Dogecoin is ending the primary week of 2026 parked on a cluster of long-watched helps, and three chart-focused analysts are converging on the identical query: is that this the upper low that begins a broader bottoming course of, or simply one other pause inside a bigger corrective leg?

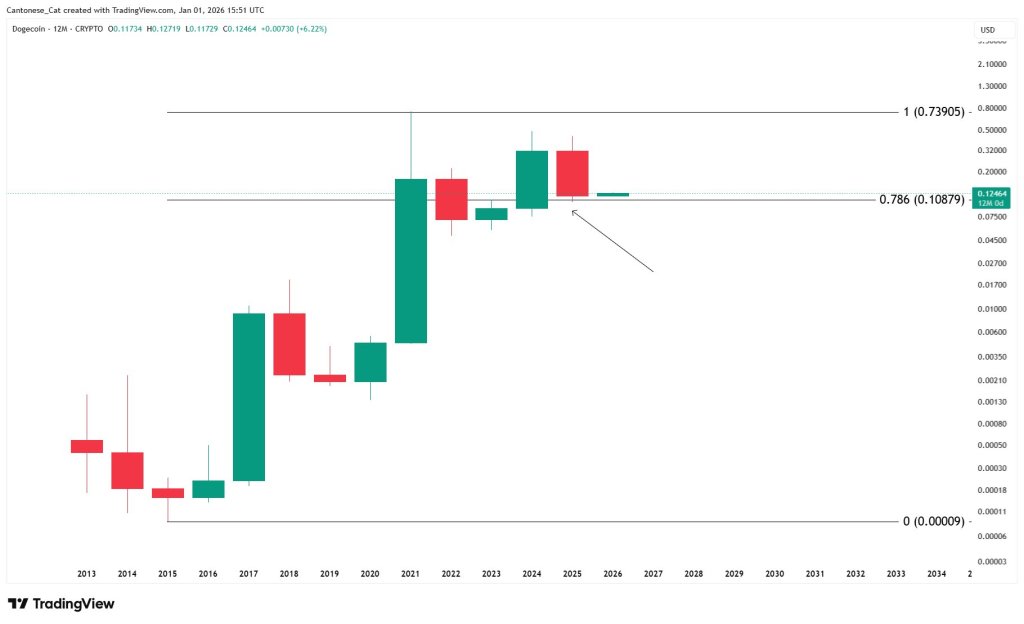

The Yearly Dogecoin Chart

On the yearly view, Cantonese Cat’s chart frames 2025 as a maintain of the 0.786 log Fibonacci assist at roughly $0.10879, with the market printing an inside candle into year-end. In that development, the important thing takeaway is just not momentum however construction: worth revered a significant retracement line on a log scale and stayed boxed contained in the prior 12 months’s vary: “DOGE ended 2025 holding 0.786 log fib as assist, forming an inside candle, favors bullish continuation,” the analyst writes.

The identical yearly chart additionally contextualizes what “continuation” on the yearly view means: the subsequent main reference degree is the 1.0 fib line up close to $0.73905. That isn’t being introduced as an imminent goal, but it surely does underscore why analysts care about this zone, if the 0.786 degree holds on larger timeframes, the chart’s mapped upside is structurally open, even when the trail is just not linear.

Associated Studying

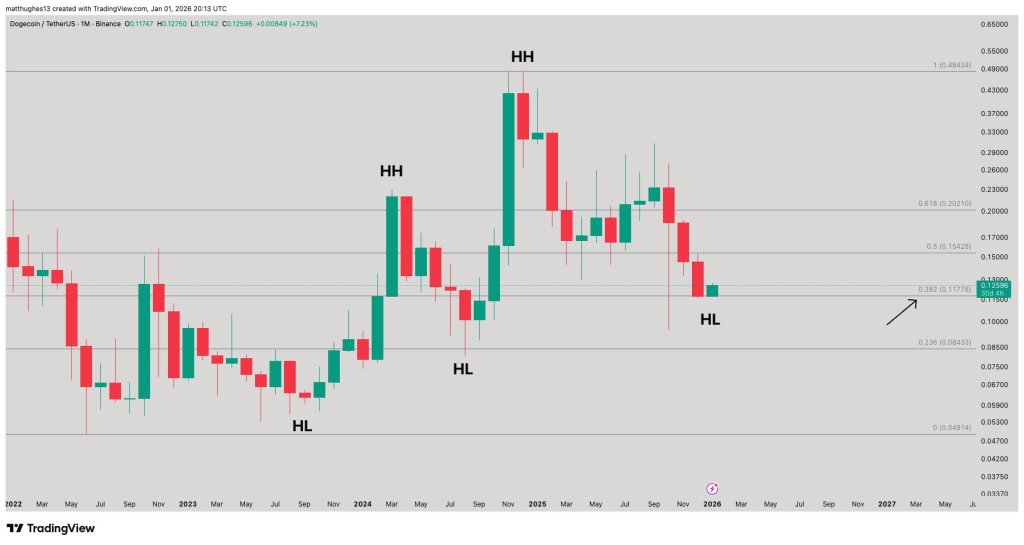

The Month-to-month DOGE Chart

Matt Hughes aka “The Nice Mattsby’s” month-to-month chart tightens the main focus to a single, exact degree: the 0.382 Fibonacci retracement at $0.11778. Worth is proven holding that line whereas carving out what the chart labels as a better low, and the analyst is express about what that may imply in market-structure phrases.

“To me, this seems like the upper low wanted to begin the bottoming course of, particularly with worth holding the 0.382 Fib retracement at 0.11778,” Mattsby wrote, including that he views the “.11–.12 zone” as compelling on a threat/reward foundation. On this framing, the thesis is conditional: the market is just not “bullish” as a result of it bounced, it’s constructive as a result of it’s making an attempt to cease making decrease lows whereas defending an outlined retracement.

Associated Studying

If that $0.11778 degree offers approach on a month-to-month foundation, the identical fib ladder proven on the chart highlights decrease references beneath it, together with the 0.236 retracement round $0.08433. On the upside, the subsequent retracement markers seen are $0.15428 (0.5) and $0.20210 (0.618), which might be the close by “show it” areas if that is, actually, a basing course of somewhat than a dead-cat bounce.

The Weekly Dogecoin Chart

Kevin (Kev_Capital_TA) shifts the emphasis to the weekly. By way of X, he posted: “Nonetheless early however Dogecoin is presently printing a very nice weekly reversal demand candle inside a significant demand zone.”

His circumstances are tight and time-bound: “In case you can verify that weekly candle by Sunday shut, reclaim the 4HR 200 sma/ema on each Doge and BTC then you would see the low put in for this main correctional part and the counter development transfer larger occuring. All eyes on 88K-91K on BTC.”

For Dogecoin merchants, the quick calls are easy: Dogecoin must preserve defending the $0.11–$0.12 space, whereas the weekly shut both validates or negates Kevin’s reversal-candle thesis.

If worth loses the $0.11778 month-to-month retracement, the “bottoming” narrative weakens rapidly; if it holds and begins reclaiming close by resistance ranges, the charts collectively argue the market could also be transitioning from correction to base-building, one confirmed shut at a time.

At press time, DOGE traded at $0.13242.

Featured picture created with DALL.E, chart from TradingView.com