XRP pushed as much as $1.87 as exchange-held provide fell to its lowest degree since 2018, reinforcing a tightening-float narrative whilst worth stays caught under the heavy $1.88–$2.00 resistance band that has repeatedly capped rebounds.

Information background

Alternate balances are being handled as a key sign once more. Provide held on buying and selling venues has fallen to roughly 1.6 billion XRP, down about 57% since October, suggesting extra tokens are transferring into longer-term storage or custody fairly than sitting able to be offered.

That drawdown is arriving throughout a broader section of selective positioning throughout majors: establishments have more and more leaned on structured and controlled rails for publicity whereas spot markets stay uneven, leaving tokens like XRP buying and selling with a supportive long-term bid however fragile short-term momentum.

For XRP particularly, the falling alternate stock issues as a result of it might probably amplify strikes when demand picks up — but it surely doesn’t assure upside if sellers present up at recognized technical ranges (and $2 has been that degree).

Technical evaluation

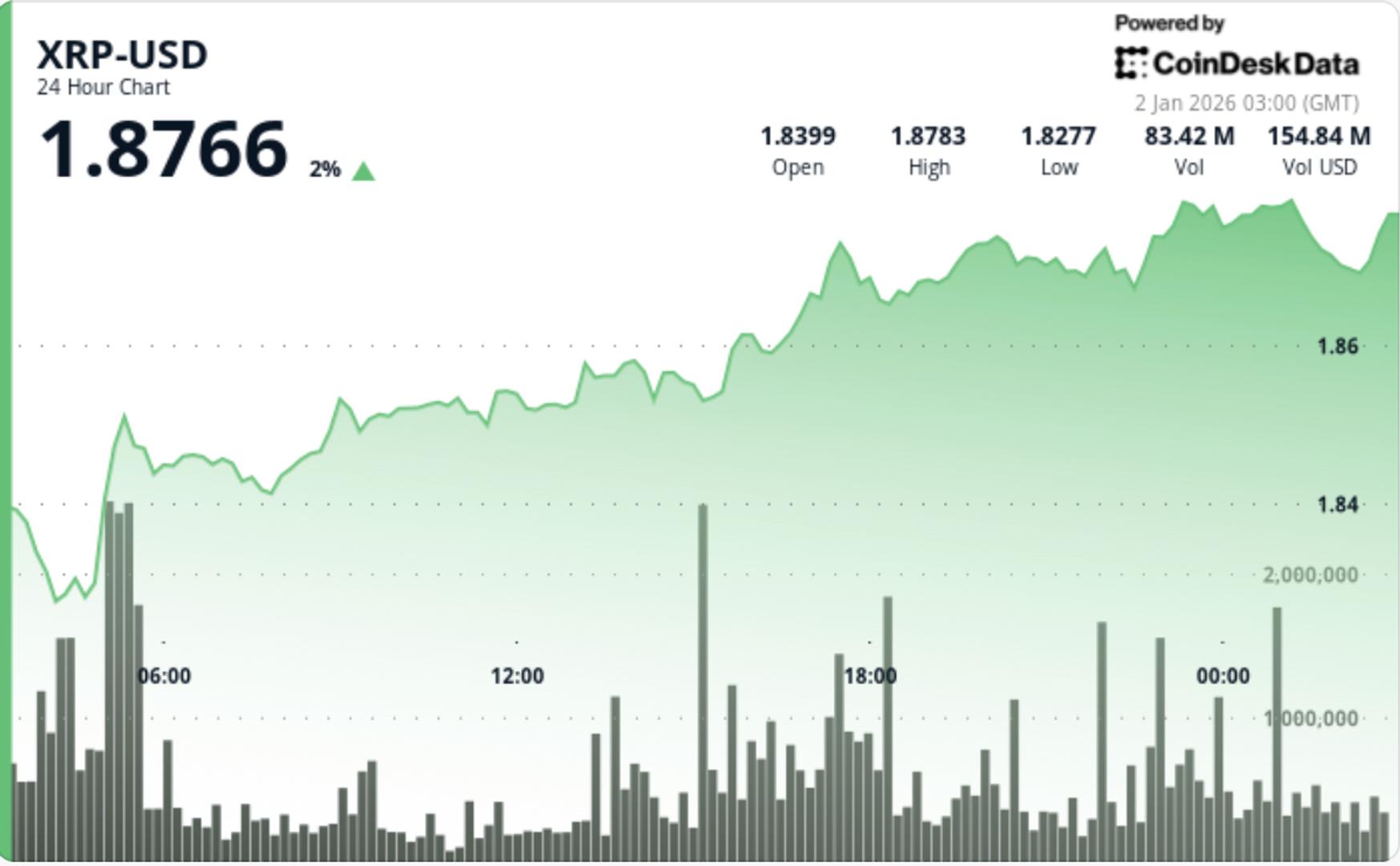

XRP climbed roughly 1.7% from $1.84 to $1.87, printing increased lows by the session and holding a comparatively contained $0.05 vary (about 2.5% intraday volatility). Participation improved on the proper second: quantity expanded throughout the push increased (round 32 million, about 50% above common) — an indication this wasn’t merely drifting upward on skinny liquidity.

However the tape nonetheless reads like managed restoration inside a broader ceiling. XRP repeatedly slowed because it approached the $1.88 space, a degree that additionally traces up with a broader resistance zone forward of the psychological $2.00 deal with. That issues as a result of latest makes an attempt to reclaim $2 have failed rapidly, turning the world right into a provide zone the place sellers are comfy leaning on rallies.

Momentum indicators are combined. Some oscillators present bullish divergence (momentum bettering whilst worth hasn’t totally damaged out), however the market nonetheless wants follow-through above resistance to validate it. On the decrease facet, the construction seems constructive so long as XRP holds above the $1.82–$1.83 base from the session’s early checks — and extra broadly above the $1.77 ground that has acted as the subsequent clear demand pocket.

Worth motion abstract

- XRP superior from $1.84 to $1.87, posting a gentle collection of upper lows

- Quantity expanded throughout the transfer increased, peaking round 32M, roughly 50% above common

- Worth stalled close to $1.88 resistance, protecting the broader $1.77–$2.00 vary intact

- Late-session motion consolidated round $1.873, signaling an inflection level fairly than a breakout

What merchants ought to know

The story is a tug-of-war between tightening accessible provide and a well-defined resistance ceiling.

Key ranges are clear:

- Bull case: A sustained push above $1.88 opens the door to a run towards $1.95, with $2.00 because the breakout set off. A clear reclaim of $2 would probably pull in momentum consumers and pressure repositioning from sellers who’ve been defending that zone.

- Bear case: Failure to carry the $1.82–$1.83 base shifts focus again to $1.77, the subsequent significant demand pocket. If that breaks, threat extends decrease into the subsequent broader assist area (the place consumers traditionally reappear), however the near-term battlefield is clearly $1.77 vs. $1.88.

For now, shrinking alternate provide retains the longer-term setup constructive — however the market nonetheless wants a decisive win above $1.88–$2.00 earlier than the upside narrative can take management of the tape.