As Ripple gained important scores in opposition to the SEC, XRP, now the fifth-largest cryptocurrency by market cap, has proven an astonishing rally this previous 12 months.

Having handed the $1 mark and now buying and selling at round $2 for the primary time since 2018 epic spike, XRP was poised to climb to $10 goal.

Nonetheless, that didn’t occur. The Ripple-associated cryptocurrency peaked at $3.65, having crushed its earlier ATH of 2018.

How will the XRP value transfer in 2025?

Ripple vs. SEC: case dismissed

The SEC filed go well with in opposition to Ripple in December 2020, alleging that Ripple’s sale of XRP constituted an unregistered securities providing. Ripple, nevertheless, contends that XRP must be categorised as a digital foreign money, not a safety.

This classification is essential, as a ruling in opposition to Ripple may set a regulatory precedent for different cryptocurrencies, doubtlessly reshaping the authorized atmosphere for your entire crypto sector.

On August 7, 2025, the Securities and Change Fee filed a joint stipulation with Ripple Labs, Bradley Garlinghouse, and Christian A. Larsen, dismissing each the SEC’s enchantment and Ripple’s cross-appeal and formally ending the company’s civil enforcement case.

The cross-appeals adopted a district courtroom ruling that imposed a civil penalty on Ripple and an injunction barring violations of the registration provisions of the Securities Act of 1933. The decision finalizes a June settlement for Ripple to pay a $125 million penalty.

The conclusion of the multi-year dispute coincided with a greater than 10% bounce in XRP, lifting the token to $3.31.

XRP value historical past: Can XRP hit $10?

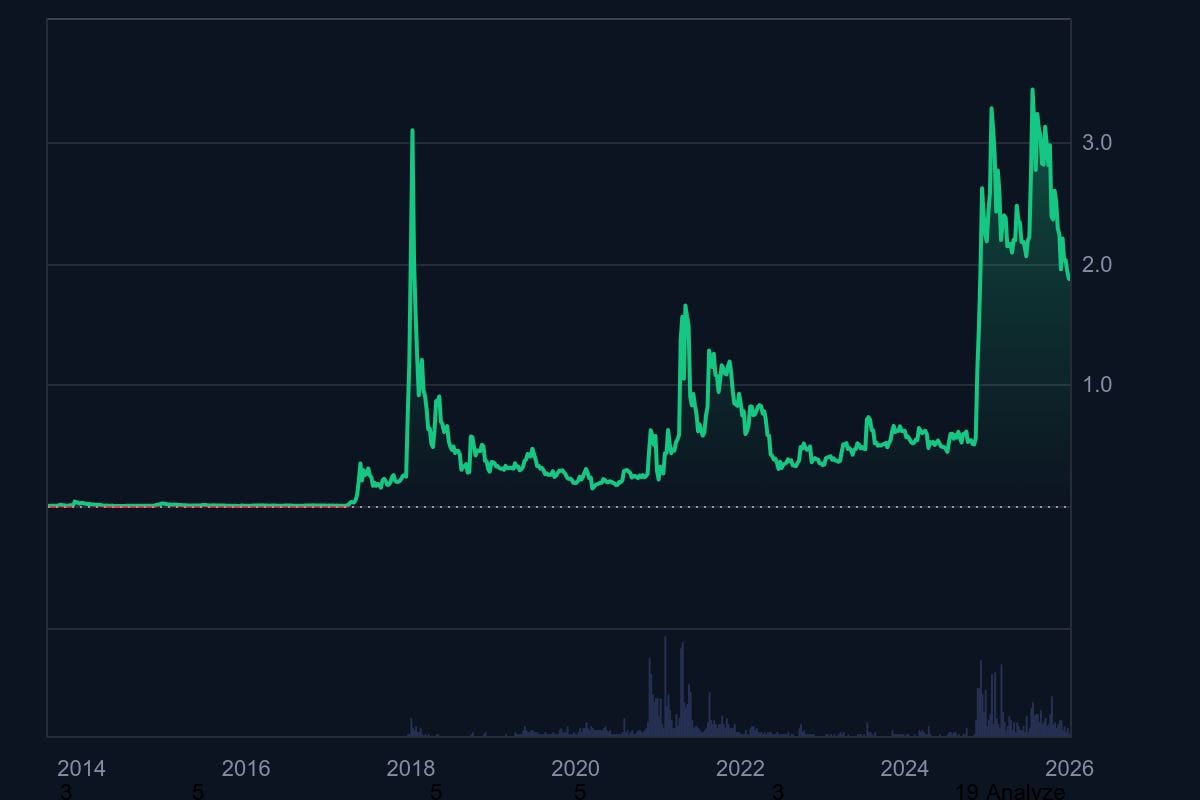

Between 2012 and 2018, XRP underwent dramatic value modifications. Initially valued at lower than $0.01 in 2012, it noticed minimal exercise till Ripple Labs started forging partnerships with monetary establishments between 2014 and 2016, although costs remained underneath $0.01.

The 2017 cryptocurrency increase marked a turning level, with XRP surging from $0.006 to over $1.00 by December, pushed by rising curiosity in Ripple’s expertise and speculative buying and selling. In January 2018, XRP hit its all-time excessive of $3.84 throughout peak market enthusiasm.

Nonetheless, the broader market crash that 12 months noticed XRP’s worth plummet to $0.60 by February and stabilize round $0.30-$0.40 by year-end. This era underscored XRP’s development and vulnerability to market tendencies and hypothesis.

XRP skilled a big value surge in 2021, however its momentum waned all through 2022. By Nov. 30, 2024, XRP was buying and selling at $1.94 per token.

Not like Ethereum, which persistently achieved new all-time highs, XRP has lagged behind. Its value spikes occurred later than most different cryptocurrencies, peaking in early 2021 as an alternative of late 2020.

The delay was largely attributed to the U.S. SEC’s authorized grievance in opposition to Ripple in November 2020, which prompted XRP’s value to drop sharply from $0.70 to $0.20, creating uncertainty across the token’s future.

2025 was a pivotal 12 months for XRP and the broader cryptocurrency market. The early surge in danger urge for food progressively gave method to a way more fragile sentiment. Bitcoin reached an all-time excessive of $126,210.50 on October 6, 2025, whereas XRP reached $3.65, clearing its path in the direction of the $4 milestone.

Since then, the market has gone downhill. The October $19 billion liquidation occasion has worn out a lot of XRP’s value beneficial properties. XRP, which climbed to No. 3 by market cap earlier, has moved all the way down to No. 5. This places a serious impediment on XRP’s method to $10 mark.

Bitcoin vs. XRP: Benefits of XRP Ledger (XRPL)

XRPL is a decentralized public blockchain enabling fast transfers of XRP, fiat currencies and digital belongings, open to all for growth.

Jed McCaleb, together with Arthur Britto and David Schwartz, established Ripple Labs in 2012 with the imaginative and prescient of making XRP Ledger (XRPL).

This initiative aimed to develop a sturdy ledger expertise able to supporting not solely the native digital asset, XRP, but in addition serving as a world fee infrastructure.

Ripple Labs aimed to deal with the inefficiencies and delays inherent in conventional monetary techniques by introducing a decentralized ledger able to settling transactions in seconds.

Advantages |

XRP |

Bitcoin |

| Quick | 3-5 seconds to settle | 500 seconds to settle |

| Low-Value | $0.0002/tx | $0.50/tx |

| Scalable | 1,500 tx per second | 3 tx per second |

This represented a big departure from Bitcoin’s proof-of-work mannequin, as XRPL carried out a novel consensus mechanism referred to as the “XRP Ledger Consensus Protocol”.

Ripple Labs launched XRPL to handle conventional monetary system inefficiencies, using the XRP Ledger Consensus Protocol as an alternative of Bitcoin’s proof of labor. This protocol ensures transaction order and validity with out energy-intensive mining.

The Ripple Protocol Consensus Algorithm (RPCA) underpins XRPL, figuring out legitimate transactions collaboratively amongst validators. Not like Bitcoin’s PoW, RPCA is eco-friendly and fosters quicker transaction affirmation.

Validators, a subset of nodes, validate transactions to forestall fraud in XRP Ledger. Nodes keep ledger copies, making certain decentralization and community integrity. This construction permits safe, speedy transactions on XRPL.

XRP Ledger (XRP) prioritizes scalability and speedy transaction settlement, able to processing a big quantity of transactions per second. With its skill to finalize transactions inside seconds, the ledger is well-suited for various purposes requiring quick and environment friendly transaction execution.

XRP ETFs: Will BlackRock step in?

On Wednesday, November 19, Bitwise formally submitted its Kind 8-A for the spot XRP ETF after a lot anticipation from the XRP neighborhood.

The filings, which have as soon as once more put XRP within the highlight, will see the funding product launch before common with the ticker “XRP.” Whereas the appliance aligns with needed laws carried out by the SEC, it’s anticipated to launch on Nov. 20 and can be listed for buying and selling on the NYSE.

$XRP has met the expectations of analysts, pulling in an enormous $107 million in inflows on its first day of buying and selling regardless of the broad crypto market slowdown.

Whereas this marks a profitable launch for the Bitwise XRP ETF regardless of the extended crypto market downturn, it has additionally emerged as one of many notable and strongest ETF launches this 12 months.

The ETF’s debut additionally coincided with a dramatic rise in community exercise. XRP alternate inflows surged 762%, climbing from 1.34 million the day earlier than to 11.57 million on launch day.

Nonetheless, the ETF launch failed to avoid wasting XRP value from falling. The Ripple-linked cryptocurrency has plunged by a whopping 16% over that week.

Nate Geraci, president of NovaDius Wealth Administration, predicts that BlackRock will ultimately file for each XRP and Solana ETFs.

Geraci argues it will be illogical for BlackRock to disregard two of the highest 5 non-stablecoin cryptocurrencies by market capitalization. At the moment, Franklin Templeton is the most important agency to enter the XRP ETF race, whereas Constancy Investments filed for a Solana ETF in March.

21Shares, a distinguished European issuer identified for managing quite a few crypto exchange-traded merchandise (ETPs) globally, has already teased the debut of its U.S. spot XRP ETF (TOXR).

The place will Bitcoin value go in 2026?

As XRP value dropped beneath important $2 mark, two questions stay: how low can it fall and the way shortly will XRP bounce again. Each solutions will rely upon basic buyers’ confidence.

Some analyst anticipate a possible correction in 2026. The S&P 500 not too long ago ended a streak of 138 consecutive days closing above its 50-day shifting common.

Nonetheless, main bubbles normally burst amid excessive euphoria, when buyers consider “this time is completely different”. That doesn’t describe the present temper: the CNN Cash fear-greed index was in excessive concern simply weeks in the past and has solely not too long ago returned to impartial. After a brief pause and inside rotation, the market might proceed rising in Q1–Q2 2026.

Legendary dealer Peter Brandt has not too long ago warned that Bitcoin should still face a deeper correction, noting that every one earlier bull markets have resulted in an identical method.

He factors out that main bull cycles have sometimes been preceded by value corrections of 75% or extra. Since Bitcoin’s launch in 2010, there have been 5 such cycles. In every case, value adopted a steep, curved parabolic rise, ultimately broke beneath that curve, after which entered a pointy and extended correction.

Brandt compares late 2025 to late 2021 in reverse: costs falling whereas conventional indexes just like the S&P 500 stay secure. The principle concern is that lots of belongings already commerce as if charges are going to drop shortly. Crypto adopted the identical logic, ignoring that future cuts might already be within the chart.

Brandt’s foremost thesis is that Bitcoin’s explosive development is slowing down over time. It isn’t dying, however it’s maturing. This primarily implies that every “bull cycle” is much less highly effective than the final.

Regardless of the slowing exponential development, Peter Brandt predicted that the following main bull cycle may nonetheless carry BTC towards the $200,000 to $250,000 stage. Nonetheless, the large rally won’t occur within the close to time period, and Bitcoin may must fall as little as $50,000 first to attain this goal.

XRP value prediction: One other breakout in 2026?

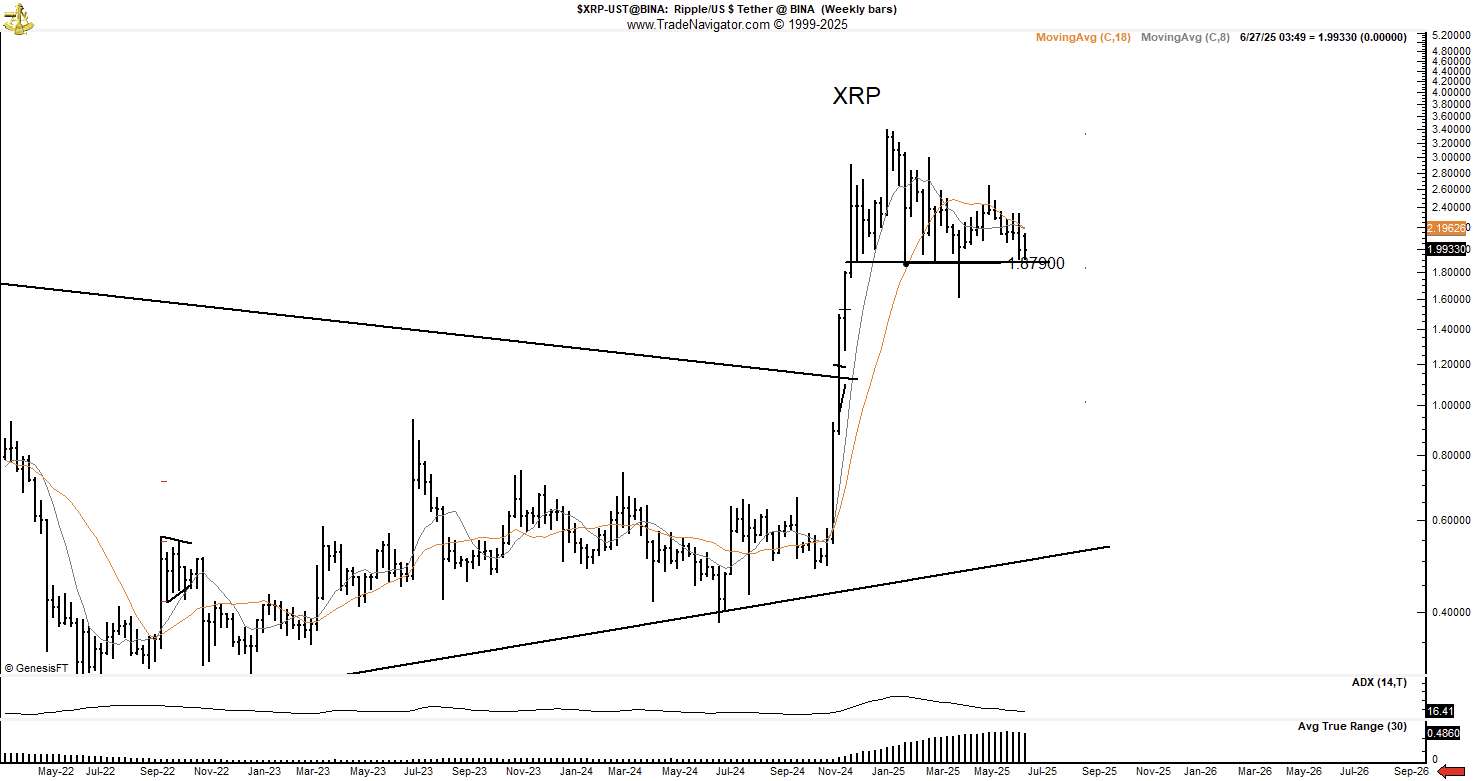

XRP sceptic Peter Brandt has ialready issued a bearish XRP prediction in July. This time he’s pointing to a potential head and shoulders (H&S) prime forming on the weekly chart. For Brandt, if merchants see the April 7 value spike as only a random anomaly, it seems to be like a traditional topping formation.

The chart exhibits XRP not too long ago dropping into a decent consolidation vary, with assist slightly below the $2.00 mark, precisely the place the neckline of this potential head and shoulders sample is. If that is confirmed, it may imply that the late-2024 rally has reached its peak.

On the entire, the XRP value shot up from late 2024 and broke out of a multi-year wedge, main to an enormous vertical run that cooled off across the $3.20 stage. Since then, it has been forming a high-tight flag, and the danger now’s whether or not that construction resolves greater or collapses again into the breakout zone.

Fibonacci extension ranges, a generally used software in technical evaluation, counsel that XRP may doubtlessly attain as much as $18 or $20.

Commonplace Chartered forecasts that XRP may attain $12.50 by the tip of 2028. Geoffrey Kendrick, the financial institution’s World Head of Digital Property Analysis, initiatives XRP at $5.50 in 2024, $8 in 2026, $10.40 in 2027, and $12.50 by late 2028.

That path implies a acquire of greater than 500% over the following three years. Commonplace Chartered additionally suggests XRP may surpass Ethereum in market capitalization, turning into the second-largest cryptocurrency by late 2028.

The decision adopted the launch of the primary U.S. XRP ETF, which doesn’t supply direct publicity to the token. As a substitute, it makes use of swap-based devices designed to trace XRP’s value, making it a particular product within the digital asset market.

The Grayscale Digital Giant Cap Fund not too long ago secured SEC approval underneath the Generic Itemizing Requirements, bringing to market a multi-asset exchange-traded product that features Bitcoin, Ethereum, XRP, Solana, and Cardano.

Galaxy CEO Mike Novogratz has predicted that 2026 may doubtlessly be an ideal 12 months for crypto. He claims that Bitcoin would want to reclaim $100,000 in an effort to begin gaining momentum.

In accordance with Novogratz, excessive apathy usually signifies a backside as a result of it means all of the sellers have possible already offered. He views this lack of hype as a bullish setup for 2026 as a result of the market is not overheated.

In a latest report, Coinbase factors to an earlier liquidity increase, with reserve development anticipated to proceed by way of April 2026. The Federal Reserve’s shift from stability sheet runoff to web injections may, in accordance with Coinbase, assist crypto markets.

Hunter Horsley, CEO of Bitwise, has additionally argued that the four-year cycle principle is successfully over. He expects a serious bull run subsequent 12 months, saying, “Every part is lining up for an enormous 2026. It’s beautiful.”

In any case, XRP has been considered as an underperformer since 2020. Regardless of the large 2025 bull run, the anticipated $10 mark hasn’t been reached but. Nonetheless, XRP efficiency in 2026 will largely rely upon basic market situations.