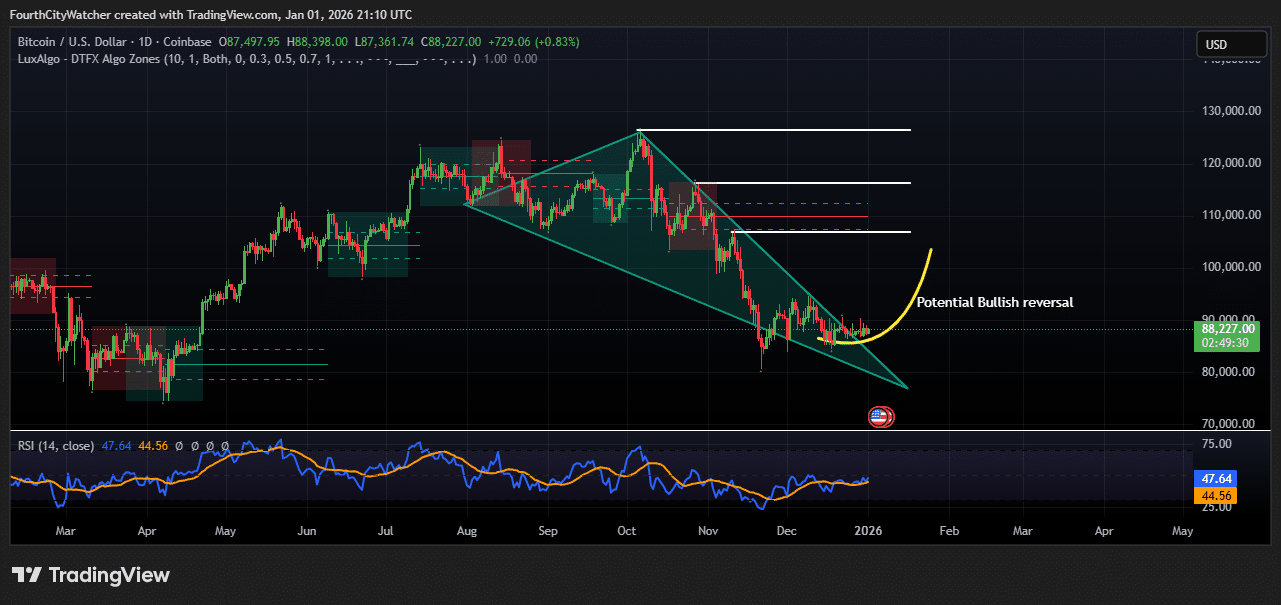

Bitcoin (BTC/USD) is at present buying and selling at $88,227 on the day by day chart. Since reaching highs above $130,000 in late 2025, BTC has been in a downtrend. Throughout this era, the worth has shaped a descending wedge sample, proven in inexperienced on the chart.

A descending wedge normally alerts a possible bullish reversal. It means BTC has been making decrease highs and decrease lows, however the wedge is narrowing, exhibiting that promoting strain is weakening and a reversal could possibly be close to.

The RSI indicator, it at present reads 47.64, barely under the impartial 50 degree, with the RSI shifting common at 44.56. This exhibits BTC is neither overbought nor oversold. Not too long ago, the RSI has been rising, which means that bullish momentum could also be slowly returning.

If the RSI continues upward and strikes above 50, it could present stronger proof that the downtrend is likely to be ending, supporting the concept of a development reversal.

BTCUSDT Chart Evaluation. Supply: Tradingview

The chart additionally exhibits assist round $85,000–$88,000, the place BTC has discovered non permanent stability. This degree may act as a base for a possible upward transfer. A transparent breakout above the wedge’s higher boundary would sign that patrons are returning, doubtlessly triggering a stronger rally.

On the upside, the chart highlights three key resistance ranges at $110,000, $120,000, and close to $130,000, which have been earlier highs over the past uptrend. These ranges are doubtless targets for any rally and areas the place merchants could take income.

A confirmed breakout above the wedge and a rising RSI for stronger proof of an rising upward development. If BTC fails to interrupt above the wedge, it could proceed consolidating within the $85,000–$88,000 vary and even check decrease assist ranges earlier than making an attempt one other upward transfer.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection