- Tom Lee predicts Ethereum might attain $62,000 based mostly on Bitcoin-relative valuation

- He believes tokenization will drive Ethereum’s subsequent main breakout section

- Analysts see enhancing technical momentum, however warn of draw back dangers

Bitmine chairman and Fundstrat co-founder Tom Lee sparked contemporary debate throughout crypto markets this week after predicting Ethereum might surge as excessive as $62,000 within the coming months. Lee made the feedback throughout a keynote tackle at Binance Blockchain Week, the place he framed Ethereum because the core infrastructure behind the following main monetary shift.

Recognized for his long-term bullish stance on digital property, Lee argued that Ethereum is coming into a historic second just like a significant turning level in conventional finance.

Ethereum’s “1971 Second” In response to Tom Lee

Talking on stage, Lee in contrast Ethereum’s present setup to 1971, the yr the U.S. deserted the gold commonplace, triggering a basic shift in world finance.

“Ethereum this yr is having its 1971 second,” Lee stated.

He believes 2025 marks the start of large-scale tokenization throughout monetary markets, pushed by blockchain-based settlement rails relatively than legacy methods.

“In 2025, we’re tokenizing all the things. It’s not simply the greenback. It’s shares, bonds, actual property, and Wall Road is once more going to reap the benefits of that and create merchandise onto a sensible contract platform,” he stated.

Lee famous that Ethereum has traded in a comparatively tight vary for almost 5 years, however now seems to be breaking out, prompting his agency to extend publicity to ETH.

“Ethereum at $3,000 is grossly undervalued,” he added.

How Lee Will get to a $62,000 ETH Value

Lee defined that his worth goal relies on Ethereum’s historic relationship with Bitcoin. If ETH merely returns to its long-term common ratio towards BTC, Lee believes Ethereum might attain roughly $12,000.

However the extra aggressive situation comes if Ethereum captures a bigger share of Bitcoin’s market worth.

“If it will get to 0.25 relative to Bitcoin, that’s $62,000,” Lee stated.

The prediction assumes Ethereum performs a dominant function in tokenized property, institutional finance, and good contract-based infrastructure as adoption accelerates.

Bitcoin Nonetheless Headed to $250,000, Lee Says

Alongside his Ethereum name, Lee doubled down on his bullish Bitcoin outlook. He reiterated earlier feedback suggesting BTC might attain $250,000 inside months, regardless of current market weak spot.

“I feel Bitcoin goes to get to $250,000 inside a couple of months,” Lee stated, calling Bitcoin and Ethereum the 2 most necessary crypto platforms within the ecosystem.

His view aligns with feedback made earlier this yr by Cardano founder Charles Hoskinson, who stated Bitcoin might hit $250,000 in 2026 if giant firms start including crypto publicity to their stability sheets.

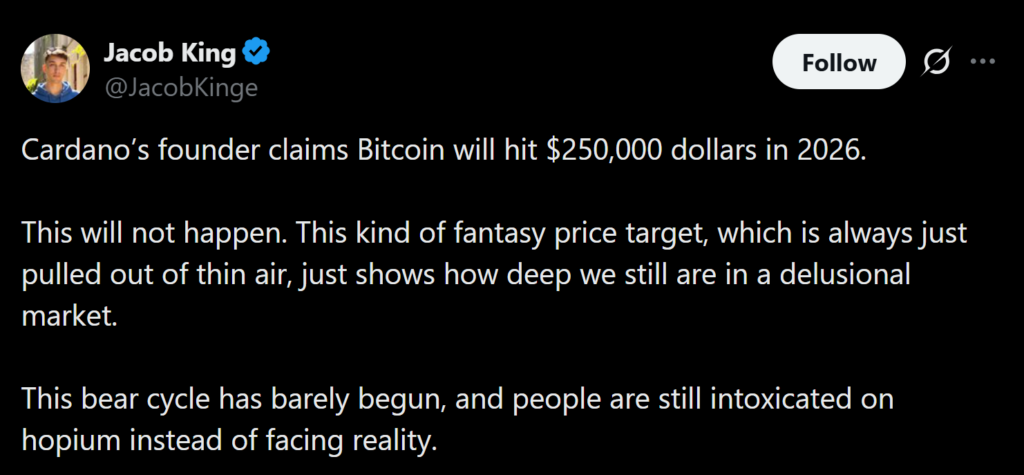

Nonetheless, critics stay unconvinced. Crypto commentator Jacob King dismissed such projections as unrealistic, arguing that markets are underestimating the depth of the present bear cycle.

Technical Analysts See Upside, With Situations

Whereas Lee’s worth targets stirred controversy, some analysts level to enhancing technical alerts for Ethereum, although dangers stay.

CCN market analyst Victor Olanrewaju famous that ETH lately broke above the higher trendline of a falling wedge sample on the each day chart, a setup usually related to bullish reversals.

“If this development continues, ETH might breach resistance at $3,541,” he stated, including {that a} transfer above that stage might open a path towards $3,876.

Nevertheless, Olanrewaju cautioned that the breakout should maintain. A failure to take care of momentum might rapidly invalidate the bullish construction.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.