- Altcoins suffered a deep structural reset in 2025, with market cap excluding the highest 10 down over 50%.

- Buying and selling exercise stays excessive, however it’s more and more dominated by whales slightly than retail traders.

- With no reclaim of key ranges on the OTHERS index, the market seems caught in consolidation, not restoration.

Altcoin season was purported to outline 2025. As a substitute, it quietly unraveled. Moderately than a broad rally lifting the lengthy tail of the market, most altcoins slid into deep drawdowns, in lots of circumstances wiping out years of progress and forcing a wave of exhausted traders to the sidelines. By the point the yr wrapped up, optimism had thinned out quick.

Heading into 2026, sentiment round altcoins feels fragile at finest. Some analysts now argue the injury isn’t performed but, pointing to weak construction, thinning liquidity, and a transparent drop in retail participation. The worry is straightforward, actually. With out recent demand, the sector might see one other leg decrease earlier than something resembling restoration reveals up.

Capital Has Left, and the Numbers Present It

Market information backs up that warning. The OTHERS index, which tracks crypto market cap excluding the highest 10 belongings, has collapsed by greater than 50% since December 2024. What was as soon as roughly a $451 billion section is now hovering nearer to $182 billion. That’s not a routine correction, it’s a reset.

This sort of contraction displays aggressive de-risking throughout mid and small caps. Demand pale, sellers stayed energetic, and liquidity dried up on the edges. For a lot of tasks, value discovery moved downward and didn’t look again. Nonetheless, not everybody believes this marks the tip of the altcoin cycle.

A smaller however vocal group of analysts factors to historical past. In previous cycles, excessive underperformance and broad capitulation usually got here proper earlier than sharp altcoin recoveries. From that angle, 2026 might nonetheless host a delayed altcoin season, however provided that liquidity improves and capital rotation restarts in a significant manner.

Buying and selling Exercise Tells a Extra Sophisticated Story

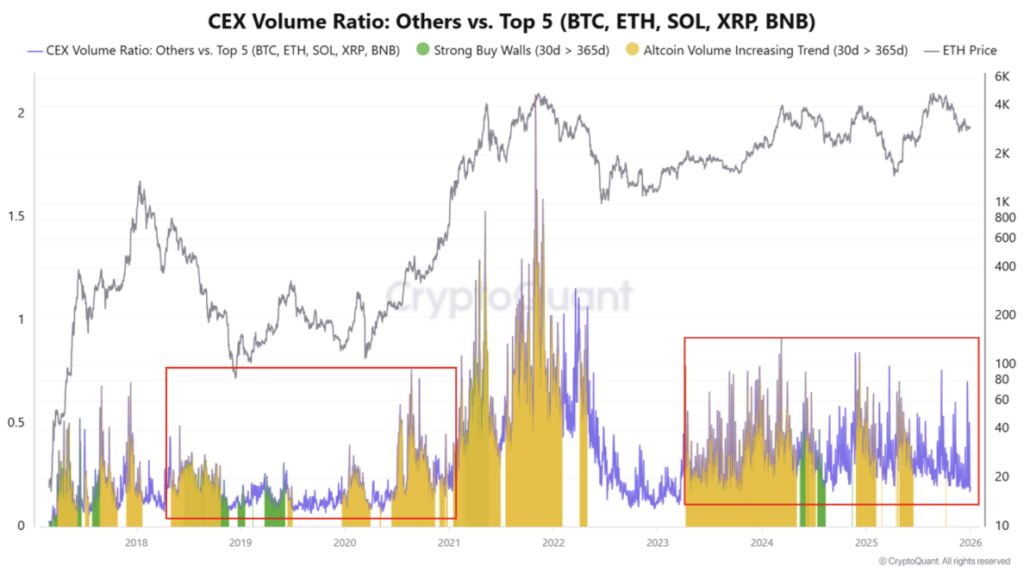

One of many extra complicated alerts comes from buying and selling quantity. A CryptoQuant report reveals that centralized change quantity for altcoins, excluding the highest 5 belongings, is definitely greater than in earlier cycles. That sounds bullish on the floor, however value hasn’t adopted.

This hole between exercise and valuation explains quite a lot of the present uncertainty. Altcoins are nonetheless being traded closely, simply not rewarded with greater costs. What’s modified is who’s doing the buying and selling. Retail participation has largely pale after months of losses, with many smaller traders giving up and shutting positions.

Their absence hasn’t diminished quantity. As a substitute, that exercise has turn out to be extra concentrated. Whales {and professional} merchants now make up a rising share of altcoin move, utilizing low-liquidity circumstances and weak sentiment to build up selectively or rotate capital with precision. It’s not quiet, it’s simply totally different.

OTHERS Chart Indicators Compression, Not Restoration

The OTHERS chart paints a transparent image of how deep this correction has gone. After peaking close to $450 billion in late 2024, the market has stabilized nearer to the $200–210 billion zone. That type of drop suggests a full structural reset slightly than a shallow pullback.

Technically, value is hovering across the 200-week shifting common, a stage that has traditionally acted as a long-term stability level throughout transitions. The failure to reclaim the 100-week and 50-week averages reveals that upside conviction stays weak. Patrons are cautious, and rallies fade rapidly.

Quantity habits reinforces this. Spikes seem throughout sell-offs or quick aid strikes, however there’s no sustained enlargement that will sign broad accumulation. The market isn’t collapsing anymore, but it surely’s additionally not breaking greater. Compelled promoting appears largely exhausted, but the absence of upper highs retains the construction impartial to bearish.

For an actual altcoin restoration to take form, OTHERS would want to reclaim the $260–280 billion vary and maintain above key shifting averages. Till that occurs, the info factors to consolidation, whale-dominated positioning, and a market nonetheless looking for a sturdy backside slightly than the beginning of a traditional altcoin season.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.